Elk secures second largest CO2 supply source in Wyoming for CO2 EOR; profitable production of ~3,400 BOEPD (20 MMSCFD+)

Freeport-McMoRan has sold another group of oil and gas assets. Australia’s Elk Petroleum Ltd (ticker: ELK) has entered into a purchase and sale agreement with subsidiaries of Freeport-McMoRan Inc. (ticker: FCX) to acquire all of FCX’s interest in the Madden Gas Field, the Madden Deep Unit Gas Field and the Lost Cabin Gas Plant in Wyoming.

The deal is valued at US$20 million, which the company said it expects to fund principally through debt financing.

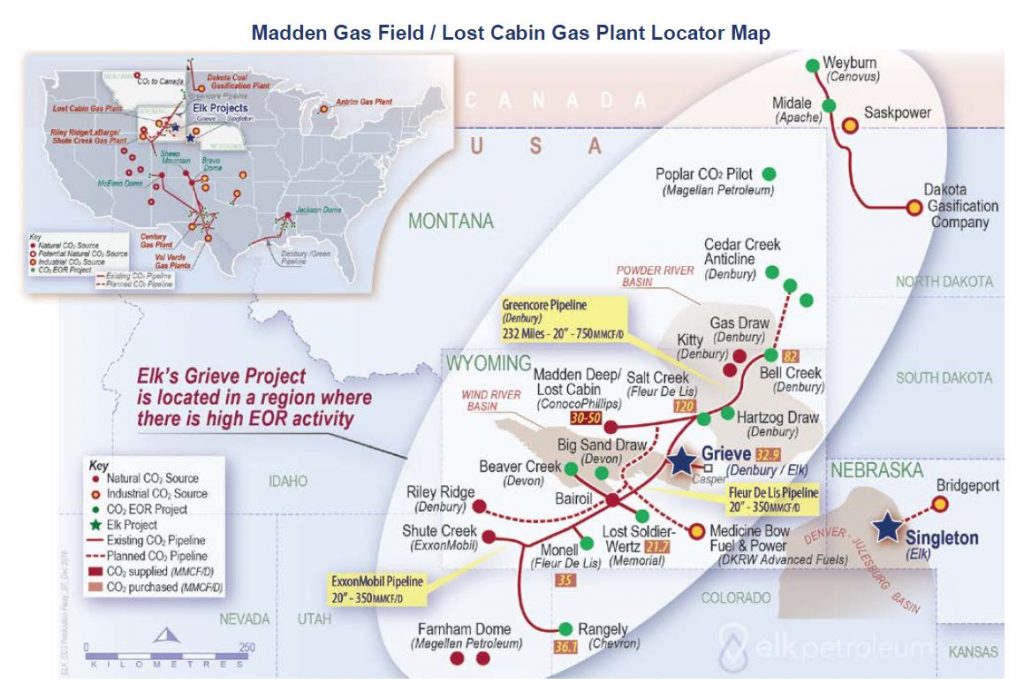

The Madden Gas Field and the Lost Cabin Gas Plant are located in Natrona and Freemont counties, Wyoming, 60 miles from Elk’s Grieve CO2 enhanced oil recovery project.

Elk will acquire an approximate 14% non-operating working interest in the Madden Gas Field and the Lost Cabin Gas Plant and associated gas gathering pipeline systems. The EIA ranks the Madden field as the 33rd largest gas field in the U.S.

The Madden Gas Field and the Lost Cabin Gas Plant are operated by Conoco Phillips (ticker: COP) (46%) and the balance of the unit and gas plant is owned by Moncrief Oil (30%) and various other private interest holders. The purchase of Freeport-McMoRan interest in the Madden Gas Field and the Lost Cabin Gas Plant is not subject to any pre-emptive rights and the PSA is subject to completion of additional due diligence for title, environmental and other customary matters. The acquisition is scheduled to be completed by 22 February 2017 with an effective date 1 January 2017, the company said in a statement.

Elk said it expects 2017 estimated positive free cash flow of more than US$7 million from the assets.

Freeport-McMoRan’s sale of its interest in the Madden Gas Field and the Lost Cabin Gas Plant is part of corporate-wide shedding of FCX’s oil and gas operations. On Dec. 30, 2016, Freeport-McMoRan announced it had closed the sale of its California onshore assets to Sentinel Peak Resources.

Madden Gas Field

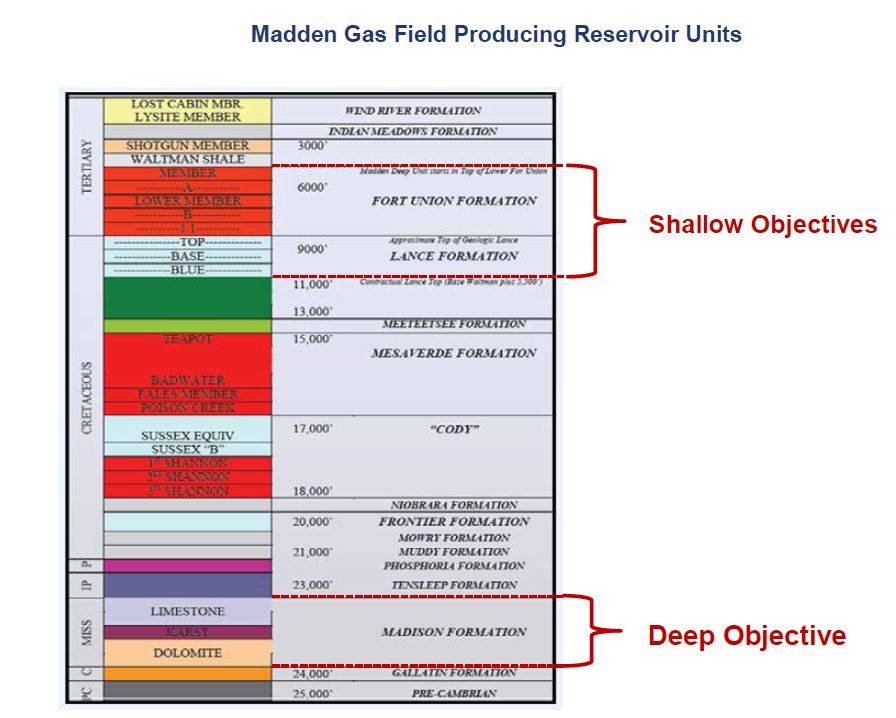

The Madden Gas Field is a giant, conventional gas field located in the Wind River Basin and one of the largest gas fields in Wyoming, Elk Petroleum reported today. The field sits on the Madden Anticline and covers an area of over 200 sq. miles / 128,000 acres. The field produces from multiple reservoir units ranging in depth from 5,000 to 25,000 feet. With an estimated original gas in place of over 5.5 TCF, to date the Madden Gas Field has produced over 2.42 TCF of natural gas, the company said.

Source: Elk Petroleum

Shallow gas production comes from 165 active gas production wells.

Elk said that Conoco, the operator of the Madden Gas Field, has identified additional development potential within the shallow units from undeveloped zones across 15,000 feet of gas bearing intervals through well recompletions, vertical infill drilling and horizontal drilling potential to target these discovered, undeveloped gas resources.

The majority of current gas production currently comes from the deeper Carboniferous (Mississippian) Madison Formation from 8 production wells. The Madison Formation reservoir is continuous over a 40 sq. mile structure with a continuous gas column that extends over 1200 feet.

According to Elk, collectively, these deeper Madison Formation wells have produced over 1.1 TCF since first discovery and commencement of production in 1995. Individual wells have so far produced between 21 BCF to 225 BCF each. Initial well production rates range from 45 to 60 MMSCF/day.

Elk said that there are no current plans to drill additional wells in the Madison Formation.

Lost Cabin Gas Plant & Gas Gathering System

Production from the Madden Gas Field is transported through an extensive gas gathering system for processing through the dedicated Lost Cabin Gas Plant (LCGP) which includes 3 raw gas processing trains with a total installed raw gas processing capacity of 310 MMSCF/day. The raw gas stream is comprised of 68% methane and ethane, 20% CO2 and 12% H2S. Currently approximately 240 MMSCF/day of raw gas is processed through the gas plant.

Sales gas is delivered from the gas plant into several interstate sales gas transmission pipelines: Lost Creek Pipeline (for delivery to Colorado Interstate Gas, Wyoming Interstate Gas, and Rockies Express) and Mountain Gas Resources Inc. (for delivery to Colorado Interstate Gas).

Both CO2 and H2S are also captured and processed for sale. The plant produces 1200-1400 tons per day of sales grade Sulphur the majority of which is transported by rail to supply the fertilizer market in Tampa, Florida with the remainder transported to a local fertilizer plant located in SW Wyoming.

Supply Agreement with Denbury Resources

Since 2013, the Lost Cabin Gas Plant has also been equipped to capture, process and deliver for sale most of the CO2 from the Madden Gas Field raw gas stream. The CO2 is under a long-term supply contract to Denbury Resources (ticker: DNR). From 2013 to 2016 the CO2 from the Lost Cabin Gas Plant was the principal source of CO2 supply for Denbury’s Bell Creek CO2 EOR Project located north of the Lost Cabin Gas Plant on the Wyoming-Montana border.

In May 2011, Elk signed an agreement with Denbury Resources to joint venture the Grieve project. Under the agreement, finalized in June 2011, Elk holds a 35% working interest in the Grieve EOR Project with Denbury holding a 65% working interest and is operator.

Reserves

| Elk reported that the acquisition delivers approximately 70 BCF (11.6 MMBOE) of Proven (1P) gas reserves and 1.2 mmbbls of natural gas liquids of which 65 BCF (10.8 MMBOE) of the gas reserves and all of the natural gas liquids are reserves classified by Netherland Sewell and Associates, Inc. (“NSAI”) as Proved Developed Producing. Summary of Madden Deep Gas Reserves

As of 30 September 2016 |

||

| Reserve Category | Gross

(BCF) |

Elk Net

(BCF) |

| Proved (1P) | 977.7 | 77.6 |

| Proved Developed Producing | 903.5 | 72.1 |

| Proved Developed Non Producing | 74.2 | 5.3 |

| Proved + Probable (2P) | 1,123 | 87.9 |

| Proved + Probable + Possible (3P) | 1,262 | 97.9 |

| Reserves independently audited by Netherland Sewell & Associates, Inc as of 30 September 2016 | ||

Interview with Elk Petroleum

Oil & Gas 360® spoke with Elk Petroleum Communications Manager Amy Anderson via email about the acquisition.

OAG360: With respect to this acquisition, where do you expect to focus some development capex in the upcoming years?

ELK: The Madden Gas Field and the Lost Cabin Gas Plant are in a very interesting position. In the first instance current production levels especially from the deep Madison Formation wells – which account for most of the current production – can be maintained at these very strong rates with very little additional capital investment in terms of either drilling or gas gathering and processing facilities. There is, however, quite significant upside in the existing unit to significantly increase both reserves and production. In terms of upside potential these largely fall into 3 main categories:

Low risk operational upside and development

- Recompletion potential and additional perforations throughout stacked play

- Capillary string program to lower lifting costs and increase well performance

Large resource potential in Madden Shallow

- Field has only recovered 1 of 6 Tcf of OGIP (15% recovery factor) leaving significant recoverable reserves and resource

- Additional potential from undeveloped zones across 15,000’ of hydrocarbon bearing interval (recompletion, vertical infill, and horizontal development potential)

- Field wide compression to extend well life and add reserves

Upside recovery potential in Madden Deep

- Incremental recovery potential in Madden Deep due to higher recovery factors and compression

OAG360: Do you expect to drill the asset at all in 2017-18?

ELK: At this point it is unlikely that much if any drilling is contemplated at current gas prices but as the gas market demonstrates its ability to maintain pricing at or above current levels this could change quite quickly due to improved overall economics. The good thing is that all of the gathering and processing and transportation capacity and infrastructure is already in place to make the most of a steadily improving market.

OAG360: What did you see in this asset that most attracted you?

ELK: Elk’s business model is all about delivering substantial growth in high quality reserves with long term profitable production even at the downside in the commodity price cycle and to do this with a core focus or linkage to CO2 enhanced oil recovery. When you apply this lens or perspective on the Madden Gas Field and the Lost Cabin Gas Plant and CO2 supply it becomes a very obvious property of interest to Elk.

OAG360: Is the CO2 asset the main objective of the acquisition?

ELK: From our perspective access to the CO2 supply wasn’t the only “main” objective of the acquisition but it did very much make the asset stand out as something of strong interest to Elk. What makes this an absolute “winner” asset for Elk is the access to a large, long-term, low cost CO2 supply to support our focus on CO2 EOR projects. In terms of the synergies with the Grieve CO2 EOR Project, through our restructured JV arrangements with Denbury Resources we have all the CO2 that is required for the primary stage of development. There is additional upside in the Grieve Project that will require additional CO2 supply and the Madden Gas Field and Lost Cabin Gas Plant can be a source of this further CO2. Where having an interest in the CO2 supply at Lost Cabin really gets exciting is the opening it provides towards the development of additional new CO2 EOR projects.

OAG360: Can you talk about the Sulphur production – who is operator of that piece of it and is this a business to expand?

ELK: The Sulphur production comes part and parcel with the deep gas production. If the deep gas production increases so does the Sulphur production. With the volatility in the Sulphur price and being near long-term lows there is significant upside in Sulphur production as one of the three main production revenue streams. Conoco is the operator of the Sulphur production and at the moment it looks pretty much like steady as she goes in keeping with the long-term gas production.