Eclipse Resources Corporation (ticker: ECR) had a net income for 2017 of $8.5 million, or $0.03 per share. For reference, the company had a net loss of $206.7 million, or $(0.86) per share for 2016.

The fourth quarter of 2017 showed a net loss of $13.1 million, or $(0.05) per share. In Q4 2016 the company had a net loss of $62.083 million, or $(0.24) per share.

Average net daily production for Q4 2017 was 311.7 MMcfe/d and consisted of 74% natural gas and 26% liquids. Production for the full year of 2017 was 310.7 MMcfe/d and consisted of 77% natural gas and 23% liquids.

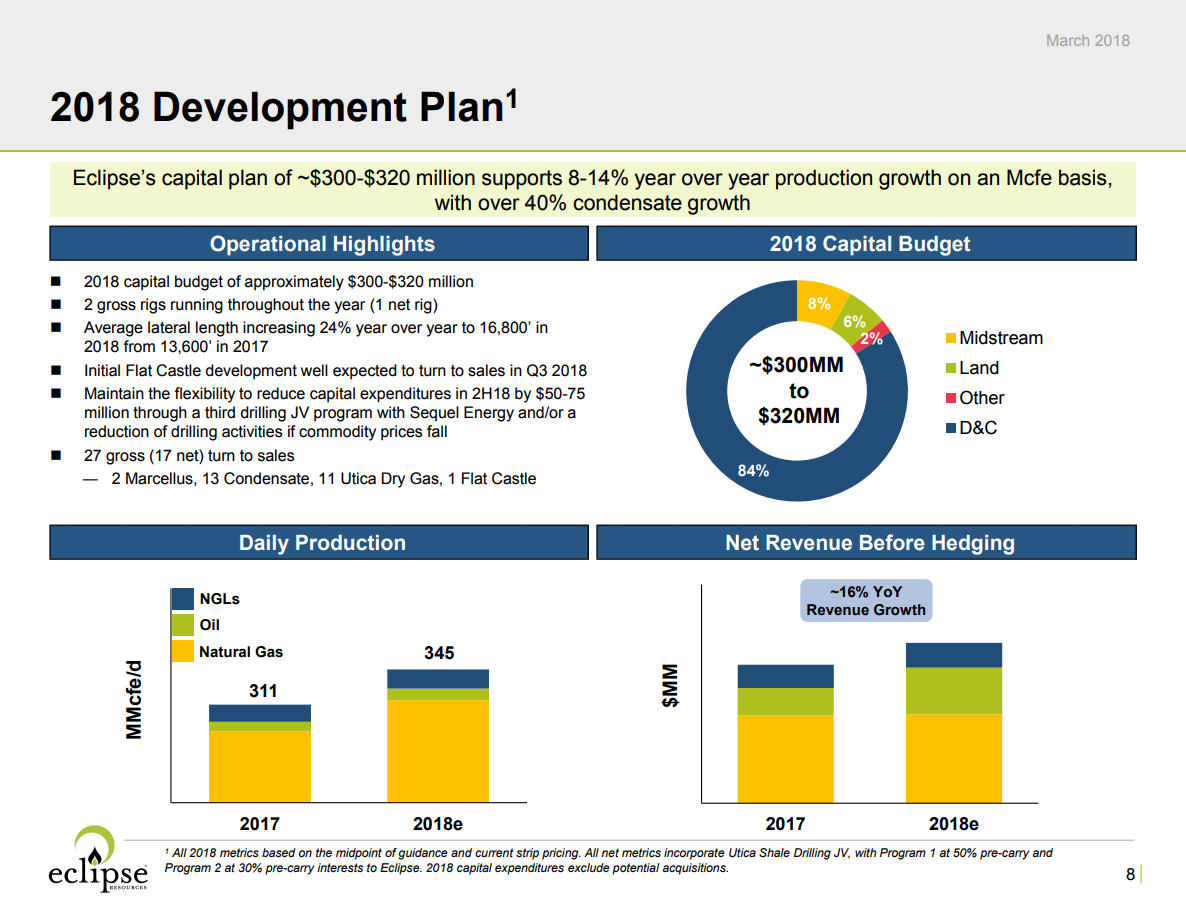

Capital expenditures for 2017 were $314.1 million, including $246.4 million for drilling and completions, $10.5 million for midstream expenditures, $55.9 million for land-related expenditures and $1.3 million for corporate-related expenditures.

Fourth quarter 2017 capital expenditures were $32.3 million, including $21.8 million for drilling and completions, $4.6 million for midstream expenditures, $5.7 million for land-related expenditures and $0.2 million for corporate-related expenditures.

More super laterals

Benjamin W. Hulburt, chairman, president and CEO, commented on the company’s fourth quarter and full year 2017 results, “During 2017, Eclipse Resources had substantial operational and strategic success leading to an expansion in our asset base, a substantial increase in cash flow and the addition of a strategic joint venture partner. Through these actions, we increased our acreage footprint by 57%, generated 85% year over year growth in EBITDAX, to a company record of approximately $189 million and commenced a $290 million joint venture process.

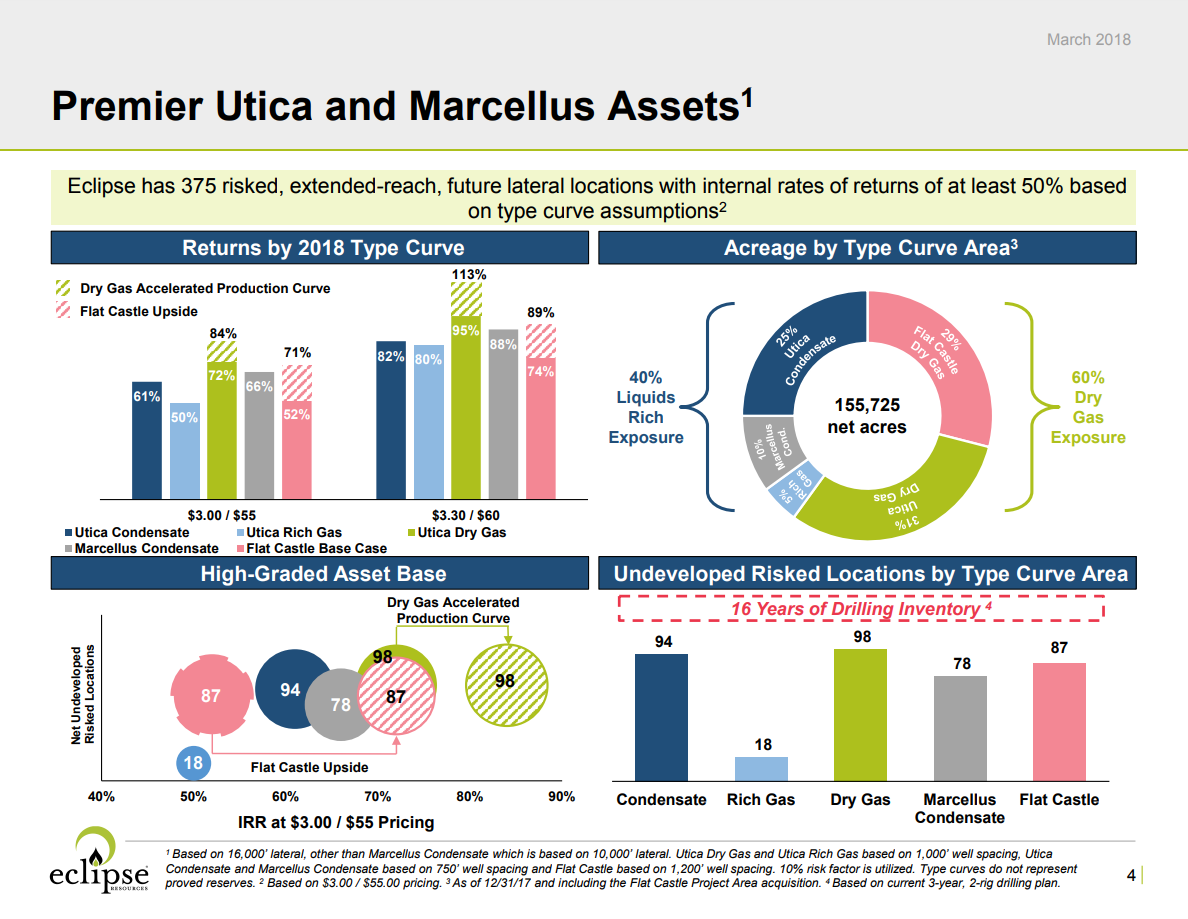

“As we highlighted during our analyst day, the strategic shift toward increasing activity in our liquids area has allowed us to capture the benefit of the recovery in oil prices and to exceed our full year 2017 guidance for both oil and NGL production. In 2018, the company plans to turn 13 gross (9 net) Utica condensate wells with an average lateral length of 16,325 feet to sales, resulting in over 40% oil production growth year-over-year. The first of which was very recently put to sales with an initial production rate of approximately 2,000 BOE per day consisting of 60% in total liquids, including approximately 735 barrels of oil, from a well with a completed lateral length of 15,600 feet.

“As the well is continuing to unload water and undergoing our managed flowback procedure we expect the well’s production to continue to increase by approximately 15-20% before hitting peak production over the next two weeks. We expect to put the two remaining wells on the pad with similar lateral lengths to sales over the course of the coming week. In addition, the company has recently turned to sales two Marcellus condensate wells with initial production characteristics exceeding expectations on Mcfe basis, and we will continue to evaluate the performance of these wells,” Hulburt said.

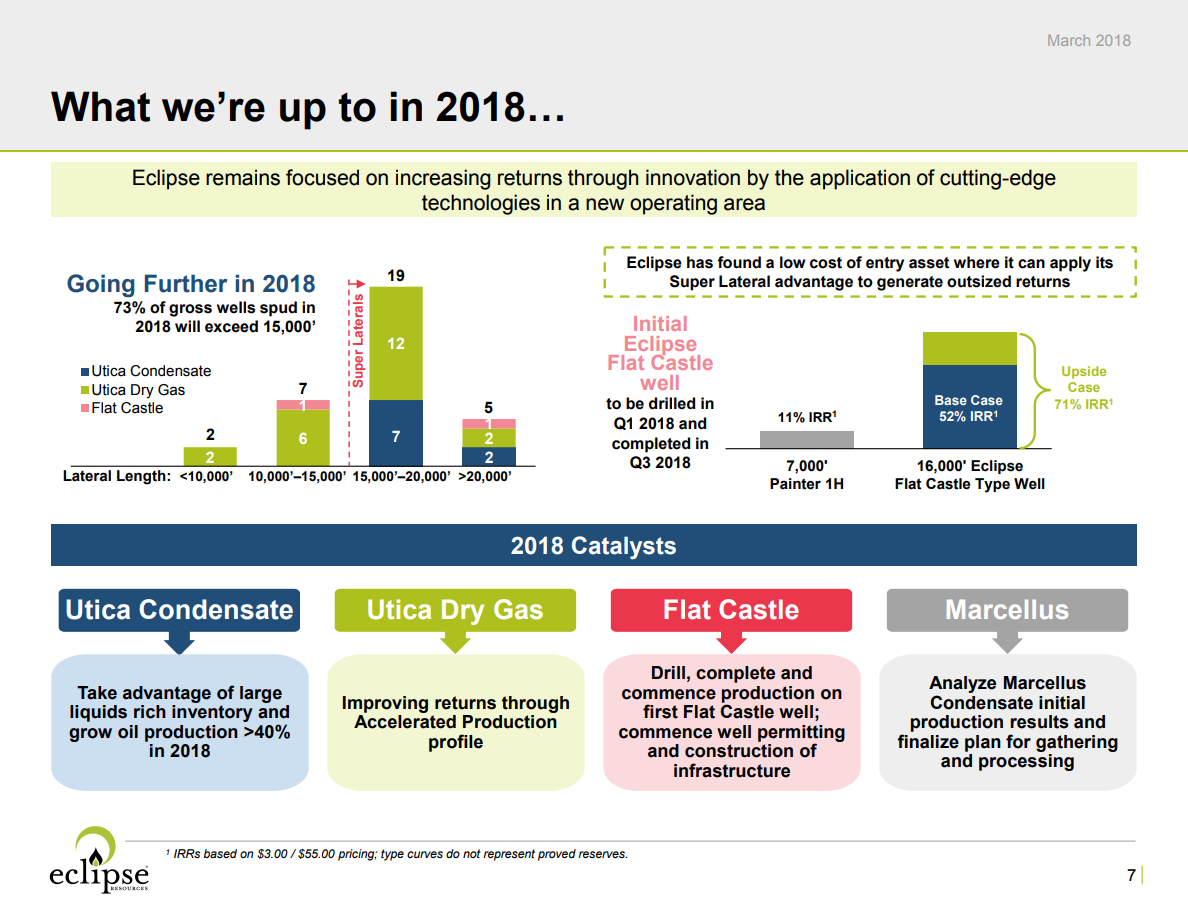

In 2017, Eclipse drilled 12 super laterals (eleven condensate and one dry gas). The longest lateral length was 20,803 feet, drilled (spud to TD) in 13.4 days.

“During 2018,” Hulburt said, “we plan to drill 33 gross wells with an average lateral length of approximately 16,800 feet, 73% of which are expected to be “super laterals” with lateral extensions exceeding 15,000 feet. This represents a 24% increase in average lateral footage per well over 2017 and remains well above any of our peers. While leading the industry on lateral lengths should allow us to continue to lower our cost per foot of lateral, we have also taken significant steps to manage our well costs through innovation, including reduced plug drill out times, expanding the use of a bi-fuel fleet, the continued evolution of engineered completions and the optimization of proppant loading.”

“Lastly, I am extremely pleased with our team’s continued ability to find creative solutions to build our business, from the execution of our previously-announced joint venture agreement with Sequel Energy to our accretive acquisition of the Flat Castle acreage,” Hulburt concluded.

Drilled and completed, YE 2017 reserves

During the fourth quarter of 2017, the company commenced drilling 6 gross (3.3 net) operated Utica Shale wells, commenced completions of 5 gross (3.7 net) operated wells and turned to sales 8 gross (6.6 net) operated wells.

During 2017, the company commended drilling 29 gross (21.6 net) operated Utica and Marcellus Shale wells, commenced completions of 24 gross (21.3 net) operated wells and turned to sales 24 gross (22.2 net) operated wells.

Proved reserves grew 211% over the previous year to approximately 1.46 Tcfe at SEC pricing. Finding and development costs, including revisions, for 2017 decreased to $0.26 per Mcfe, utilizing drilling and completion costs and $0.31 per Mcfe including all capital uses.