Productivity growth is slowing

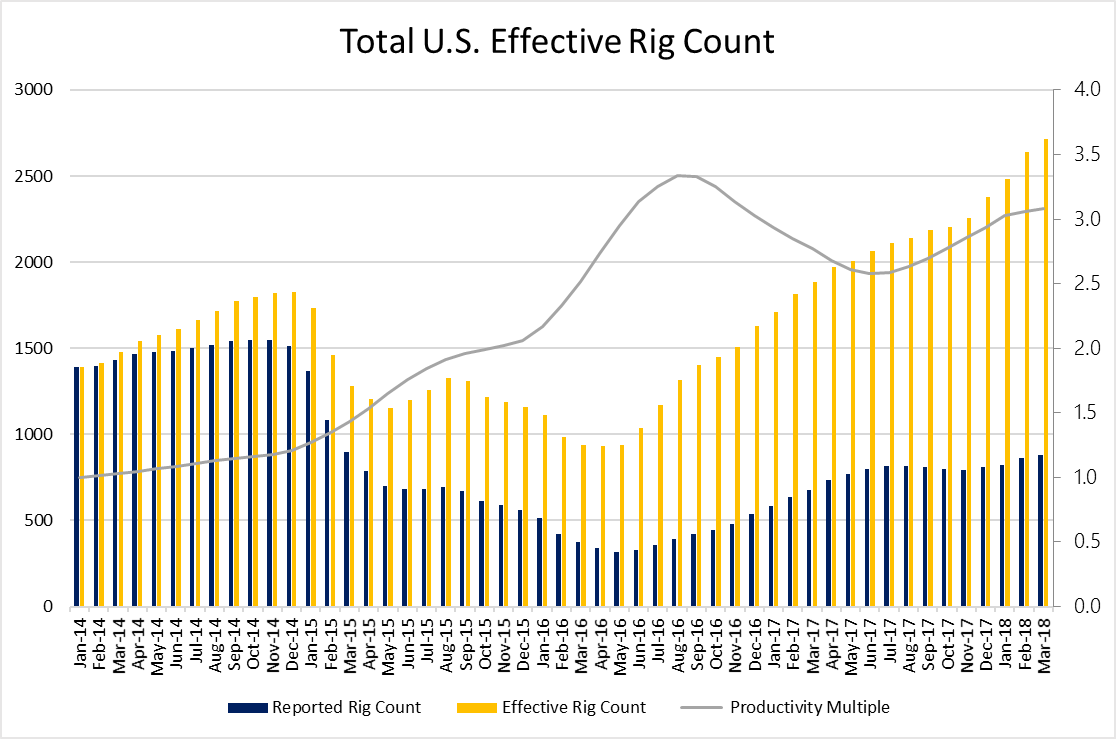

EnerCom has released the latest Effective Rig Count, examining the state of drilling activity in major shale basins.

The EERC is now 2,712, meaning the current level of growth would require 2,712 rigs from January 2014 to achieve. Rigs in today’s drilling environment are now 3.09 times more productive than January 2014 rigs, as operations have shown significant improvement since before the downturn.

Rigs, completions are better but operators are also laser-targeting best rock

Better drilling and completions techniques have combined with targeting the best portions of plays to give significant productivity gains over the past four years. Over the last three months, however, growth has slowed noticeably. This is primarily due to the continued completions lag, as wells drilled do not immediately translate into production but instead often languish as drilled uncompleted wells.

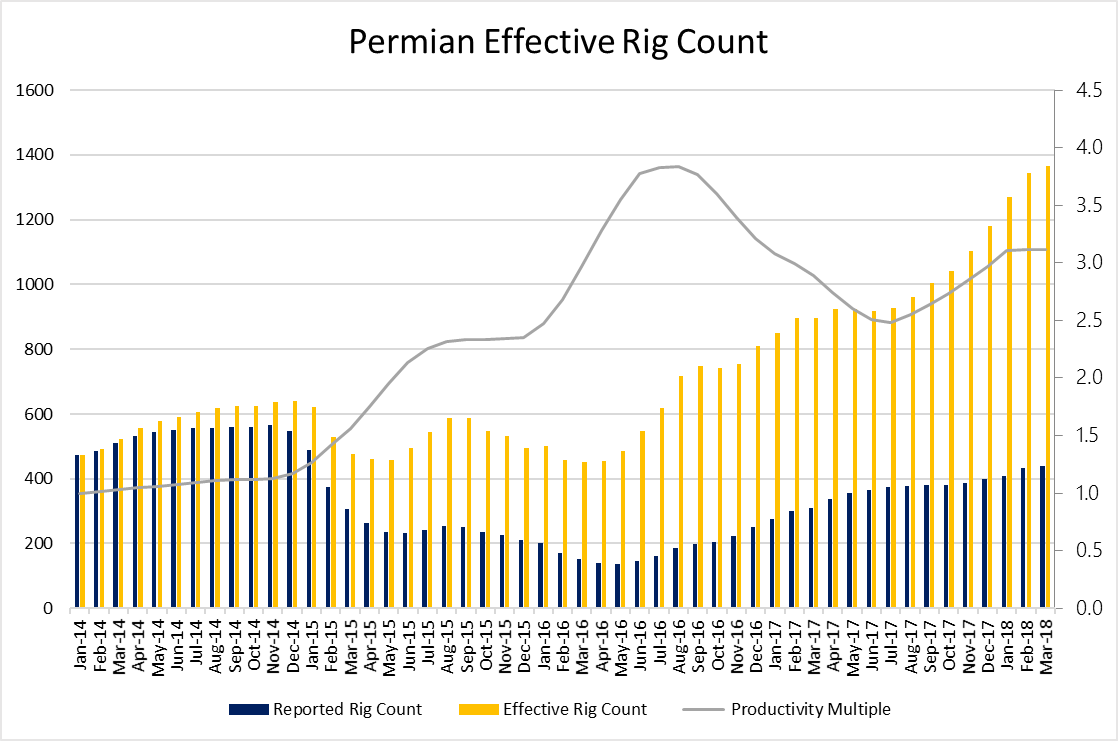

Permian accounts for 1,367 effective rigs

As usual, the Permian dominates the EERC, accounting for just over 50% of all effective rigs. The 438 rigs in the Permian are currently yielding the same production as 1,367 January 2014 rigs. Productivity growth in the Permian has been essentially flat in 2018, however, as improving processes and the completions lag are roughly canceling each other out. Rigs in the Permian are currently 3.12 times more productive than those of January 2014.

Unlike last month, this month did not see in increase in Effective Rig Count across the board. Instead, the EERC in the Niobrara fell by six as productivity gains were insufficient to counter a slightly falling reported rig count. The largest increase in ERC came from the Permian, driven by rising reported rig counts, while the largest growth in productivity came in the Eagle Ford.

Gas production up by 1 Bcf/d

The EIA predicts rapid production growth in the U.S. will from April to May, with both gas and oil output rising significantly. The major shale basins are predicted to produce 6,996 MBOPD in May, which represents growth of 125 MBOPD in the month. This growth will, of course, be driven by the Permian, where 73 MBOPD is expected to come online. Significant growth is also predicted in the Eagle Ford and Bakken, where the EIA predicts oil output increases of 24 MBOPD and 15 MBOPD, respectively.

Gas production is predicted to rise equally rapidly, with the major shale basins showing production growth of more than 1 Bcf/d from April to May. The Appalachian region is expected to provide the majority of this growth, with output rising by 386 MMcf/d, but significant growth is also expected in the Permian, Haynesville and Eagle Ford.

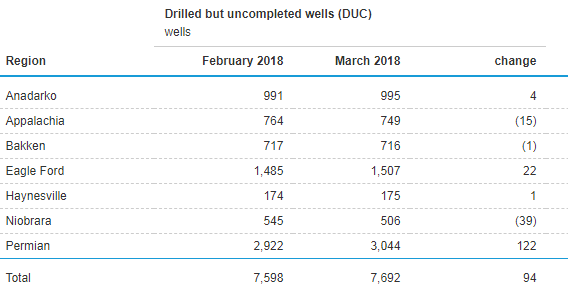

Niobrara DUC count falls sharply

While completions have not caught up with drilling in the Permian, the DUC count is stabilizing or falling in most other basins. The EIA estimates the number of drilled uncompleted wells rose by 122 in the Permian from February to March, meaning there are now 3,044 DUCs in the basin. The only other basin with meaningfully rising DUC count was the Eagle Ford, where drilling outpaced completions by 22 rigs. In the Niobrara and Appalachian regions, on the other hand, DUC counts have begun to fall steadily.

The EIA estimates completions outpaced drilling by 39 in the Niobrara in February, giving the largest decrease in DUC count of any single basin since October 2016.