Earthstone Energy, Inc. (ticker: ESTE) announced today that it entered into an agreement to sell its Bakken assets for approximately $27 million in cash to an unaffiliated party. The effective date will be December 1, 2017 and is expected to close by year-end 2017.

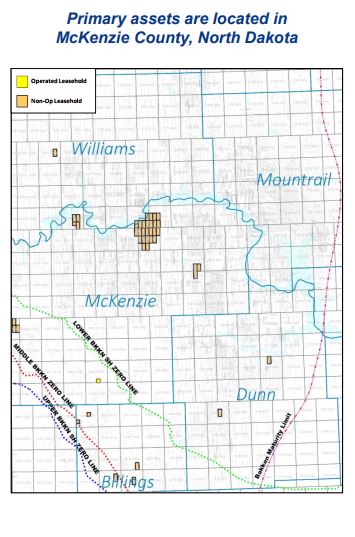

According to an Earthstone investor presentation, Earthstone’s Bakken/Three Forks assets include 5,900 net core acres predominantly in the McKenzie and Dunn Counties of North Dakota. There are 149 gross wells producing on an average working interest of ~6%. Twelve gross wells are currently being drilled or completed and there are ~155 potential gross drilling locations.

The majority of units are in McKenzie County, North Dakota. The Banks Field has the largest development area, interest in 22 spacing units, and operators are down-spacing to 6-7 wells per unit in the Bakken/Three Forks. McKenzie County also includes the Indian Hill Field.

Robert J. Anderson, Executive Vice President, Corporate Development and Engineering of Earthstone said, “The sale of our Bakken assets, which are non-operated, represents a further step in Earthstone’s continued shift in emphasis to being primarily a Midland Basin focused operator. Over the past 18 months we have established a position in the Midland Basin that stands at approximately 27,000 net acres and approximately 7,000 BOEPD.”

EnerCom Analytics examines the deal

The sale is valued at approximately $27 million dollars. Using the numbers provided by Earthstone, the company sold 5,900 acres for $4,576 per acre. The sale equates to $26,444 per flowing BOEPD and $7.50 per BOE of reserves.

Earthstone estimated a PV-10 of $26.7 million for its Bakken assets, a $.3 million positive for Earthstone. The Bakken reserves are approximately 63% oil.