Calgary-based Encana Corporation (ticker: ECA) made a big jump in reducing its debt on August 25, 2015, selling the entirety of its assets in the Haynesville for total cash consideration of $850 million. The buyer, GEP Haynesville (a joint venture involving GeoSouthern and funds managed by GSO Capital Partners LP), receives 217 MMcf/d of production and 720 Bcfe of proved reserves as of year end 2014. Approximately 300 net wells are currently operating on the 112,000 net acres spread across northern Louisiana.

Per terms of the agreement, ECA will transport and market GeoSouthern’s production on a fee basis for the next five years. In a company statement, Doug Suttles, Encana’s president and CEO, said the transaction “eliminates our midstream commitments in the Haynesville and captures ongoing revenue upside through a gas marketing arrangement.”

ECA management believes the arrangement will reduce its midstream commitments by approximately $480 million on an undiscounted basis. Overall, the Haynesville contributed 9% of companywide production and less than 2.5% of operating cash flow, excluding hedges, in the first half of 2015.

GSO Capital Remains Active

This is the first announced deal by GeoSouthern Energy since it sold its Eagle Ford assets to Devon Energy (ticker: DVN) for $6 billion in Q4’13. The company was one of the largest private operators in the United States prior to the Devon deal and currently has no debt outstanding, aside from an undrawn revolver. GSO Capital, GeoSouthern’s partner in the deal, is a credit division of Blackstone and manages approximately $81 billion of capital. GSO struck a strategic alliance earlier this year with LINN Energy (ticker: LINE) for up to $500 million of funding with 5-year availability.

Encana, meanwhile, inflicts a meaningful dent on its debt levels. Global Hunter Securities projects net debt to EBITDA to remain below 3.0x for the remainder of 2015. The company was already projecting to fully fund its 2015 capital program prior to the divesture announcement.

ECA’s Haynesville History

Encana was one of the early movers into the Haynesville Shale, securing its first lease in 2005 and drilling three vertical wells in 2006. A 50/50 joint venture was established with Royal Dutch Shell (ticker: RDS.B) in 2007, and the partners drilled an additional five wells in the year. Encana spoke highly of the play, saying it “could rival the Barnett Shale.” The company made a considerable splash in June 2008, acquiring 325,000 net acres in the play. Another deal was made in July 2008, acquiring an additional 89,000 acres of mineral rights for $457 million.

The group maintained their position for roughly six years before disbanding. Shell sold its stake to Blackstone and Vine Oil & Gas LP in August 2014 for $1.2 billion, consisting of 107,000 net acres in North Louisiana. The region included 418 producing wells (193 operated by Shell) and total gross production of 700 MMcf/d (250 MMcf/d net). Encana reportedly began reaching out to private equity firms and exploration companies in April 2015 in hopes of divesting its Haynesville stake, placing the value at as high as $1 billion.

Lining up the Deal

A note from Capital One Securities said the built-in arrangement regarding the midstream assets makes the deal difficult to compare to other Haynesville positions. Per the transaction metrics, Encana is selling the assets for $1.18/Mcf of proved reserves and $3,917/Mcf/d of flowing production. “Considering the $2.95/Mcf strip price for natural gas in 2016 the purchase price roughly matches what we consider to be fair value for flowing dry gas production ($4,000/Mcf/d),” Capital One explains. “On that assumption, the deal price ascribes no value to the acreage left to be developed. This is consistent with our modeling… which implies no value for any undeveloped Haynesville acreage after backing out production at a $4,000/Mcf/d marker.”

Date |

Buyer |

Seller |

$ per flowing Mcf/d |

$ per Mcf Reserves |

$ per acre |

| 07/08 | Encana | Indigo Minerals |

N/A |

N/A |

$5,134 |

| 08/14 | Vine Oil & Gas | Shell |

$4,800 |

N/A |

$11,214 |

| 08/15 | GEP Haynesville | Encana |

$3,917 |

$1.18 |

$7,589 |

Encana’s Shift

According to the Ross Smith Energy Group, Encana was the second largest North American gas producer in terms of net after royalties in Q4 2006. The company Encana exemplified its shift to a natural gas producer from an oil producer by spinning off its initial oil segment into Cenovus Energy (ticker: CVE) in November 2009. ECA’s presentation at EnerCom’s The Oil & Gas Conference® in 2010 refers to Encana as “a pure play natural gas company,” and places its United States gas production volumes at second to only ExxonMobil (ticker: XOM). At the time, the Haynesville was estimated by Morgan Stanley to have the same economics as the Marcellus Shale.

Management publicly acknowledged plans in 2013 to increase its presence with liquids, and followed through on the promise with a “transitional” $7.1 billion purchase of Athlon Energy in September 2014. Athlon, a pure play Permian producer, brought 30 MBOEPD of production and 173 MMBOE of reserves to the table.

In accordance with the Haynesville deal, Global Hunter Securities believes Encana’s other non-core assets like the San Juan and Denver-Julesburg Basins could be “on the chopping block.” The two plays combined for 18% and 2% of oil and natural gas production, respectively, according to ECA’s 2014 annual report.

Moving Forward

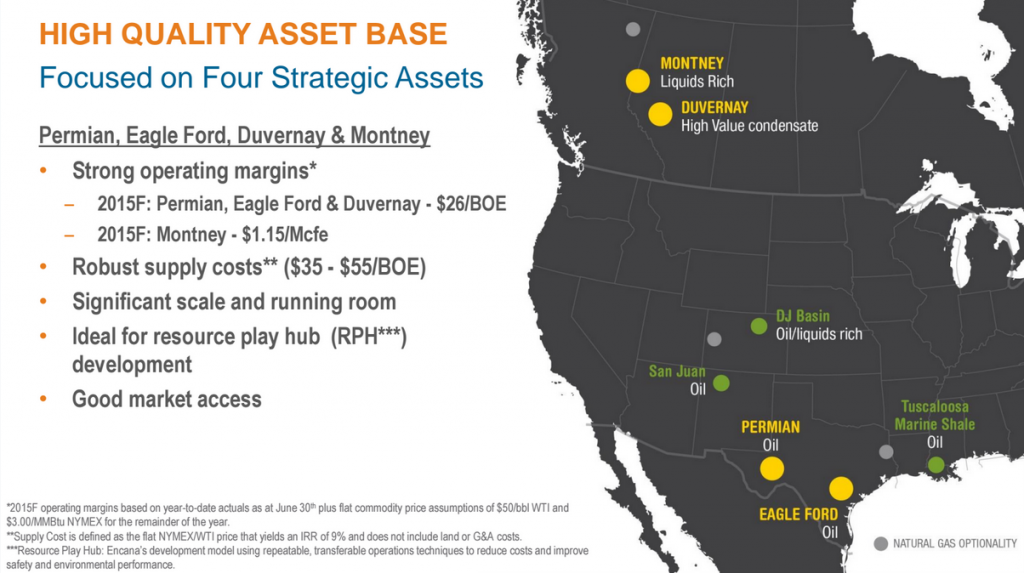

ECA moved away from further Haynesville development in its short-term outlook, identifying four core plays located in the Permian and Eagle Ford of the United States along with the Duvernay and Montney plays in Alberta. The Duvernay and Montney were the focus of several analyst questions in ECA’s breakout session at EnerCom’s The Oil & Gas Conference® 20 last week. More than 80% of its 2015 capital plan is directed at developing its four core assets, ultimately resulting in year-over-year liquids growth of approximately 50%. Average output from the core areas is on target to reach 270 MBOEPD by Q4’15, accounting for 65% of the company’s overall production.