Eclipse Resources Corporation (ticker: ECR) reported a net loss for Q1 2018 of $2.6 million, or $(0.01) per share. Average net daily production was 315.2 MMcfe/d, consisting of 72% natural gas and 28% liquids.

The company had realized an average oil price, before the impact of cash settled derivatives, of $56.52 per barrel, a $6.39 per barrel discount to the average daily NYMEX WTI oil price during the quarter. As for NGLs, Eclipse realized an average price of $25.55 per barrel, or approximately 41% of the average daily NYMEX WTI oil price during the quarter.

During the first quarter of 2018, the company commenced drilling eight gross (3.7 net) operated Utica Shale wells, commenced completions of eight gross (5.8 net) operated wells and turned to sales five gross (3.7 net) operated wells.

Eclipse recently completed drilling its first Utica Shale well in Pennsylvania, in the Flat Castle project area. This well was drilled to 25,017 feet of total measured depth with a horizontal lateral of 13,857 feet.

First quarter 2018 capital expenditures were $71.7 million, including $59.9 million for drilling and completions, $5.7 million for midstream expenditures, $5.8 million for land-related expenditures and $0.3 million for corporate-related expenditures.

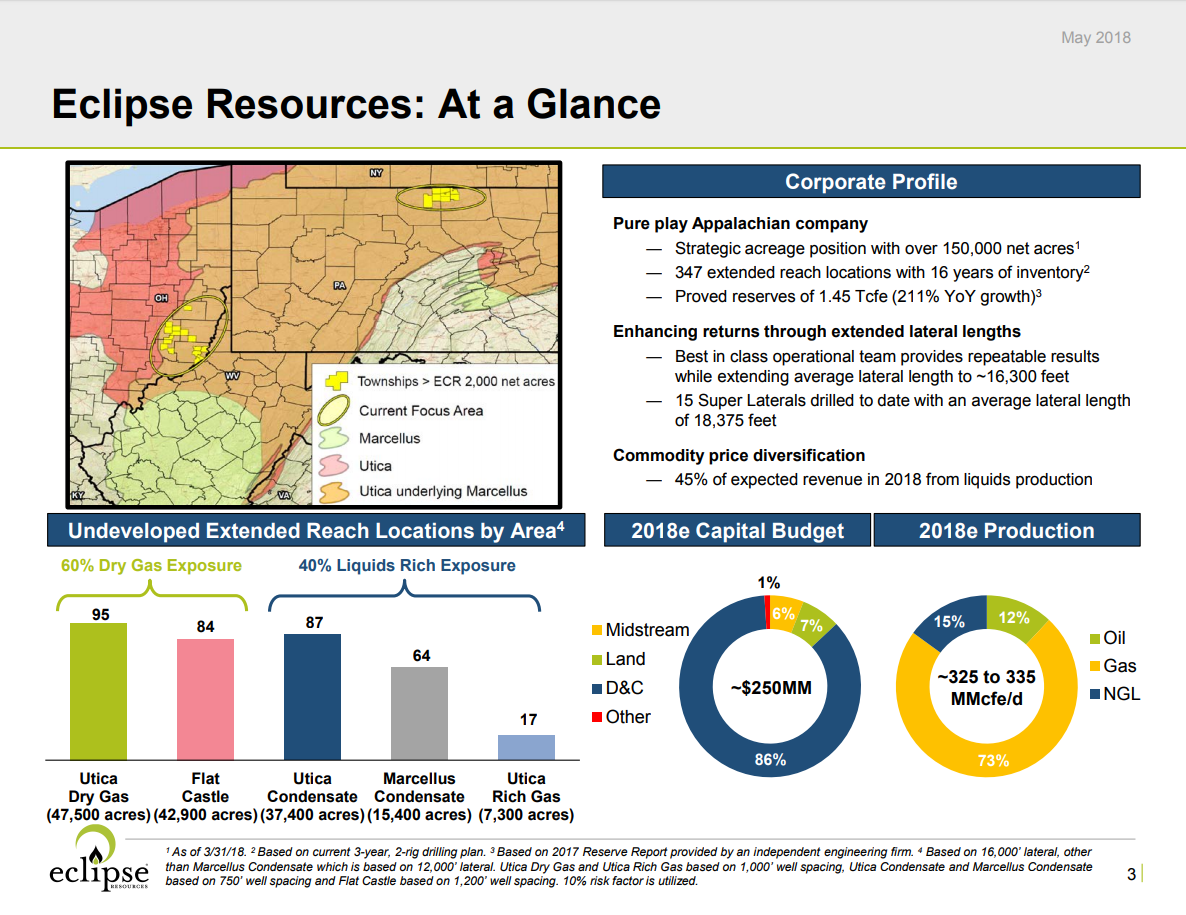

Eclipse said it was revising its full year 2018 capital expenditures guidance to approximately $250 million, or ~20%, below the company’s initial 2018 guidance of $300-$320 million.

Conference call Q&A excerpts

Q: Ben, can you remind us how many existing Utica pads you have in Monroe that you could re-enter into the Marcellus with?

CEO Benjamin W. Hulburt: There’s probably four or five existing pads. But this would most likely be new pads that we’re going to come onto and drill deep Utica wells followed by the Marcellus wells. There are a couple of existing pads that could be very early in the process, one in particular that we purposely built quite large so it can accommodate a large number of wells.

However, for cycle times and corporate level returns, we’re unlikely to go on a pad and drill 8 or 10 wells at a time because your cycle times just get too long.

Q: What do you guys attribute the outperformance relative to your model now in the early days of the Marcellus? Is it something geological that your model had risked a bit more heavily? Or what are like the key factors you think so far that you’re seeing that are driving some of this outperformance?

Hulburt: I’d say, one, there’s a little bit higher reservoir pressure than we had anticipated. But the biggest factor right now is we’re seeing a much gentler decline curve in the production than we would have anticipated.

But our type curve expectations there – there’s not a lot of analog data in that area. So they were purposely designed to be conservative. And it would appear that we may have projected a decline rate that is a lot steeper than what we’re actually seeing.

Q (continued): Is the decline rate shallower than what you see in the Utica wells?

Hulburt (continued): Significantly. And in liquids area in the Marcellus, that’s pretty common across the entire Marcellus core area. But to be safe, we originally forecasted that to be closer to a Utica-type decline.

Q: What were you seeing from a science, information or technical standpoint at Flat Castle that led to conservative estimates?

Hulburt: Well, we’ve obtained full core in the area now, which did cause us to slightly increase our gas in place estimates. Based on what we’ve seen as we’re drilling the wells, a little bit higher carbonate percentage than what we see in Ohio, which we think will ultimately affect the effectiveness of the completions design.

But we also think that we’re seeing a good indication that most wells in the area have not adequately drained both of the sub-members where the gas in place is in this area. And it’s something that we think we will be able to do, which could ultimately push our recovery of gas in place up to the same levels that we see in Ohio, which would mean that we’ve significantly underestimated the per well reserves.

But I want to be careful. This is all speculation based on science at this point not on actual results. So that’s why we’re waiting until we see the actual results of this first well and evaluate where this drilling goes in our Q.