Investors and oil and gas industry executives overflowed the EnerCom Dallas presentation room for a second day.

EnerCom sponsor PLS, along with Samson Oil & Gas, Mid-Con Energy Partners, Raging River Exploration, Blackbird Energy, Flotek Industries and Blackstone Minerals presented to a room full of energy-focused institutional investors in the morning sessions at EnerCom Dallas on Mar. 2.

Private equity: a harder time buying in the Permian

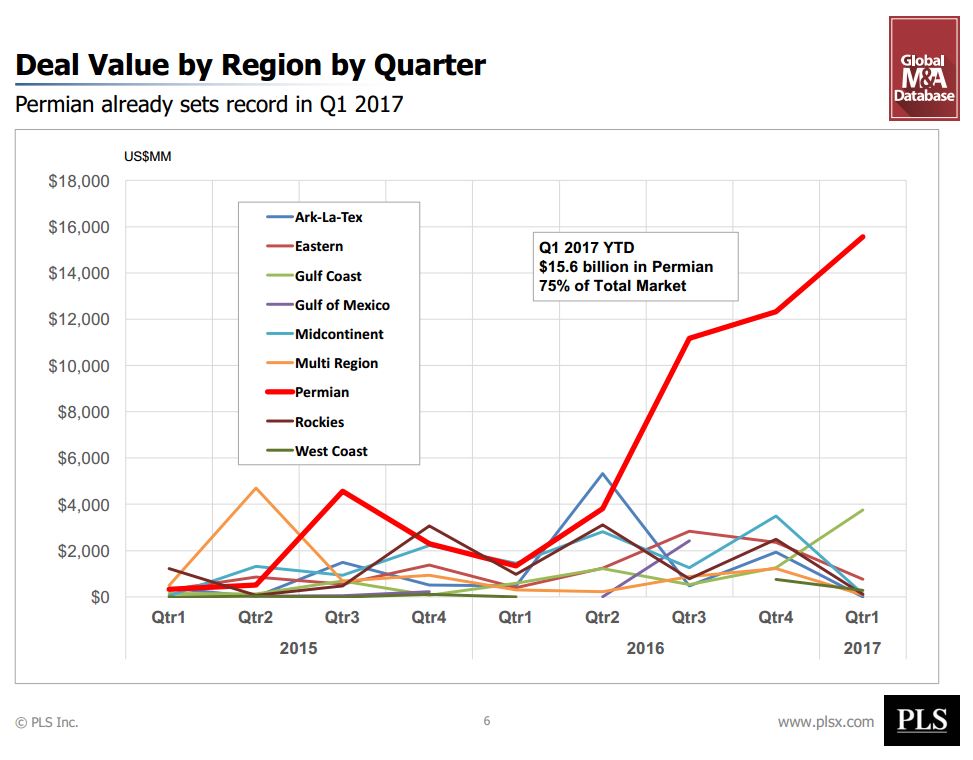

PLS Managing Director Brian Lidsky gave a detailed rundown of the state of A&D activity in the industry, pointing out that the Permian basin had a sharp lead in the category. Lidsky said the buying was coming mainly from public companies with capital from overnight equity raises. He said there is also private equity capital, but it is having a difficult time competing with public companies for Permian acreage and production. Lidsky said there is a lot of private capital ready to go into the Permian.

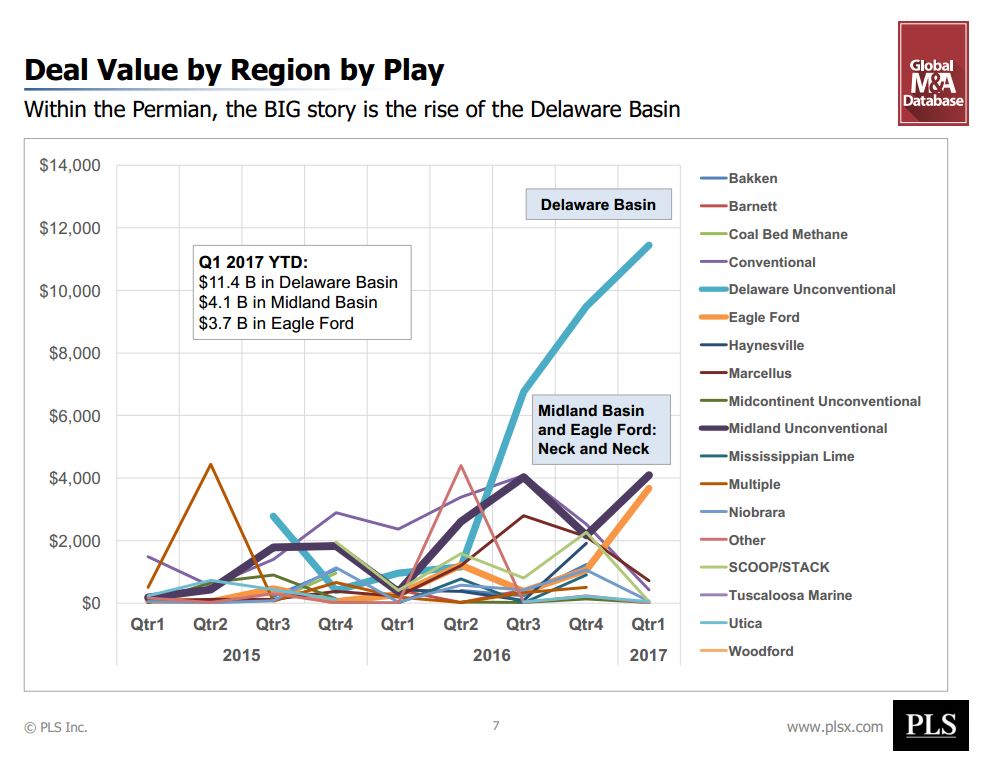

Lidsky said there were $36 billion in transactions in the Permian in the past eight months that acquired 5.7 million acres. He said the Permian represents 75% of all M&A activity this year. Lidsky said after the Permian, the Eagle Ford ranked next in A&D transactions, followed by the STACK/SCOOP, Marcellus, Haynesville and Cotton Valley.

A white knuckle project in Utah

Terry Barr, CEO of Samson Oil & Gas Ltd. (ticker: SSN) discussed his company’s conventional play focus starting with the company’s Forman Butte Bakken acquisition in North Dakota. “It’s not a resource play. I guess you could say we’ve gone back to the roots of the oil business,” Barr said, discussing his company’s development plan for the shallow Bakken play.

Samson secured another conventional asset in the Paradox basin in Utah that Barr described as a “white knuckle project.” The Cane Creek project is home of the Cane Creek Unit 12-1 well which Barr said was the most prolific well drilled in 2012, producing 802,967 barrels of oil in two years, EUR 1.2 MMBO.

Mid-Con Energy Partners (ticker: MCEP) CEO Jeff Olmstead said his company, an MLP, is known as “the waterflood guys.” Olmstead gave background on waterfloods as a very successful secondary oil recovery method. He said the company had done 16 million barrels of acquisitions since 2011. With a focus on southern Oklahoma, the company has five projects in the pipeline for 2017.

Saskatchewan Viking pure play Raging River Exploration (ticker: RRX) VP of Production and COO Jason Jaskela said that the company has grown production from its founding in 2012 of 1,500 BOPD to 22,500 BOPD today, 2/3 of that through organic growth and 1/3 through acquisition. Jaskela said the company has 3,600 net economic drilling locations—70% Crown and 30% freehold—10 years of inventory.

Blackbird Energy’s (ticker: BBI) CEO Garth Braun presented the company, a liquids rich Montney producer. Braun said his company sells condensate at $71.50, a 22% premium to Western Canada Select. He detailed the results from the company’s first group of wells and its use of Stage Completions’ innovative completion technology, which Blackbird invested in.

Flotek Industries (ticker: FTK) CEO John Chisholm took the room through his company’s transformation from a service provider to a more diversified chemistry company. The company’s tagline is “The Pursuit of Transformative Chemistry.” Chisholm said the company divested its downhole technology and production technology businesses and now operates two business segments: “Energy Chemistry Technology” and “Consumer and Industrial Chemistry Technology.” He discussed the company’s intellectual property portfolio, its Global Research and Innovation Center and it’s citrus oil refinery in Florida. “Twenty percent of our revenue is created by products that didn’t exist before,” he said.

Mineral and royalty interest owner, non-operator, Black Stone Minerals, L.P., (ticker: BSM) discussed the partnership’s 16 million gross acres in the U.S. The company does not pay for drilling new wells, but it benefits from the production coming out of the ground throughout the U.S. through its mineral and royalty stakes. The company said that 35% of all the permits filed in the Hayneville and Bossier shales are on Black Stone acreage.

Comstock Resources CEO Jay Allison and President Roland Burns were present at EnerCom Dallas talking about the company’s operations. “We were in and out of the Delaware, but we determined that we were going to drill the Haynesville. We have had 700 operated locations in the Haynesville since 2007. 2016 was very lumpy, but we think 2017 will be very predictable,” Allison said. The company has a 22 well program planned for 2017—15 in the Haynesville.

Tamarack Valley Energy (ticker: TVE) and Evolution Petroleum (ticker: EPM) presented before lunch.

Tom Petrie, founder of Petrie Partners, delivered the luncheon keynote, updating the status of Saudi Arabia’s oil industry and effects of middle east policy and politics on the global oil industry.

Privately held Stage Completions, Warren Resources, GeoPark Limited (ticker: GPRK), Manitok Energy (ticker: MEI), TransAtlantic Petroleum (ticker: TAT) and Razor Energy Corp. (ticker: RZE) presented after lunch.

EnerCom Sponsor Hein & Associates’ Lori Mettille and Joe Blice gave a presentation entitled “IPO Readiness.”