Sanchez, Chesapeake dominate Dimmit County with 210 permits in 2017

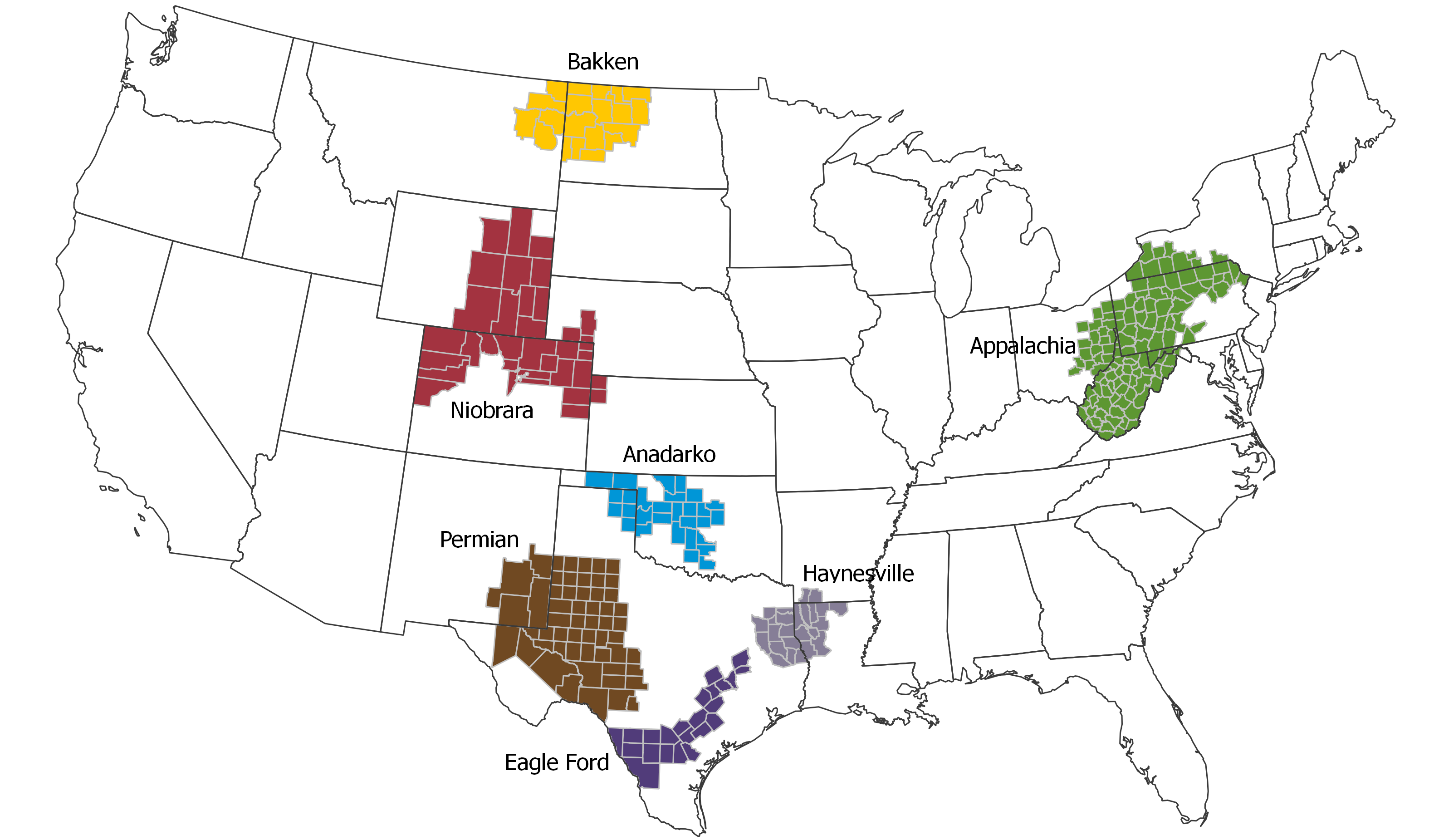

While it has been recently eclipsed by the Permian, the Eagle Ford in South Texas remains one of the most important shale basins in the world. According to the EIA, the basin will produce 1,280 MBOPD in September, making it the second-largest oil-producing basin in the U.S.

Despite temporary interference from Hurricane Harvey there are currently 71 rigs active in the basin, making the Eagle Ford second in drilling activity as well.

Just like any other area of Texas, these rigs require drilling permits, obtained from the Texas Railroad Commission (RRC), to operate. So far this year, the RRC has issued a total of 2,318 permits in the Eagle Ford. The EIA lists 23 counties as part of the Eagle Ford, but current activity focuses on certain locations.

Karnes County tops the 2017 Eagle Ford permitting race

Three counties account for almost half of the 2017 permitting activity in the Eagle Ford, Karnes, La Salle and Dimmit Counties. Karnes County, located in the middle of the Karnes Trough portion of the Eagle Ford, has received 449 permits since the beginning of the year, 20% of all permits. La Salle and Dimmit Counties are located near the southwest edge of the Eagle Ford. These two counties have received a combined 622 permits, or 28% of all 2017 activity.

Current operations lag 2014 levels

Historical activity is generally similar to current operations, with only minor changes in the popularity of various counties. Dimmit and La Salle Counties are slightly more popular than Karnes overall, and De Witt County represents a higher share of activity in 2017 than overall.

Like elsewhere in the U.S., activity in the Eagle Ford took a nosedive when the commodity price downturn hit the industry. In Dimmit County, which was the most popular county in 2014, permitting activity dropped from 1,226 in 2014 to a mere 203 in 2016, a drop of 83% over two years.

Unlike in the Permian, however, activity in the Eagle Ford has not yet returned to previous levels. If current permitting trends continue, the RRC will issue about 720 permits in Karnes County this year. While this exceeds levels seen in 2015 and 2016, it falls well short of the 1,060 permits that were issued in 2014. Activity in most other counties have not even recovered to this level, and only in Maverick County, where activity is minimal, is 2017 permitting expected to outpace 2014 levels.

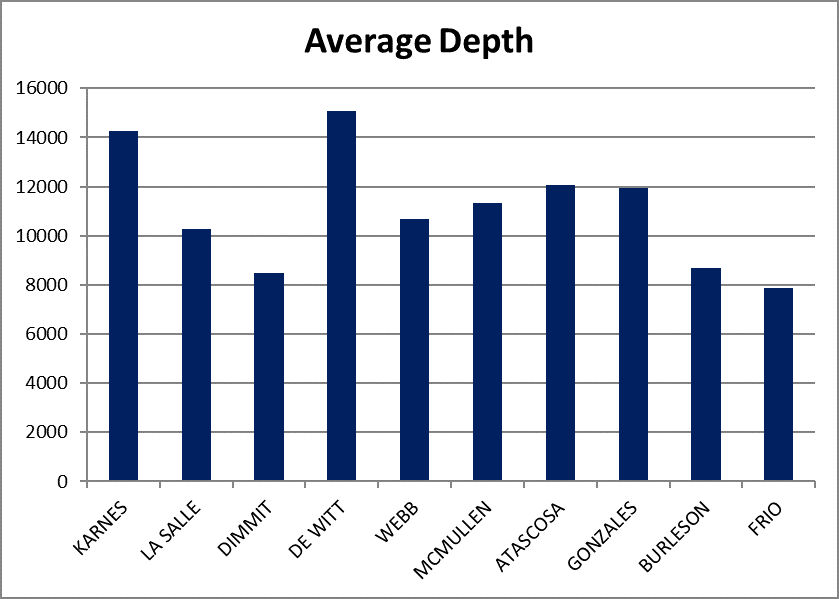

Karnes Trough has longest wells

Based on this year’s well permits, lateral lengths vary widely in different sections of the Eagle Ford, with the longest wells found in the Karnes Trough.

De Witt County holds the longest wells in the Eagle Ford, with average wells exceeding 15,000 feet measured depth. Karnes County follows closely behind with wells averaging around 14,250 feet in depth. In general, average well length decreases as distance to the Karnes Trough increases. Dimmitt County and La Salle, both located in the southwestern portion of the Eagle Ford, average 10,275 feet and 8,500 feet, respectively.

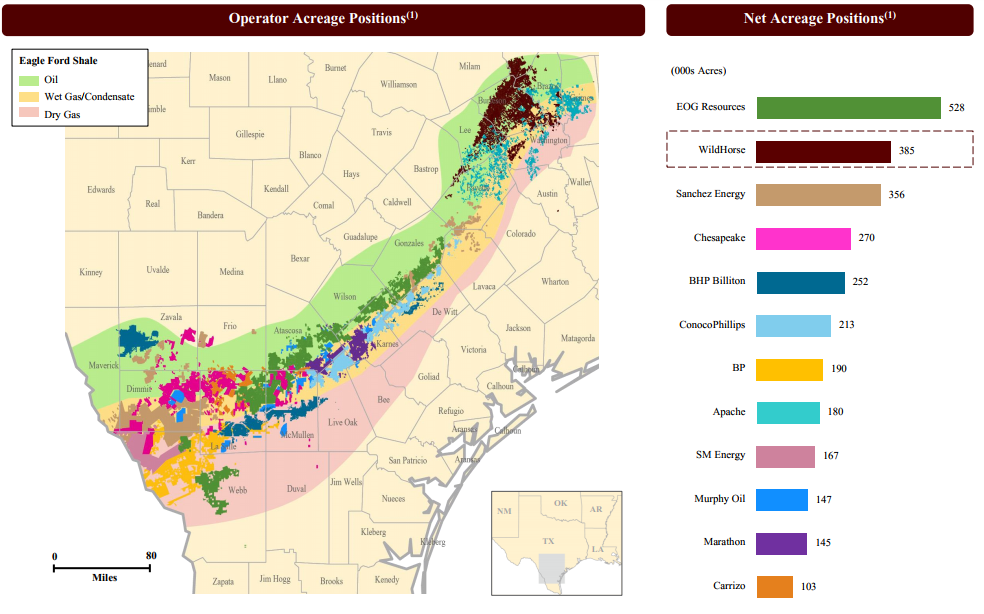

152 different companies have received permits in 2017

A total of 152 companies have received permits from the RRC to drill in the Eagle Ford this year. The top three companies make up about one quarter of all operations, a higher share than is seen in the Permian.

- EOG Resources (ticker: EOG) ranks first among 2017 companies, receiving 263 permits.

- Chesapeake Energy (ticker: CHK) comes in second with a total of 169 permits approved.

- Sanchez Energy (ticker: SN) comes in third with 155.

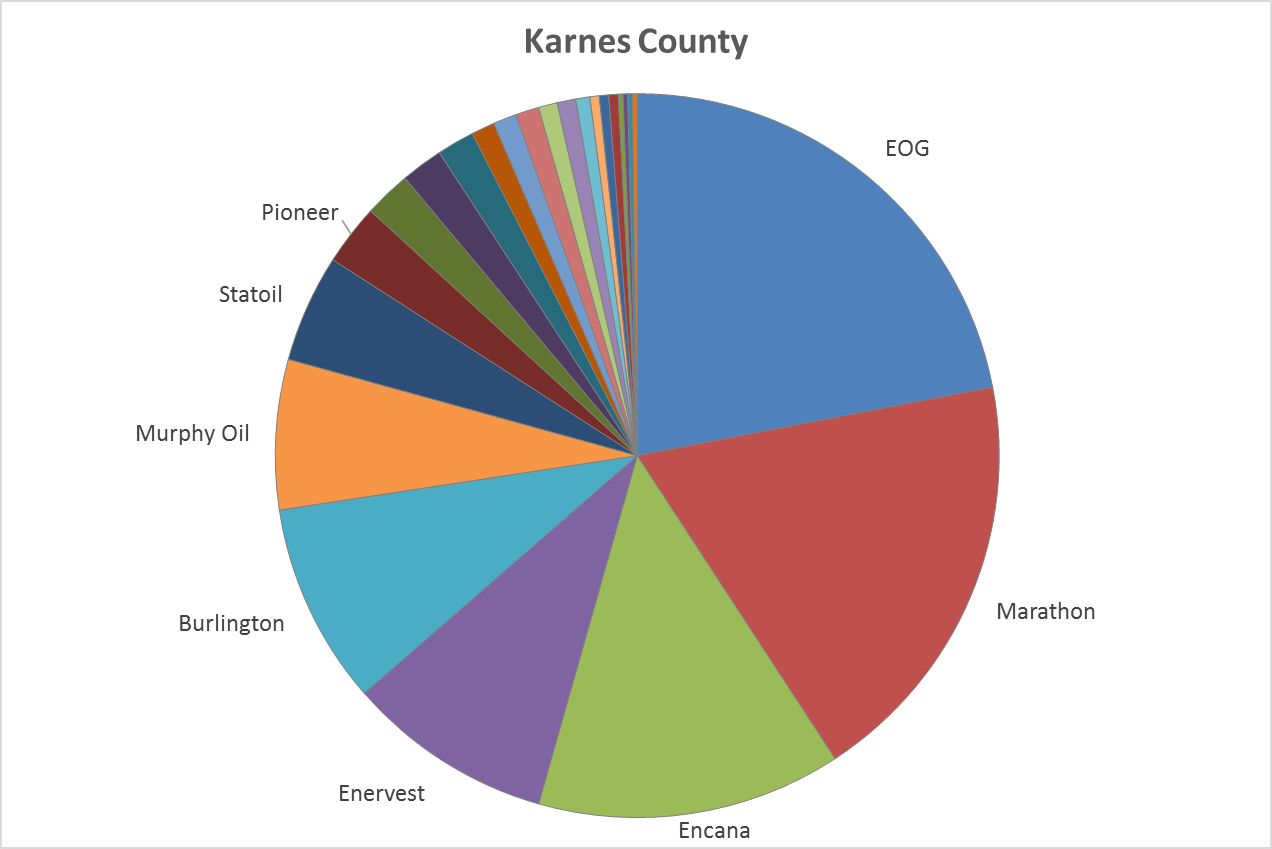

Karnes County: EOG, Marathon, Encana actively permitting

Like in overall activity, operations in individual counties are dominated by a few companies, to a higher degree than is seen in the Permian.

- EOG’s operations focus on Karnes County, so the company ranks first in permitting activity in the region with 105 approved permits.

- Marathon Oil (ticker: MRO) has received the second-most permits in Karnes County with 90.

- Encana (ticker: ECA) ranks third with 65.

Together these three companies represent 54% of the 478 permits issued in Karnes County this year. A total of 24 different companies have received Karnes County drilling permits.

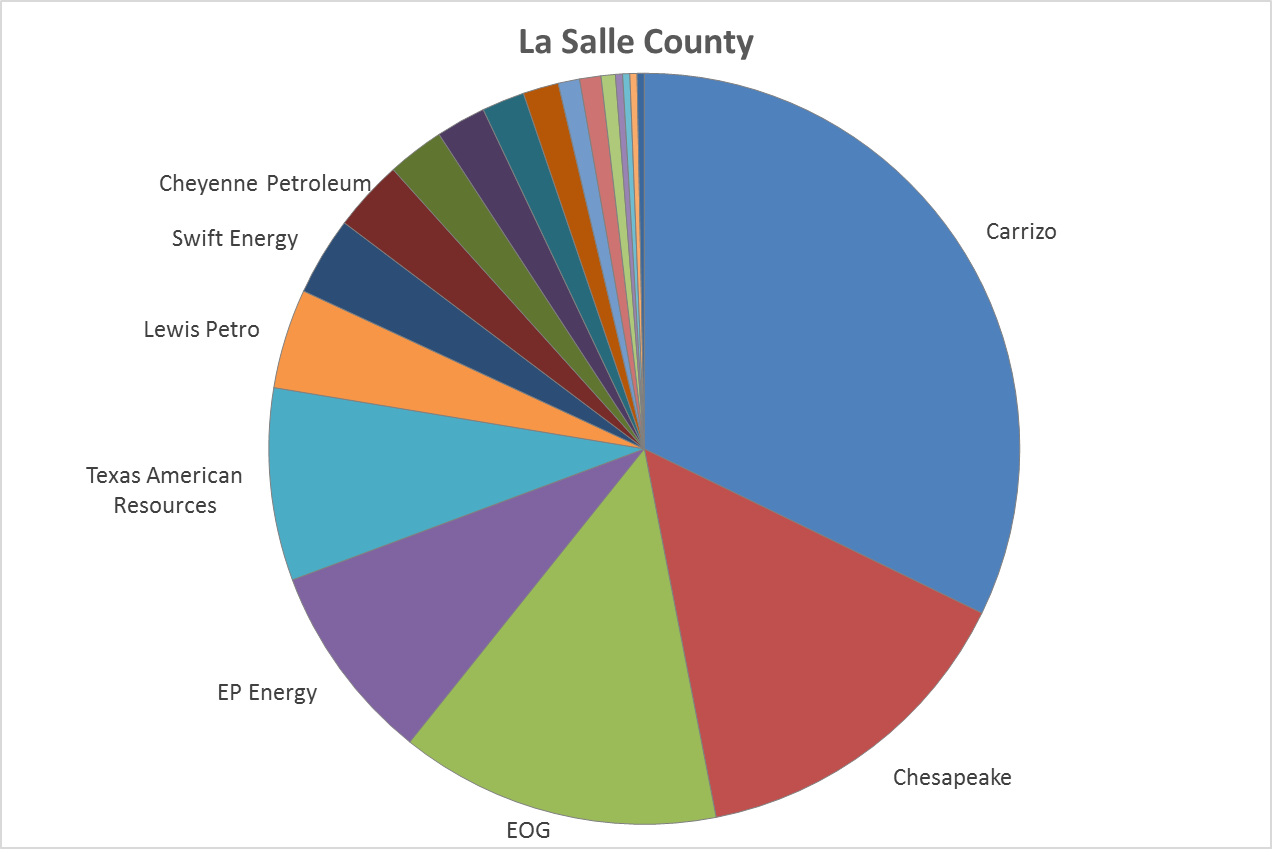

Carrizo dominates La Salle

Carrizo (ticker: CRZO) is foremost in La Salle County, with 105 permits awarded so far this year. Chesapeake and EOG have nearly equal activity levels in the county, with 48 and 45 permits. A relatively small number of companies operate in La Salle, only 19 different firms have received permits thus far.

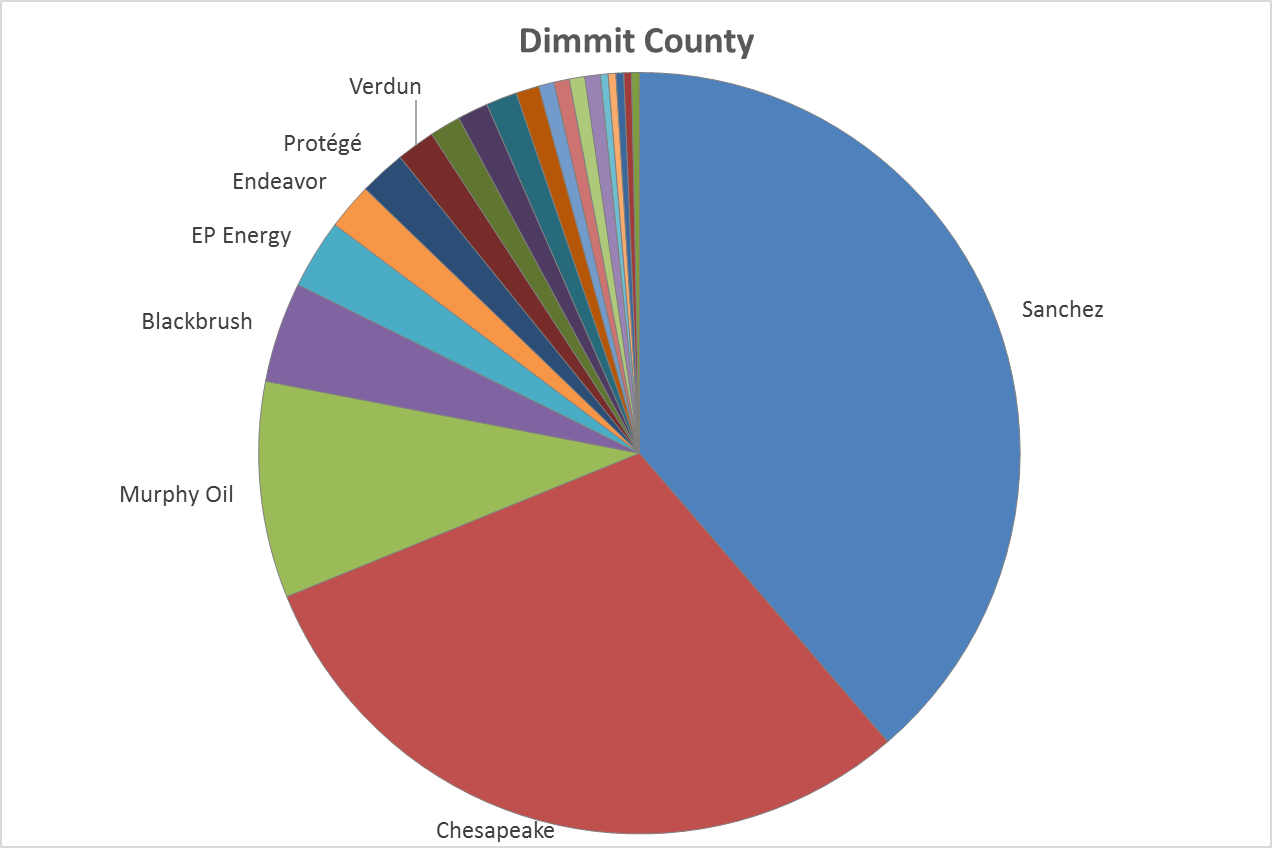

Sanchez, Chesapeake dominate Dimmit

Activity in Dimmit County is very focused in the top two companies, which account for a combined 69% of all permitting.

Sanchez Energy ranks first with 118 permits, the highest number of permits that a single company has received in any county in the Eagle Ford.

Chesapeake comes in a close second with 92 permits, while third-place Murphy Oil is far behind with 28. Twenty-one companies have received drilling permits in Dimmit County this year.

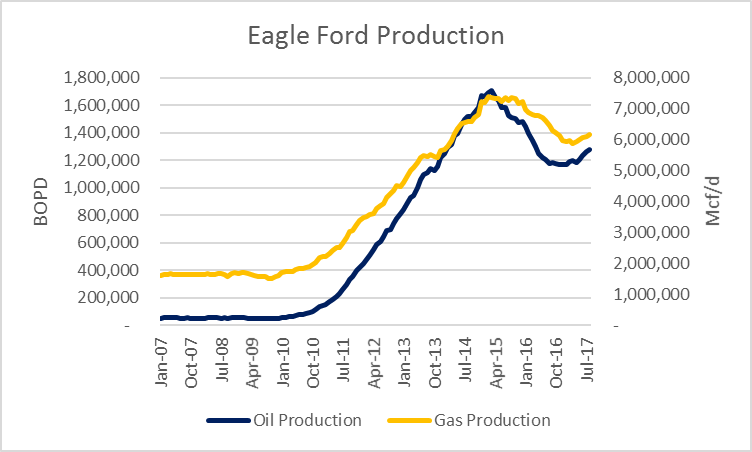

Eagle Ford production has resumed growth, after falling for 22 months. Oil production from the basin was nearly zero until 2010, when companies began to significantly ramp up operations. Oil production grew steadily for five years, until the commodity price downturn caused companies to curtail their growth strategies. Production in the basin declined from March 2015 to January 2017, until the current shale resurgence allowed companies to increase operations again.

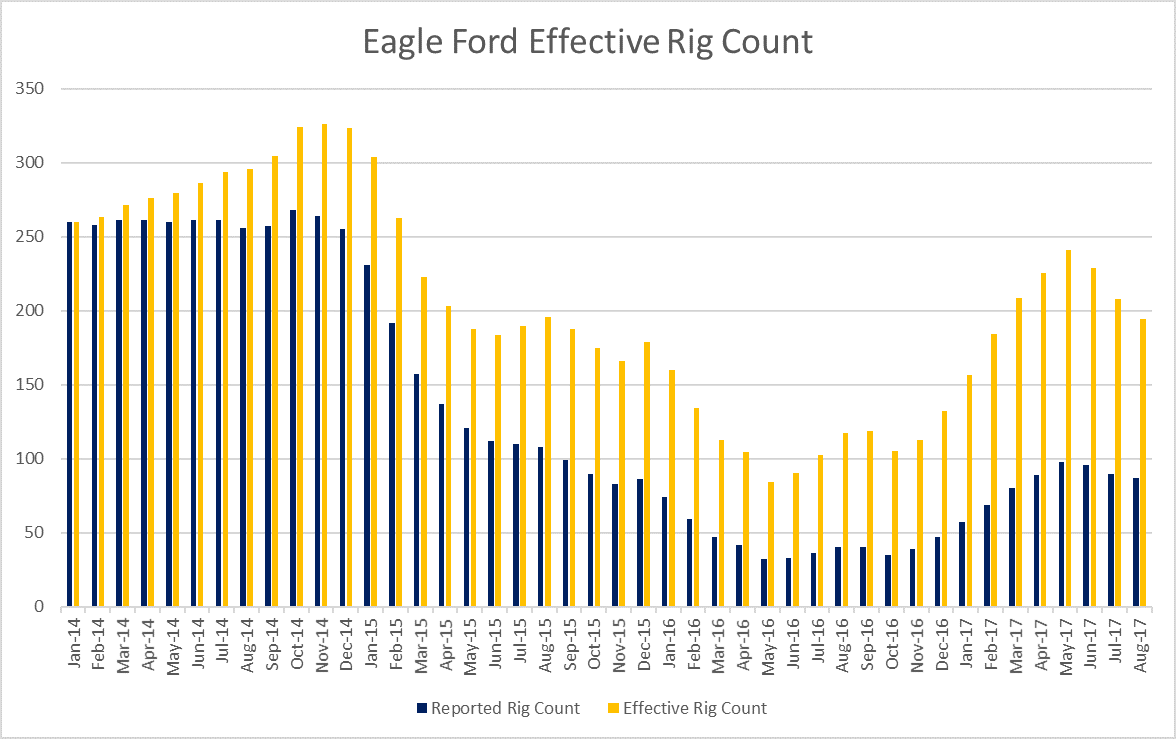

According to EnerCom’s Effective Rig Count, there are now 194 effective rigs operational in the Eagle Ford, compared to a reported 87, meaning current operations are yielding 2.2 times more production than January 2014 operations were.

County-specific production mirrors total Eagle Ford production, with minimal production reported until around 2010, then significant growth until 2015. Some counties, like Dimmit, have not yet seen production recover to previous levels, while others, like Karnes, are approaching or exceeding precious highs.