Enbridge Q3 results: projects are moving forward

Enbridge Inc. (ENB) – ENB Q3 highlights

- Earnings were $765 million or $0.47 per common share for the third quarter and $2,322 million or $1.57 per common share for the nine-month period, both including the impact of a number of unusual, non-recurring or non-operating factors

- Adjusted earnings were $632 million or $0.39 per common share for the third quarter and $1,969 million or $1.33 per common share for the nine-month period

- Adjusted earnings before interest and income taxes (EBIT) were $1,738 million for the third quarter and $4,966 million for the nine-month period

Enbridge Energy Partners, L.P. (EEP) – EEP Q3 highlights

- Net income was $93.1 million

- Adjusted EBITDA and distributable cash flow (DCF) were $426.2 million and $193.6 million, respectively

- In the Bakken region, transportation on the legacy North Dakota system into Clearbrook, Minnesota averaged over 219 kbpd

Enbridge Inc. (ticker: ENB) and Enbridge Energy Partners, L.P. (ticker: EEP) reported Q3 financial results on Nov. 3.

Enbridge Energy Partners, in its Q3 press release said, “This quarter represents the first full quarter following our restructuring to a new lower risk, pure-play business model. With the sale of the natural gas business now closed, the partnership has returned to its core business of stable liquids pipeline and storage assets.”

Spectra transaction

Enbridge closed the Spectra Energy merger in late February. The company said the Spectra assets and projects are currently being integrated and coming into service. Norlite and JACOS both came into service, benefitting the Regional Oil Sands Systems. Additionally, the Sabal Trail in Florida came into service in Q3.

The Merger of Enbridge and Spectra Energy creates the largest energy infrastructure company in North America, the company said, with roughly C$166 billion (US$126 billion) in enterprise value and the strongest liquids and natural gas infrastructure franchises in North America.

Enbridge Mainline

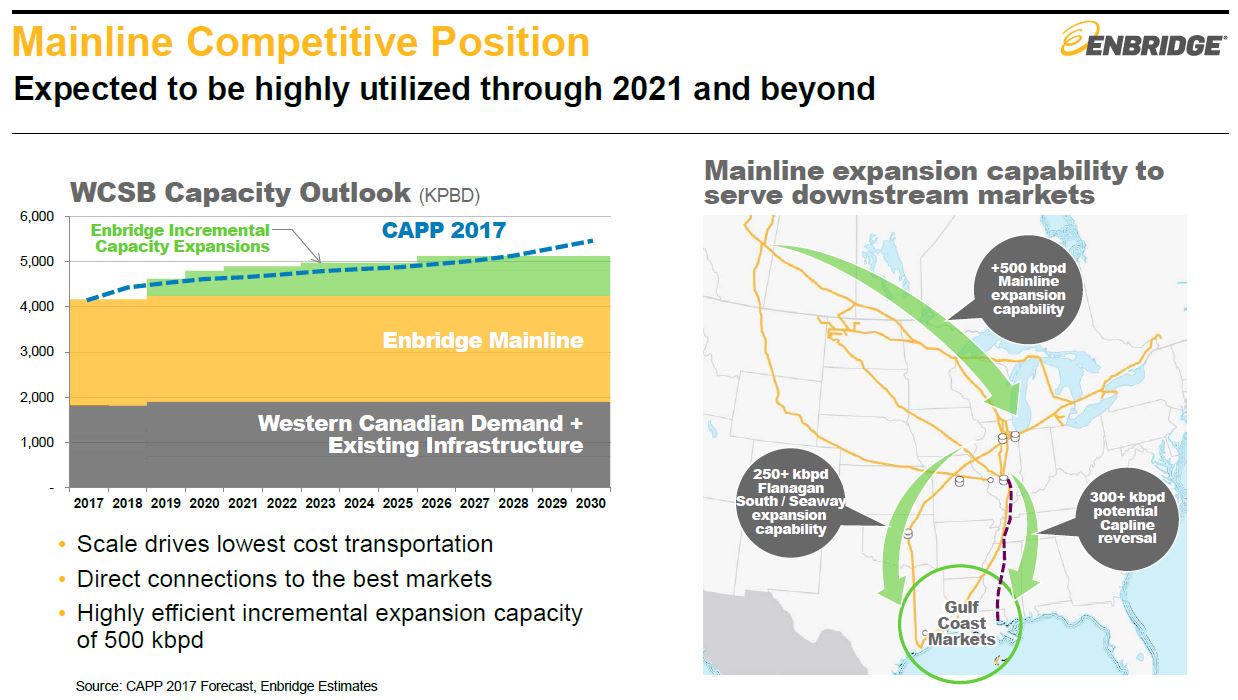

The Canadian Mainline now contributes about 15% of overall EBIT. Even with the Line 3 Replacement in 2019, pipe capacity in the near term and medium term will be tight and overflow will be carried by rail. Over the last two years, Enbridge has developed optimization solutions capable of moving about 250,000 barrels per day of extra heavy. Additionally, Enbridge has recently implemented solutions to restore 45,000 barrels per day of capacity in Line 4.

Enbridge said that the pipeline system carries 2.8 million barrels per day, plus on-system and downstream connect pipe demand that’s connected to markets that provide netbacks for Western Canadian producers.

Enbridge, Inc. President and CEO Albert Monaco said, “We also have low cost incremental expansion capacity of about 500,000 barrels per day that comes with minimal permitting, along with downstream expandability of our Flanagan South and Seaway system, which provides a low cost full path route to the Gulf.”

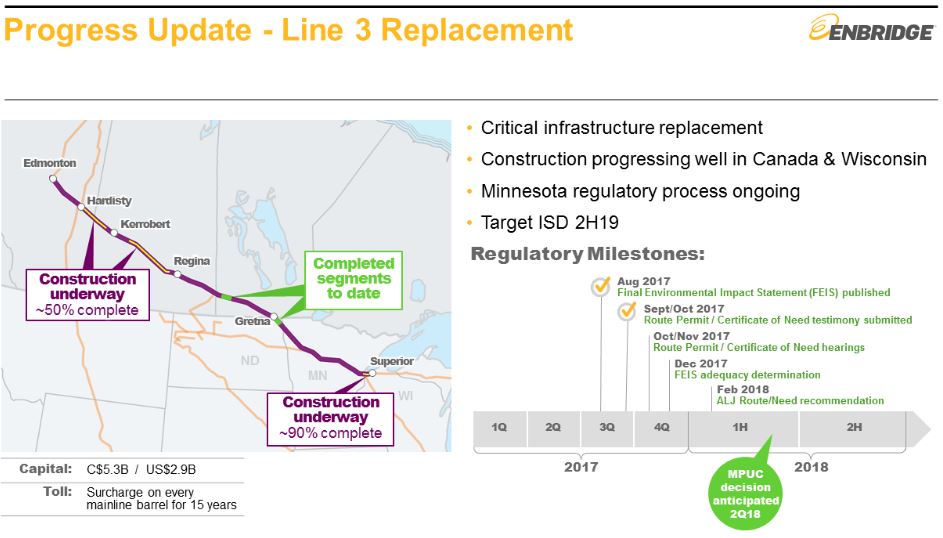

Line 3 Replacement Program

Line 3 supplies the U.S. Midwest and Gulf Coast markets. The dry summer has helped construction progress. Regulatory permitting is in place in North Dakota and in Wisconsin, where construction is under way. Some other sections, indicated on the map, have been completed.

Minnesota’s Final Environmental Impact Statement was issued in August and its adequacy determination is expected from the Public Utilities Commission (PUC) in Dec. 2017. The projected in-service date for Minnesota is expected to be the second half of 2019.

Pipeline permits and approvals

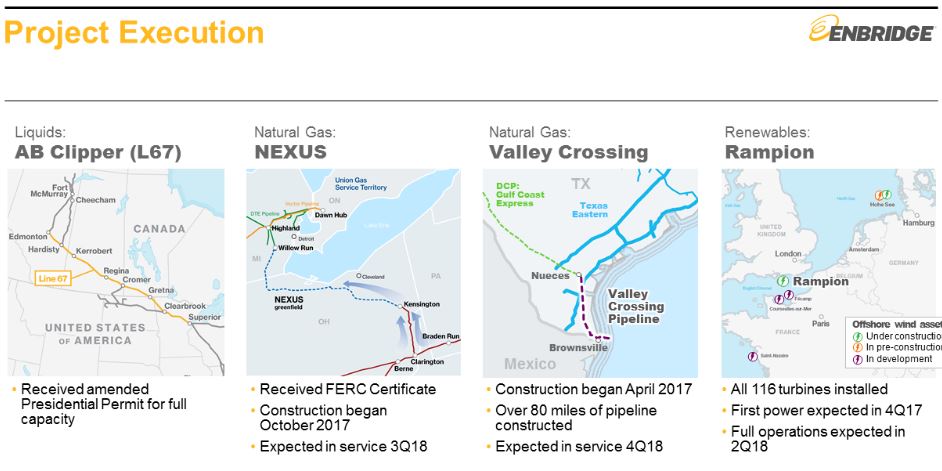

Enbridge received an amended Presidential Permit for the expansion of the Alberta Clipper liquids pipeline. The Alberta pipeline will enable full utilization of the Mainline system in the future.

NEXUS received FERC approval for construction. Enbridge expects an in-service target date of Q3 2018. Existing infrastructure will be used in the construction of NEXUS when possible. The NEXUS serves as an outlet for Marcellus and Utica gas, delivering to 3.5 million customers in Michigan, Ohio, and Ontario. NEXUS comes with strong demand pull contracts, there is about 1.7 Bcf of interconnects being requested in Ohio.

Valley Crossing construction continues to move along. Enbridge said that Valley Crossing will be a critical link between the Permian and Eagle Ford supply basins and increasing demand in Mexico.

The Rampion offshore wind project in the UK has all 116 turbines in, totaling 400 megawatts of capacity. First power is expected later in November and full operation is scheduled for the first half of 2018.

Enbridge, Inc. CEO Al Monaco said, “We brought CAD 9 billion [in projects] into service so far this year, most recently JACOS, the Chapman Ranch wind farm, and the Dawn-Parkway gas pipeline expansion. We’ve also got a few more to come in online this year, the biggest one being the Wood Buffalo Extension [which] was completed earlier in the year on time and on budget.”

Conference call Q&A

Q: There are concerns about getting pipeline projects done in the U.S. Can you share your views?

EEP: When you look at what our track record has been, I think you can point to fairly difficult projects being placed into service. From an execution standpoint, there’s a lot of concern out there about if we can get projects done. Well, there really hasn’t been anything that we could point to that we haven’t accomplished. Are things a little bit more expensive these days or is it a little more challenging? Sure, but these projects are getting done.

If you look at the fundamentals, whether it’s New England, whether it’s the Gulf Coast, electric power generation fired by gas and the reliability discussion, those fundamentals point to the need for more infrastructure, especially in the natural gas space.

I think there’s an awful lot of opportunity and I think we sometimes get down on ourselves when things are just simply changing a little bit and are getting a little bit tougher. Yeah, they’re getting a little tougher, but we are executing.

Q: I understand the big increase in capacity in 2019 is due to the Line 3 Replacement. Is that due to incremental expansions?

EEP: The foundation of our continuing Mainline expansion is through these smaller scale staged increments of capacity that, generally speaking, are more readily executable and have fewer regulatory requirements attached to them. Several of those have the potential to move sooner than maybe what we’ve represented in that profile, but there would have to be some commercial work done to get them advanced at that point in time.

Q: There’s been some recent developments in the industry that require certain projects to review upstream and downstream, greenhouse gas emissions as part of the review process. I’m wondering how this impacts the company’s expected growth plans?

Enbridge, Inc. President and CEO Albert Monaco: We’ve seen this in a couple of instances in Line 3, we had a very comprehensive review of emissions, upstream and downstream. So generally, we’ve gotten through the process well.

I think from a climate change perspective, the province of Alberta has been leading the charge there and making sure that we’re always focused on that as part of industry and more generally in society. So I think we don’t really see, at least at the moment, an impact in terms of stopping projects or reconsidering projects based on that.

Obviously, the pipeline itself is not a large emitter. But there are upstream effects, and those are generally reviewed in the context of the bigger picture in Canada and in the U.S. So I’m not seeing a huge effect there.

The second part, which is costs and timeline, that certainly is a factor in how we look at developing projects and how much capital we’re putting at risk before we see final authority for permitting and so forth.

Costs are higher and timeline is more extended. But it’s the job of the execution people to make sure that we’re budgeting for that with appropriate contingencies. I would say the bigger driver, frankly, is the hard work on the ground with communities and indigenous groups to make sure that we’re communicating well.

Q: What’s the maintenance CapEx fall off that you anticipate as you go to Line 3 in the second half of 2019?

EEP: When we entered into the deal, we evaluated that number over the period from when the deal was done through to the early part of the next decade. I want to say it was in the neighborhood of CAD 1.8 billion to CAD 2 billion of maintenance capital that we thought would be avoided across that period, some of which will already have been avoided and some of which will be avoided post the new in-service date.