WPX Energy (ticker: WPX) will be presenting at EnerCom’s The Oil & Gas Conference® 21 in Denver on Tuesday, August 16, 2016. WPX Energy is an upstream oil and gas operator with assets in the Williston, San Juan, and Permian Basins.

In the earnings call for the first quarter of 2016, the company announced its goal to start leaning into the Delaware Basin more by adding an additional rig for the second half of the year. Rick Muncrief, the company’s president and CEO, said, “The Delaware is going to be the engine that drives our company for decades.”

The company announced a goal to drill a “vision well” for this region, costing $5 million and providing an estimated ultimate recovery of 1,000 MBoe.

The company is currently testing the upper and lower Wolfcamp A and has plans to move onward into the X and Y benches. Wells in Wolfcamp A have a current well cost of $5.3 million, with drilling cost accounting for $2.7 million and completions at $2.0 million. EURs in Wolfcamp A are 900 MBoe per well.

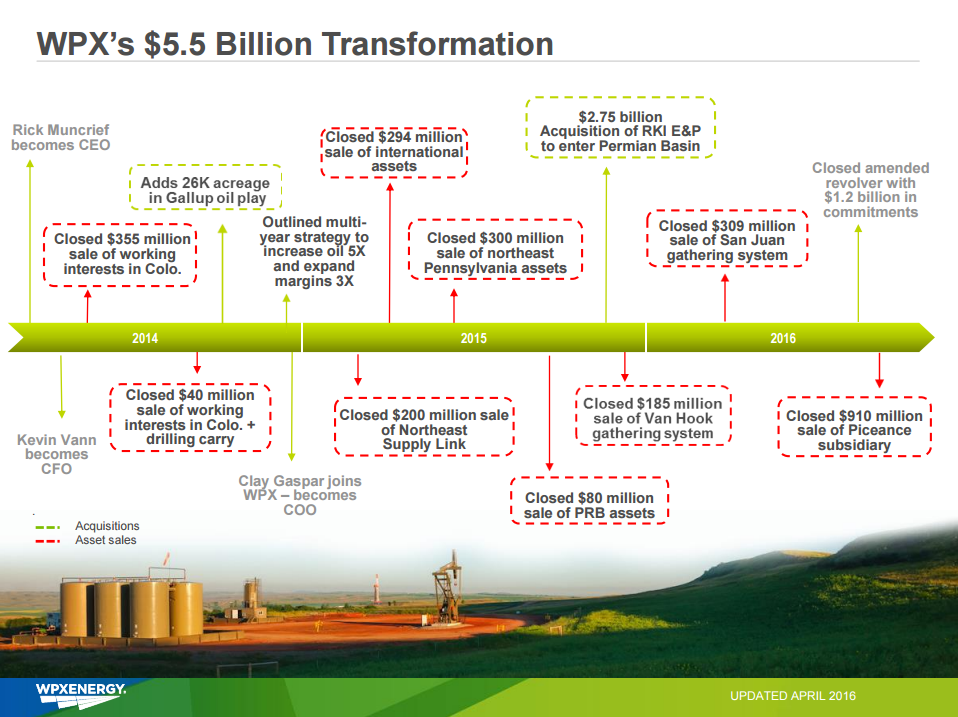

WPX Energy has been able to maintain its liquidity while paying down debt maturities on senior notes. The company increased its liquidity by 60% to $1.6 billion (which includes $600 million in cash). It also retired all 2017 debt obligations which totaled $217 million. The next maturity on senior notes occurs in 2020, which is expected to be $500 million. Kevin Vann, the chief financial officer, attributes the growth in liquidity and reduction of debt maturities to the completion of a series of asset sales and a revolver size amendment.

In the first quarter 2015, WPX initiated what it calls “a rapid transformation” to become more engaged in the production of oil, over natural gas. The transformation took hold when the company decided to enter the Permian Basin in August 2015. Overall, the company has sold a total of $2.7 billion in assets since early 2014, while simultaneously shifting their focus toward the Permian Basin in Texas. The acquisition of RKI E&P for $2.75 billion gave WPX a 92,000 net acre position in the Delaware Basin. The stacked pay zones in the Permian represents more than 670,000 prospective net acres. The move into the Permian along with the sale of assets has allowed the company to shift production mix from 70% natural gas in first quarter 2015 to 62% oil & NGLs in first quarter 2016.

When asked about the company’s three assets and its plan for the next couple of years, Muncrief said, “We are extremely pleased with all three of these assets. This is relatively new, and we don’t have a year completed in the Permian. However, the Permian will be with us for a long time. We love our Bakken position and it is obvious why if you look at our performance … It gives us some optionality and we are pleased. I don’t think we have a big need for a fourth basin, so two to three is our range.”

In the first quarter of 2016, WPX recorded 80.1 MBoepd of production, and increase of 20% over first quarter 2015 production of 66.6 MBoepd. The increase in production came despite the decrease in capital expenditures. The company spent $480 million in capex in Q1 2015 compared to $170 million in Q1 2016. WPXs liquidity positon currently stands at $1.6 billion.

WPX carries a strong portfolio of hedges with roughly 80% of estimated 2016 production hedged at $60.35 per barrel and natural gas production fully hedged at $3.93 per Mcfe. These hedges will help lock in cash flow for the company, WPX has been cash flow positive through the entire down cycle that began in late 2014.

For additional details read the recent Oil & Gas 360® interview with Rick Muncrief here.

EnerCom’s The Oil & Gas Conference® 21 is in Denver Aug. 14-18, 2016. WPX will present on Tuesday, August 16. Register for the EnerCom conference here.