Oil executives and traders attending major industry gatherings in Singapore and Abu Dhabi this week have flagged deteriorating demand growth in key markets such as China and India for downbeat expectations on crude oil heading into 2020.

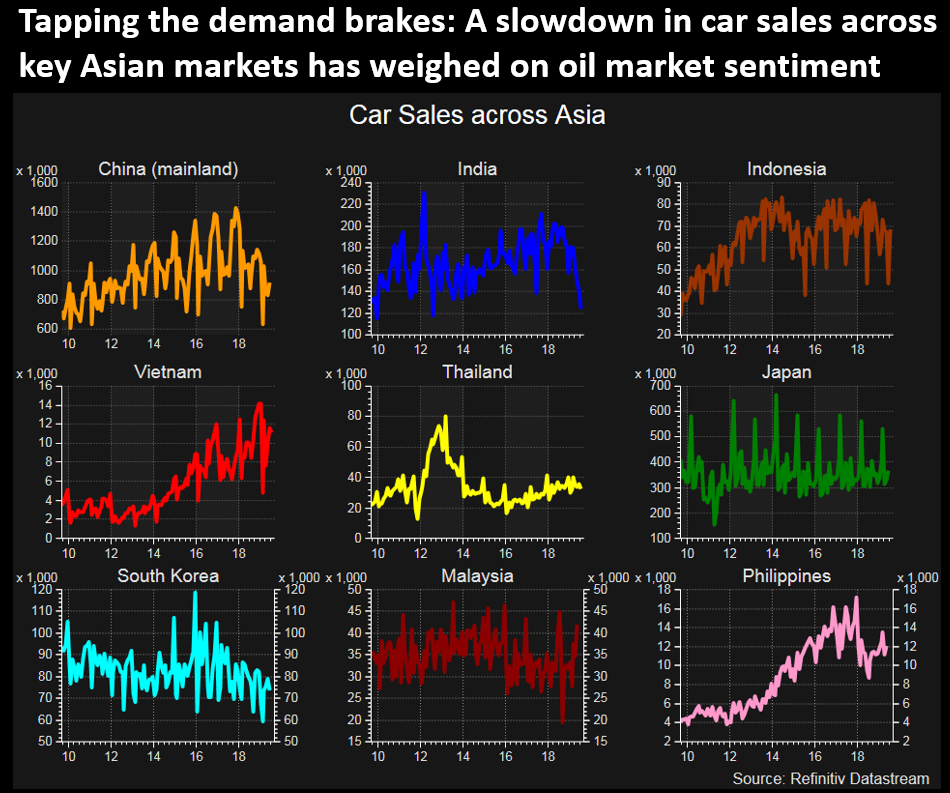

Disappointing data releases across key economies, including historically weak car sales in China and India and a contraction in China’s factory activity, have helped to fuel the gloom.

Benchmark crude oil prices have shed about $10 a barrel since April to just under $63 as global economic malaise set in. On Tuesday, the U.S. Energy Information Administration (EIA) forecast that Brent would average $60 a barrel in the fourth quarter. [O/R]

“The flat price had the best it’s going to have this year. We’re bearish until year-end,” said Ben Luckock, co-head of oil at trading house Trafigura [TRAFGF.UL] at the Asia Pacific Petroleum Conference in Singapore this week.

That bearish outlook echoed sentiments from the World Energy Congress in Abu Dhabi.

Russian Energy Minister Alexander Novak said the Organization of the Petroleum Exporting Countries and its allies including Russia would discuss slowing oil demand when they meet on Thursday.

He added that there were no fresh proposals to change oil production volumes within a current deal to cut global output by 1.2 million barrels per day (bpd), but the group may discuss new metrics for monitoring the agreement.

In a monthly report, OPEC cut its growth forecast for world oil demand in 2020 to 1.08 million bpd, 60,000 bpd less than previously estimated.

China’s latest factory data was emblematic of the broader economic concerns, with factory-gate prices shrinking last month at their fastest in three years as the trade war with the United States weighed on the manufacturing sector.

Energy consultancy Wood Mackenzie cut its forecast of global growth in demand for energy liquids to 700,000 bpd for 2019, down from 850,000-900,000 bpd, due to stiffening economic headwinds related to the U.S.-China trade war.

At a presentation in Singapore this week, WoodMac said weakness in China’s manufacturing sector due to the trade war had restricted the country’s overall fuel consumption.

The EIA also shaved its global growth forecast for 2019, to 890,000 bpd from 1 million bpd previously.

JBC Energy, an oil and gas research firm that tracks demand data from more than 100 countries, also pegged global growth in oil demand at below 1 million bpd for 2019.

“There is simply no strong engine for growth in the market. Large economies are constrained by geopolitical uncertainty (trade war/Brexit), while emerging/developing economies are dealing with this and relatively high prices,” said Richard Gorry, managing director at JBC Asia in Singapore.

“We are of course also tracking the Fed fund rates, treasury rates, commodity indices, PMIs etc, all of which support our concerns on demand,” Gorry said.

ANZ economists joined the bearish chorus in a research note that cut its 2019 oil demand growth forecast to 1.0 million bpd from 1.2 million, also citing weakening purchasing managers’ index (PMI) data and shrinking global car sales.

Looking to 2020, though, JBC and WoodMac forecast a modest recovery in demand growth.

“Next year we would see demand back around 1.2 million bpd, marginally IMO-driven, and partially as a base effect of low demand growth in 2018 and 2019,” said Gorry, referencing new maritime rules that will force ships to upgrade their fuel.

WoodMac’s 2020 growth forecast is 1.3 million bpd.