Three companies that will be presenting at EnerCom’s 22nd The Oil & Gas Conference® have reported financial and operational updates for the second quarter of 2017.

Gastar Exploration

Gastar Exploration (ticker: GST) indicated today that it averaged 6,100 BOEPD in production—a number that exceeded its guidance for the quarter. Liquids made up 73% of total production.

The company’s president and CEO, Russell Porter, said that Gastar continues “to make progress delineating the Meramec and Osage formations,” and that the company had drilled a total of, “21 Meramec and 13 Osage wells across [its] STACK play,”—granting the company a bounty of information on its acreage.

The company holds 89,900 net acres, 63,200 acres of which is core STACK acreage. The remaining 26,700 acres is in the WEHLU trend.

Gastar is increasing its 2017 drilling capital budget to approximately $129.2 million in order to accommodate higher working interests, more operated wells, and an increase in non-operated drilling activity. The capital budget was increased by approximately $45.3 million.

Goodrich Petroleum

Houston based Goodrich Petroleum (ticker: GDP) announced that it had produced a total of 3.3 Bcfe for the quarter, averaging approximately 36,300 Mcfe per day—85% of which was natural gas. Goodrich’s Q2 production was 40% higher than its reported Q1 production, which averaged approximately 26,000 Mcfe per day.

The company’s production continues increasing, with an average July production of approximately 44,000 Mcfe per day. Goodrich as revised its production guidance to between 55,000 and 60,000 Mcfe per day. Goodrich also reported quarterly revenue of $12.5 million.

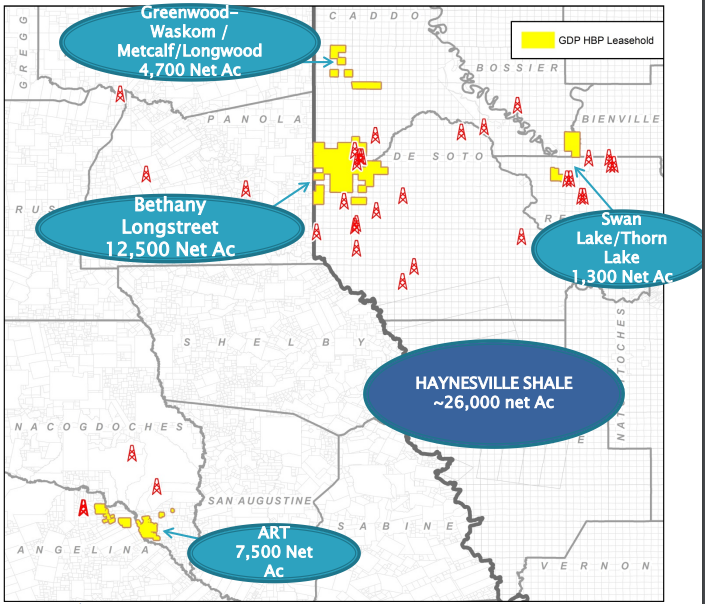

In its Haynesville Shale, Goodrich—as of its Q2, 2017 update—was in the process of drilling one well with a 10,000 foot lateral. After that well is completed, Goodrich intends to drill and complete another two wells—both with an expected lateral length of 7,500 feet.

Goodrich anticipates that its Haynesville acreage, which totals 50,000 gross (26,000 net) acres across Louisiana and Texas, has 250 gross (100 net) potential drilling locations.

The company added 3,000 net acres in two acquisitions during Q2.

Gran Tierra Energy

Gran Tierra Energy (ticker: GTE) indicated that it was producing 34,178 BOEPD as of the last week of July, 2017—an increase of 20% over its average Q1 production.

Gran Tierra announced progress in multiple development areas. In its Costayaco acreage, where it is targeting the A-Limestone, two horizontal wells are now on production.

A multi-zone discovery in an exploration well in its Putomayo basin showed production of 1,938 BOPD out of one zone and 217 BOPD from another zone.

Gran Tierra also saw good performance from two Putomayo wells that are targeting the N Sand, which produced over 2,000 BOPD between the two. The company has also more than doubled the production out of its Acordionero assets since acquiring the assets 11 months ago. The production has leapt from 5,620 BOPD to 11,958 BOPD in the field.

In an effort to focus more heavily on its Colombia assets, Gran Tierra sold its assets in Brazil for $38 million in late June. This caused the company to revise its average 2017 production guidance to between 33,300 and 34,300 BOEPD.

Gastar Exploration, Goodrich Petroleum, and Gran Tierra Energy are presenting at EnerCom’s The Oil & Gas Conference® 22

GST, GDP, and GTE will be presenting companies at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.