By Tim Rezvan, CFA – EnerCom

Equity and commodity volatility are keeping the incremental energy investor away

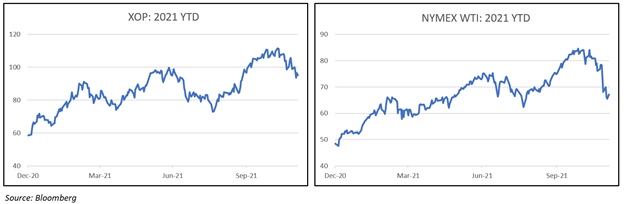

The gravy days of October seem like a distant memory for the Energy sector. After a strong YTD rally in both crude oil and energy equities (as seen below), the wheels have quickly come off for both since late October.

A combination of COVID variant fears and aggressive jawboning from the Biden Administration on oil and gasoline price inflation has weighed on WTI pricing and, in turn, the earnings outlook for equities in the Energy sector. These negative headline risks are impediments to expanding the number of investors looking to own equities in the Energy sector. The disappearance of the long-only investor remains one of the biggest concerns for energy companies that have survived the pandemic, emerged as stronger companies and are now looking to tell their story to investors.

Commodity-Equity Correlation Weighs on the XOP and Dampens Sentiment

We use the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) as a proxy for the E&P industry. The ETF is a weighted average of 54 equities, most of which are upstream and downstream companies. We prefer this ETF because its weightings are not dominated by integrated companies. The correlation between the XOP and NYMEX WTI has been quite high since the start of 2020 (+0.92). This implies that for most long-only fundamental investors, a bullish outlook on crude is necessary to form a constructive outlook for the upstream sector. However, the bullish uptrend in crude has broken down since its recent high of almost $85/b in late October.

As we wrote in a mid-October article highlighting recent company visits in Houston (link here), management teams had not yet seen a big return of the coveted long-only fundamental investor. That article came less than two weeks from the recent top for WTI ($84.65/b on 10/26). The sharp sell-off (-21% since the late October high) is unlikely to help attract investors.

Bottom line – the debate on the return of long-only investors remains an “if” versus “when” debate, and a volatile commodity price outlook will not help the sector attract new investors.

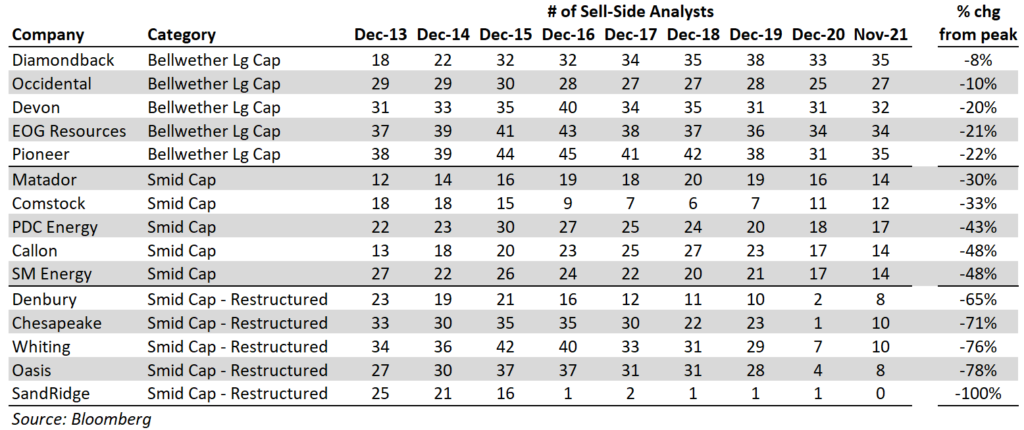

Decrease in Sell-Side Research Disproportionately Impacts Small/Restructured Companies

We view the reduction in sell-side equity research coverage as another impediment creating challenges for public companies. We looked at sub-groups of upstream companies to quantify this reduction. We were not surprised to see a significant decrease in overall sell-side coverage, attributable to investor apathy, less capital markets activity and increasing regulation, among other topics. But we were surprised to see the dramatic differences in the reduction of coverage among each sub-group.

To understand the issue better, we came up with three sub-groups of upstream companies to analyze: bellwether large caps, smid caps and small caps that went through restructuring. We picked five companies within each group. We selected the companies before pulling data to avoid intentionally skewing results.

For the bellwether group, the median change in sell-side coverage from the company’s peak is -20%. For the smid caps, this figure is -43%, and for the small caps that went through restructuring, this figure is -76%. While there is an ongoing debate about the quality of sell-side equity research coverage in the Energy sector, it is clear there is less quantity. There are far fewer companies/analysts engaged in small/mid cap research now. In terms of scale, the gap between the haves and the have-nots in terms of published research has significantly widened.

Bottom line – small cap operators will continue to struggle to gain mindshare with investors if they rely on traditional sell-side research coverage to get their story out.

Conclusion: Remains an Uphill Road for Upstream Companies, and Smaller Companies Will Need Help Getting their Stories Out

While the conclusions presented above are unlikely to bring smiles to the faces of small cap management teams in the Energy sector who have seen shares come under pressure QTD, we believe there is a silver lining in this message. The silver lining is that management teams should now feel emboldened to pursue new paths to gain mindshare. The traditional model of relying on the sell-side may not be dead, but it is on life support. Targeted outreach to investors to highlight attributes of the equity that may appeal to the generalist crowd can be effective. We believe companies that can flex their execution in areas such as: an improving leverage profile, dedicated environmental stewardship, incentive alignment between shareholders and management, and a commitment to returning capital can still win mindshare.

Here at EnerCom, we are engaging with clients that have aspirations to increase mindshare, and we maintain a dialogue with investors on what they are looking for as they choose to invest in the sector. Please reach out to learn more about what we can do.

Tim Rezvan, CFA is a Director at the energy consulting firm EnerCom, Inc. He has experience in sell-side equity research, asset management, corporate strategy, investor relations and ESG. Mr. Rezvan’s sell-side equity research experience in the E&P industry focused on leverage trends, full-cycle costs, emerging unconventional resource plays, M&A analysis and corporate governance.

EnerCom, Inc. is the energy industry’s leading communication experts. We can help you with corporate strategy, ESG, media and government and stakeholder relations to effectively communicate your company’s story. Contact: services@enercominc.com