Duke gains 1 million new customers in Piedmont acquisition

North Carolina based Duke Energy (ticker: DUK) announced that it will acquire Piedmont Natural Gas (ticker: PDM) for $4.9 billion in cash, and assume Piedmont’s $1.8 billion in debt, for total consideration of $6.7 billion. The acquisition was unanimously approved by the boards of both companies.

Upon transaction closing, Piedmont shareholders will receive $60 in cash for each share of PDM that they own, representing an approximately 40% premium to Piedmont’s October 23, 2015, closing price.

Duke plans to finance the transaction with a combination of debt, between $500 million and $750 million of newly issued equity and other cash sources, according to a release from the company. A fully underwritten bridge facility is in place with Barclays to complete the transaction.

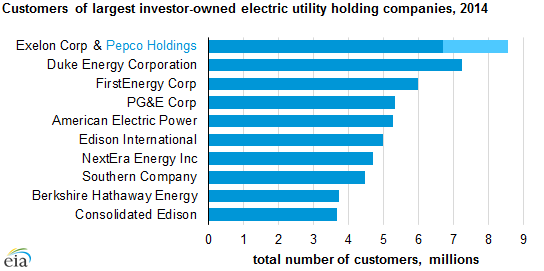

The acquisition comes less than a week after news that Exelon (ticker: EXC), an electrical utility company serving the North East, will purchase Pepco Holdings (ticker: POM) for $6.8 billion in an all cash transaction. The acquisition of POM would have made Exelon the nation’s largest investor-owned electric utility holding company, a spot previously held by Duke.

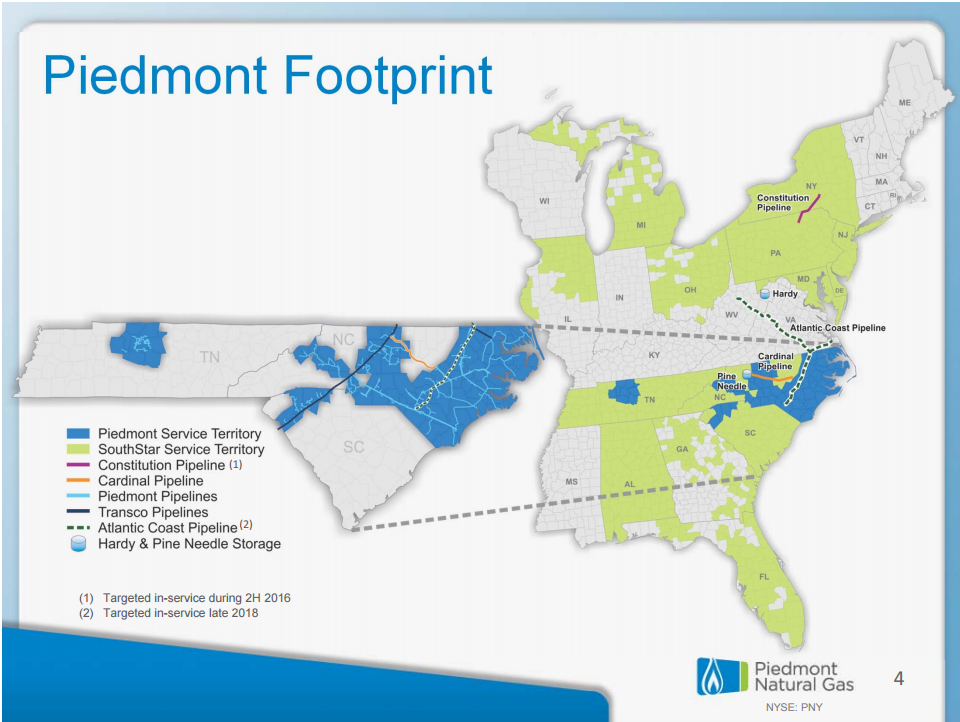

Duke’s acquisition of Piedmont will not allow it to regain the title as the nation’s largest utility, but it will add an additional one million customers to its services, according to an investor presentation from Piedmont. The combined company will have a customer base of approximately 8.3 million, compared to the combined Exelon/Pepco customer base of approximately 8.6 million.

Everybody wants in the gas infrastructure business

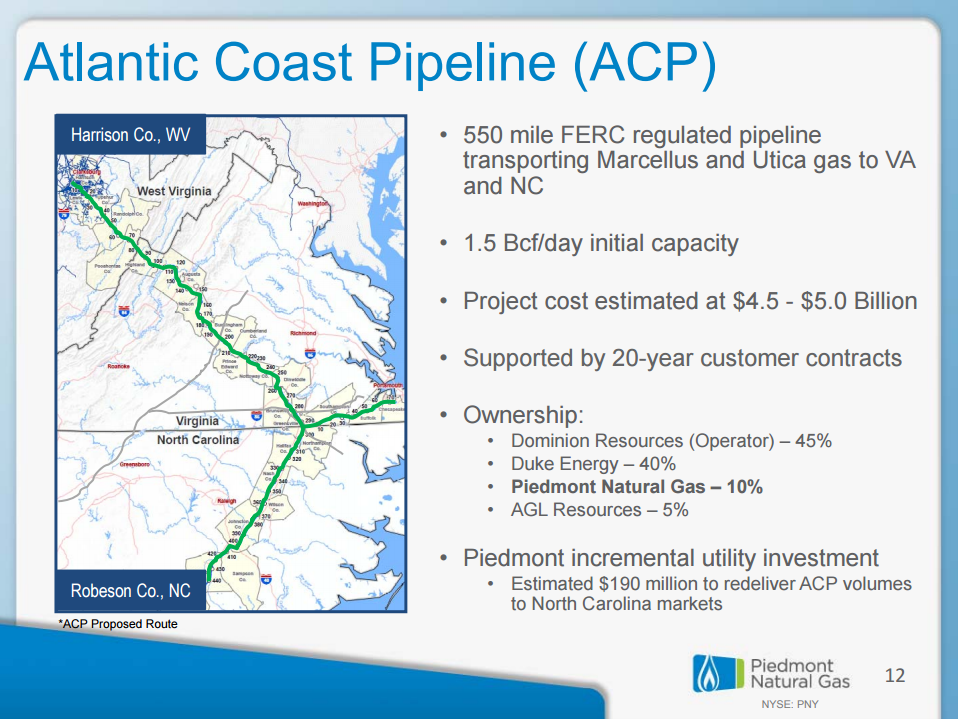

In addition to the one million customers Duke will add to its customer base, the acquisition of Piedmont also affords the company a shale gas distributor, which should help the company grow as power demand slows.

“It’s opening Duke’s door into the gas infrastructure business,” Shahriar Pourreza, a New York-based analyst for Guggenheim Securities LLC, told Bloomberg. “Utilities are going through a period where organic growth is slowing down, so they have to grow through acquisitions. Everybody wants to be in the gas infrastructure business.”

The deal “enhances” Duke’s forecast earnings per share growth rate of 4% to 6%, the company said. Piedmont’s rate base and EBITDA have been rising annually at about 9%, Duke Chief Financial Officer Steven Young said on a conference call with analysts and investors.

Predictable, state-regulated profit from Piedmont’s fuel delivery will reduce Duke’s reliance on its international segment, Pourreza said.

“This combination provides us with a growing natural gas platform, benefiting our customers, communities and investors,” Duke Chief Executive Officer Lynn Good said in Monday’s statement. Duke anticipates expanding Piedmont’s system to supply power plants as gas displaces coal as the leading generation source, Good said on the call.