Sundance Energy Australia Ltd. (ticker: SDCJF) will be presenting at the EnerCom conference Wednesday August 17, 2016.

Headquartered in Denver, Colo., and trading on the Australian Securities Exchange since 2005, Sundance focuses on a growth strategy of acquiring high working interest positions in Sundance operated projects.

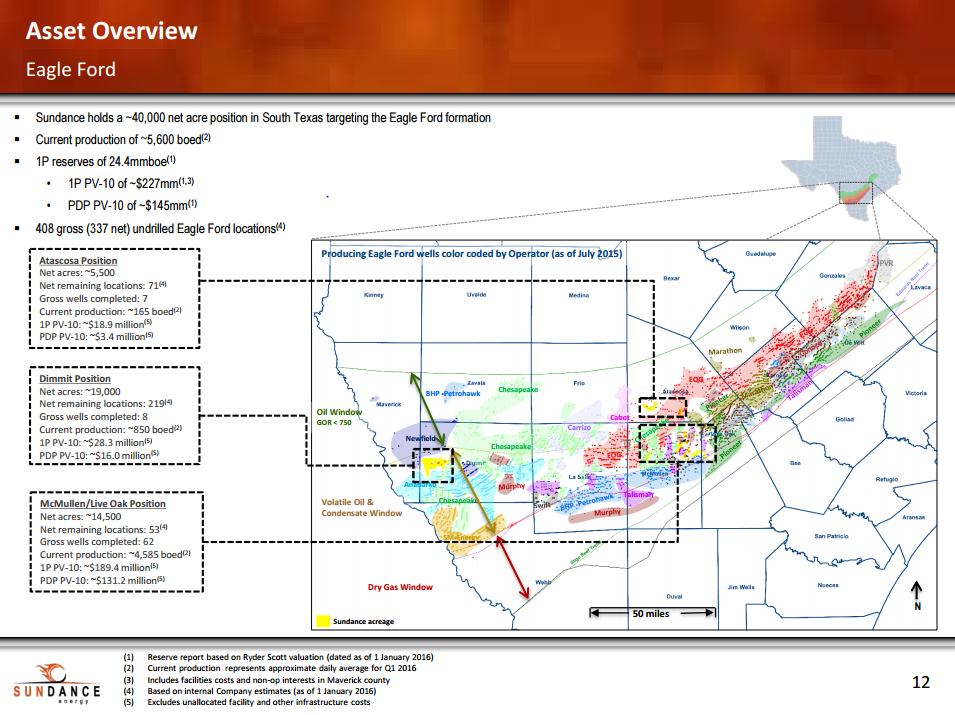

The company’s core operational focus is in the Eagle Ford in south Texas and the Anadarko Basin in Kansas and Oklahoma. Sundance holds 40,937 net acres in the Anadarko Basin and 26,160 net acres in the Eagle Ford.

Sundance announced the closing of an acquisition in the Eagle Ford July 29, 2016 for a previously announced agreement to acquire 5,050 acres for $15.5 million. The expected production of this asset is 600-700 Boe/d for the remainder of 2016, with total proved reserves of 3.0 MMBoe, and 27 gross (9.6 net) wells, primarily operated by Sundance. Funding for the acquisition will come from a recently completed capital raise.

While the company did not bring any new wells on production during the last quarter in either the Eagle Ford or Anadarko Basin, they participated in several non-operated completions. At quarter end, the company was in the process of completing three gross (2.7 net) Sundance-operated wells in the Anadarko Basin and had nine gross (6.8) horizontal wells, primarily in the Eagle Ford, scheduled for completion starting in Q3 2016.

In partnership with Schlumberger Limited, Sundance Energy plans to re-fracture five gross (4.7 net) wells in the Eagle Ford in Q3. The program is expected to generate 5-6x initial production uplift and 40% to 50% increase in reserves for each well.

During 2015, Sundance implemented a down-cycle plan to limit capital expenditures for drilling, completions, and well facility. The result was that Sundance was able to keep capital expenditures funded entirely through operational cash flow.

The company spent $60.5 million in CapEx, with $64.5 million in cash flow on the books. The company plans to maintain this course through 2016, with $45.0 million in CapEx funded through cash flow, with an average production rate of 6,800 to 7,400 Boe/d in 2016.

Sundance Energy’s adjusted EBITDAX was $10.3 million and produced 5,200 Boe/d for Q2 2016, cash operating costs continued to decline from $14.17/Boe for the year ending December 2015 to $12.29/Boe for the six month period ending June 2016. Lease operating expenses (LOE) decreased from $5.79 in Q1 to $5.48 in Q2. This is attributed to on-going field-level improvements, including additional electrification projects set for the remainder of the year that will drive LOE costs lower, the company said.

Sundance Energy successfully raised AUD$80 million in a two tranche placement, resulting in pro forma cash of $53 million. Hedging contracts resulted in $2.8 million realized gains at the end of Q2. The hedging program covered a total of 1.9 million barrels through 2019 with a weighted average floor of $50.01 and a ceiling of $57.93.

Sundance is in process of finalizing arrangements with NASDAQ and BNY Mellon to allow its shares to begin trading through a Level II American Depositary Receipt.

EnerCom’s The Oil & Gas Conference® Denver – August 14-18, 2016

Sundance Energy Australia Ltd. (ticker: SDCJF) will be presenting at EnerCom’s The Oil & Gas Conference® 21 in Denver on Wednesday, August 17, 2016 at 3:30 EDT. Conference information and registration for this year’s EnerCom conference may be accessed here.