Birchcliff Energy (ticker: BIR) will present at EnerCom’s The Oil & Gas Conference® on Tues. Aug. 16, 2016.

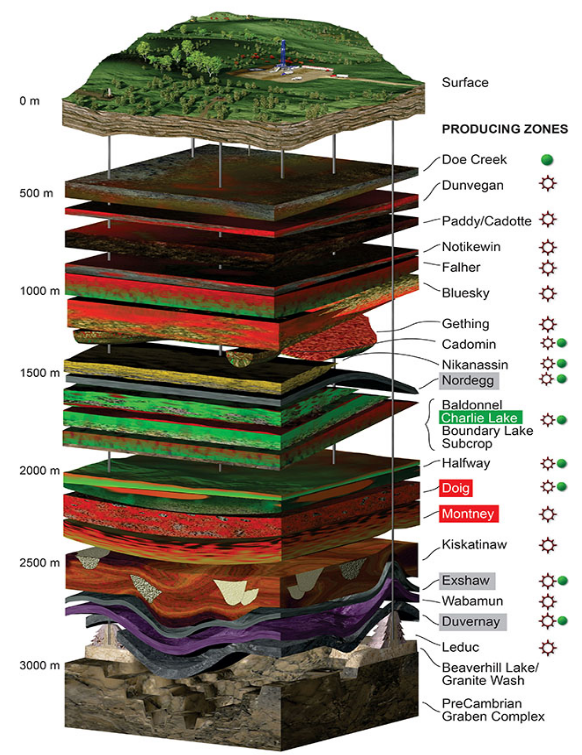

Birchcliff Energy (ticker: BIR) is a Canadian oil and natural gas exploration and production company headquartered in Calgary, Alberta, operating in the Montney/Doig Natural Gas Resource Play and Worsley Charlie Lake Light Oil Resource Play in northern Alberta. The company has increased production over the last few years from 26 Mboe/d in 2013 to 39 Mboe/d in 2015. Birchcliff’s Q1 production was 42 Mboe/d prior to the C$625M acquisition completed July 28, 2016. The company has a said they are focused on these two established plays.

The company is utilizing horizontal drilling and fracturing in the shale plays, and they looking to further reduce costs by utilizing pad drilling. The company, in its Q1 release, explains that the cost savings in pad drilling comes primarily from decreased capital costs.

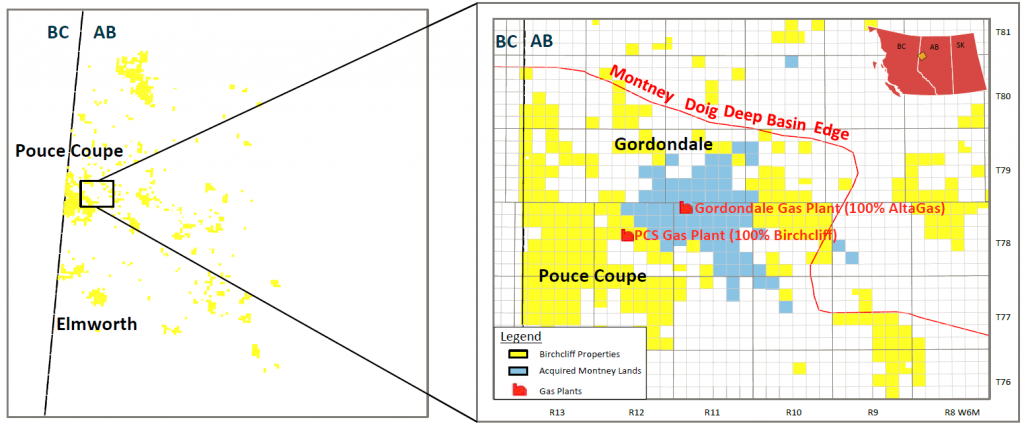

Strategic Acquisition

On July 28, 2016 Birchcliff closed on a significant acquisition of 100% of Encana’s interest in the Gordondale area. The transaction is expected to increase daily production to approximately 65 mboe/d (77% gas). This represents an anticipated 55% increase in daily production. The mix of this production will also change with a 12.5% decline in the reliance of natural gas in the overall company’s production mix. Increasing production of oil and NGLs will reduce the risk from concentration in a single commodity. The acquisition will increase proved developed reserves by 54MMboe. The total 2P reserves will be approximately 764MMboe.

The acquisition will give the company a reported 251,950 net acres in its target area with 42% of the acreage classified as developed. Birchcliff anticipates more efficient future development of the area with better plans for future development in the area that will establish best practices for accessing the formation. The substantial continuous, high working interest acreage accomplished in this transaction will better allow for this type of long term planning.

The transaction was funded through a private placement of shares by the company through underwriters and The Schulich Foundation, controlled by billionaire investor, Seymour Schulich. The offering raised aggregate gross proceeds of C$691M. The shares were sold through the private offering for $6.25/share and would convert to underlying shares as of the closing date. The subscription receipts for the private placement were delivered to the Toronto Stock Exchange (“TSX”) on July 28, 2016, and the underlying shares began trading normally on Friday, July 29.

Borrowing Base Redetermination

July 28, 2016 Birchwood also announced a 27% increase in its credit facility from C$750M to C$950M. This is C$900M syndicated credit facility and C$50M revolving facility for working capital. The borrowing based will not be redetermined in November 2016 as previously planned.

EnerCom’s The Oil & Gas Conference® Denver – August 14-18, 2016

Birchcliff Energy (ticker: BIR) will be presenting at EnerCom’s The Oil & Gas Conference® 21 in Denver on Tuesday, August 16, 2016 at 10:55am EDT. Conference information and registration for this year’s EnerCom conference may be accessed here.