Targeting 12-12.5 MBOEPD production for 2018

Earthstone Energy, Inc. (ticker: ESTE) posted a net income of $2.3 million, or $0.09 per share in Q4 2017. For 2017, the company reported a net loss of $12.5 million, or $(0.53) per share.

In Q4 2017, the company produced on average 9,071 BOEPD. For the full year of 2017, the company had an average daily production of 7,869 BOEPD – a 97% increase over 2016, Earthstone said. Proved reserves were approximately 80 MMBOE.

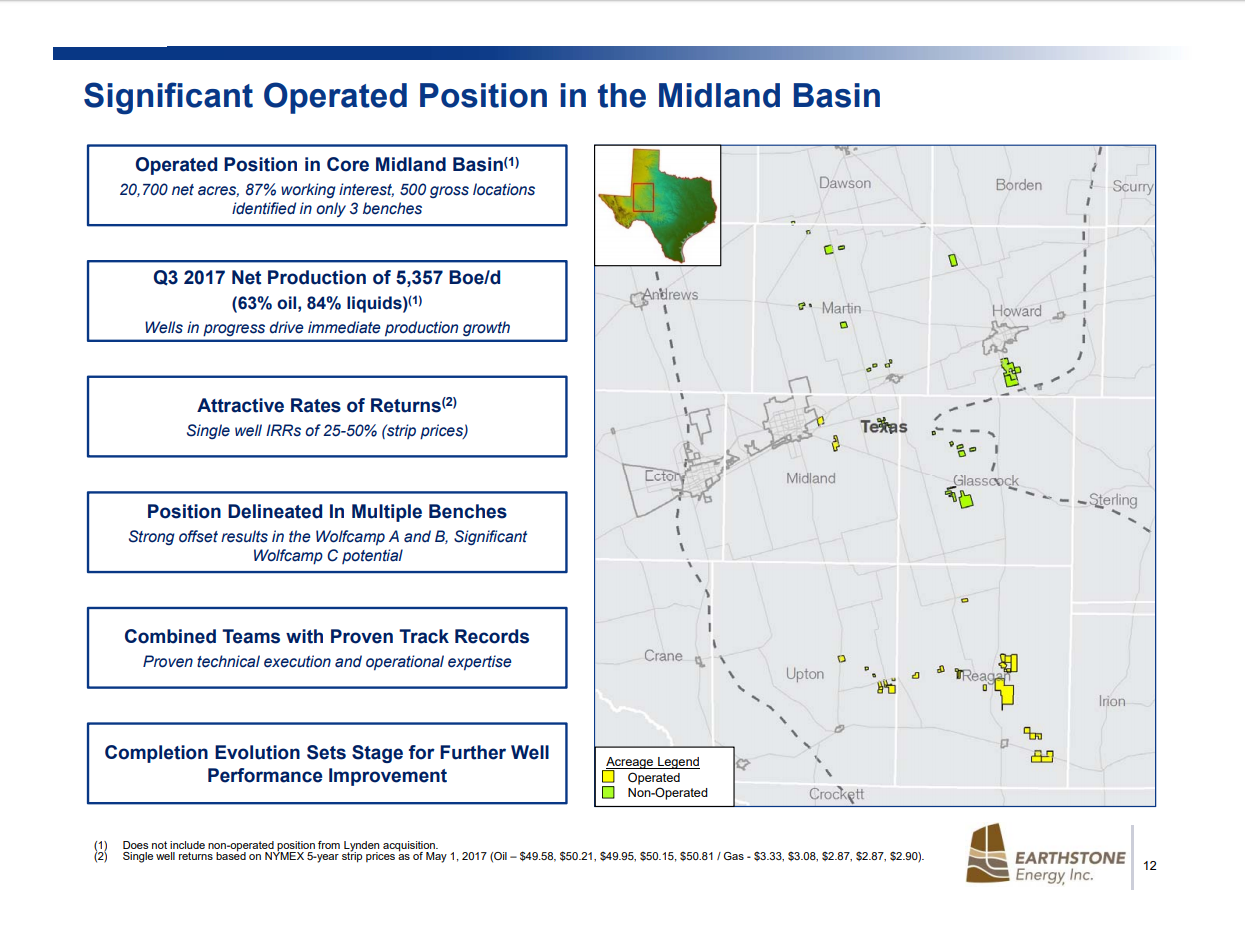

President and CEO Frank A. Lodzinski commented, “In spite of the industry downturn and significant commodity price volatility, in just three years we achieved annual revenues of more than $100 million and entered 2018 with production of more than 10,000 BOEPD. We have successfully transformed our company to have a clear focus on the Midland Basin in west Texas. We intend to further expand our footprint in west Texas while we drive down costs and profitably increase production.”

During 2017, Earthstone incurred capital expenditures of approximately $81.1 million, primarily consisting of drilling and completion costs, of which $35.7 million was incurred during the fourth quarter of 2017.

2018

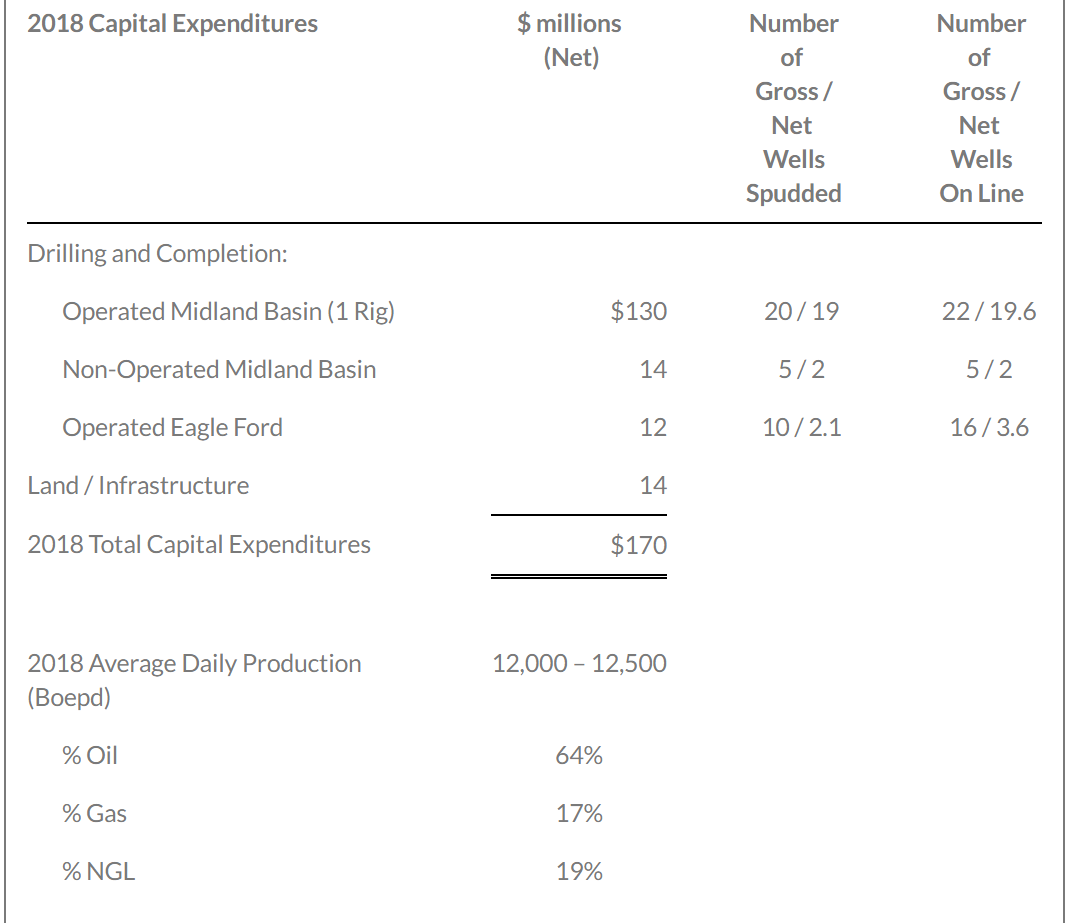

The company has set its 2018 capital budget, which currently assumes a one-rig program for its operated acreage in the Midland Basin and a 10 well program for its operated Eagle Ford acreage. Additionally, Earthstone will continue to evaluate and prepare operationally for the possible deployment of a second rig in its operated Midland Basin acreage.

Overall, the company plans to spend $170 million in 2018, with most of the budget ($130 million) allocated to the Midland Basin. The company forecasts 2018 average daily production of 12-12.5 MBOEPD composed of 64% oil, 17% gas and 19% NGLs.

In the Midland Basin, the company plans to spud 20 gross and 19 net operated wells, with 22 gross and 19.6 net wells on line. In the Eagle Ford, Earthstone plans to spud 10 gross and 2.1 net operated wells, with 16 gross and 3.6 net wells on line.

Q&A conference call excerpts

Q: My first question, Robert, probably for you. How do you guys think about — I know you haven’t put, maybe a quarterly out for the entire year. But how do you think about sort of cadence or timing throughout the year and along with that, how can you be sure of getting the frac spreads when needed?

EVP Robert J. Anderson: Well, we’re pretty confident that we’re going to get the frac spreads when we need them. We fracked several wells in August timeframe. We got the same frac crew back in December to do that five-well group, and then we’ve got them lined up to start in April. And by the time we are through with them, we will have fracked eight wells.

So, the cadence will be, we will get eight done. April, May, maybe take into June, a little bit, and then we’ll take a break with the frac crew. Let them go work on their equipment, go somewhere else for a little bit and then come back and hopefully, keep them for the last quarter plus of the year busy.

Q: Just wanted to get your thoughts on the second rig, and what you need to see happen there to get that rig on and what the timing might be?

CEO Frank A. Lodzinski: Committing to that second rig, or if one of the acquisitions we are working on works, well, then we might bring the second rig in connection with an acquisition. But you have to, as you know, you have to start planning for that second rig earlier, you have to work the infrastructure to accommodate and the locations to accommodate that.

So, we have all that in process. And if we go to a second rig, which I’m kind of leaning to right now, it could be the July-August timeframe.

Q: You’ve talked for two or three months now about getting everything in place to potentially add a second rig. If you think about adding a second rig, what do you think that — is that more of a 2019 production impact? Do you think you’d start to see some of that impact in ’18? I’m just trying to figure out the lead time on activity?

Anderson: Sure. And that’s a fair question. Even if we brought the rig in July and our plan was to go to bigger pads, where we’re consistently getting three or four wells prepared, we probably wouldn’t bring on a whole lot of extra production in 2018.

I’d like to think we could accelerate. But once you get the frac machine moving and you’ve got these obligation wells and other things that we’re committed to putting online sooner than later, some of the second rig may be back-end weighted or early ’19, before we start seeing production from it.

Q (continued): Okay. And then when you think about a rig line since you’re drilling with one rig now, at least that’s the plan, the $144 million, I think you said. Is that a pretty good guesstimate as to what you think of a rig line cost per year in the Midland?

Anderson (continued): Yeah. I mean, it varies a lot depending on lateral lengths, if you are drilling 5,000 footers or 10,000 footers. But our internal review of things is that a 7,500 footer is going to average in the high $6.8 million to $7 million range. If we averaged 85%, you’d kind of end up with that if you drilled 20 and complete 20 wells a year. That order of magnitude, you’re pretty close, but we’re going to end up averaging probably north of 8,000 foot laterals, closer to 8,400 foot this year, based on what we’ve got on the schedule for one rig and we’ll probably average about 85% to 90% working interest. So, it’s a little bit of a moving target there, but that’s about a one-rig program, 140 million, 150 million a year.