How low can oil go?

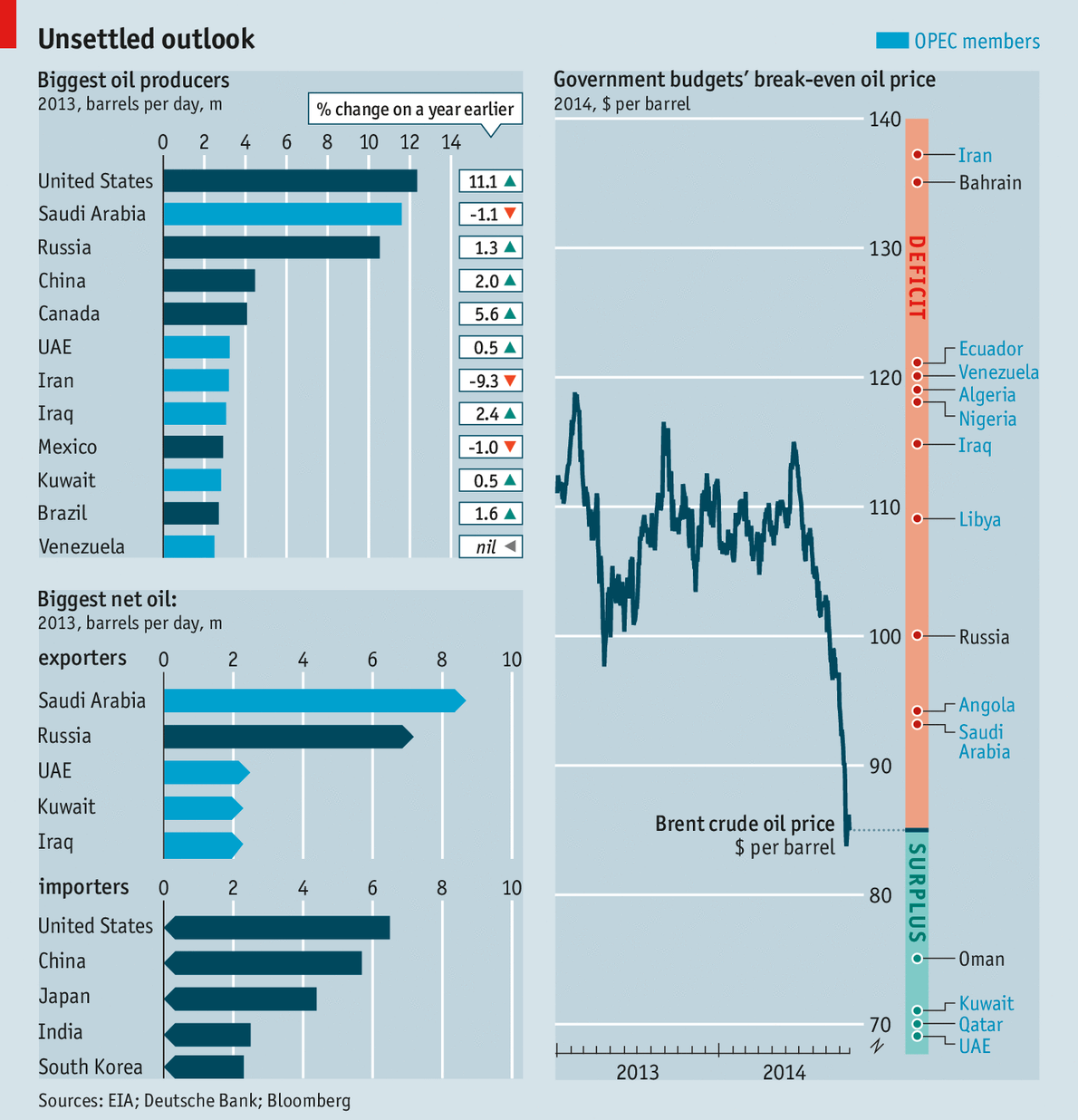

Falling oil prices seemed to level off in mid-October, quelling fears from the market that has seen the S&P 500 index drop 5% in only one week. Just when the oil market was acclimating to the $80 per barrel scene, Saudi Arabia delivered another jab to the United States energy industry. The de facto leader of the Organization of Petroleum Exporting Countries (OPEC) cut its export crude price to $77 in the United States and raised prices elsewhere, but it has yet to admit to waging a price war against the West.

“Don’t Panic”

The price of West Texas Intermediate (WTI) dropped well below the $80 per barrel threshold on Tuesday, falling below $76 in early trading. Brent flirted with the $82.50 mark on Tuesday, a four year low.

T. Boone Pickens tried to quiet fears nearly a month ago, saying he expects WTI prices to drop below $80 per barrel. “Once that happens, [the E&Ps] will start cutting their CapEx and it will sober everybody up,” he said in an interview with CNBC. The trickle-down effect of shale costs has been apparent among the world’s larger producers. Supermajors like Shell (ticker: RDS.B) and ExxonMobil (ticker: XOM) have both pledged to reduce expenditures, and ConocoPhillips (ticker: COP) announced intentions to dial back on the spending in its Q3’14 earnings release.

The Saudis, meanwhile, has sent its OPEC counterparts into an uproar. Many countries cannot return a profit with Brent approaching $85 per barrel. Venezuela publicly called on Saudi Arabia to raise the prices, saying the price cuts is forcing the country to operate at a significant loss. Reuters reports the Saudi’s oil minister is scheduled to meet with representatives of both Mexico and Venezuela next week.

“The most important thing is we should not panic,” said Abdulla Al-Badri, the secretary general of OPEC, at an event on October 30, 2014. “OPEC’s average price will still be $100 at the end of this year so we are fine for 2014… The fundamentals do not reflect this low price. OPEC does not have a price target. We must let the market settle down.”

Situation in the U.S.

Pickens likened the oil price drop to the decline in natural gas values in his CNBC interview. “The oil price has held up for a long period of time,” he said. “With natural gas, we over-drilled and became oversupplied and the price still hasn’t recovered. We can do the same thing on oil.”

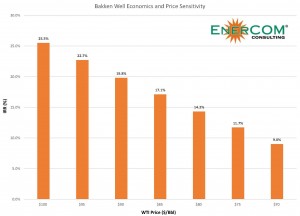

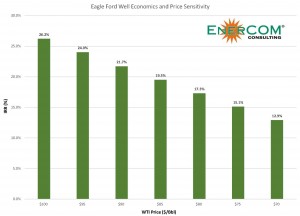

Approximately 82% of United States rigs (1,582 of 1,929 total) are focused on oil, according to the latest Baker Hughes rig count. EnerCom, Inc. compiled metrics on two of the U.S.’s largest oil plays, the Bakken and the Eagle Ford, to show the Internal Rate of Return in regards to oil price.

Despite the 25% pullback in oil prices since June, the Baird Energy team still believes major basins are economic at $75 per barrel. In an interview with Oil & Gas 360®, Baird analysts agreed producers will likely reconsider their long term drilling plans if WTI fell to the low to mid $70s range for a prolonged period. “However, the breakeven points for the major basins are still below that,” the group said.

According to The Wall Street Journal, OPEC’s critical ally might be at the other end of the E&P pipeline. The Journal says:

“An industry official familiar with the move said it wasn’t a decision to undercut shale production, which analysts have frequently suspected to be the motivation for recent Saudi price reductions. Instead, he said the lower pricing was an incentive for refiners in the U.S. to get higher margins by buying more Saudi crude. “It is about maintaining market share…It is becoming a complex strategy for Saudi Arabia,” said another industry official familiar with the move.”

The average WTI/Brent spread from January 2013 to September 2014 averaged $9.77 per barrel, according to data compiled from Bloomberg. That spread narrowed to an average of $4.61 since the beginning of October 2014, and is the closest it has been since May 2012. Refiners are already enjoying higher margins from the slipping prices. ExxonMobil and Chevron (ticker: CVX) both reported profitable quarters resulting from their respective downstream operations.

U.S. companies most at risk to sub-$80 barrels are those with high debt levels or operations in capital-intensive locations, the Journal said. Reduced operations would also have a trickle-down effect on oilservice providers. Companies with large acreage positions must also meet drilling standards on leaseholds, possibly exposing them to further commodity volatility.

Situation in OPEC

OPEC is fractured. Unfortunately for the group, Saudi Arabia is looking out for its best interests in order to maintain its market share. The Saudis produced 9.75 MMBOPD in October, accounting for 31% of all OPEC production. The approach is a sharp contrast to what happened in the 1980’s boom when the Saudis cut production in order to maintain the market price. The plan backfired as other OPEC nations ramped up production to replace the diminished supply.

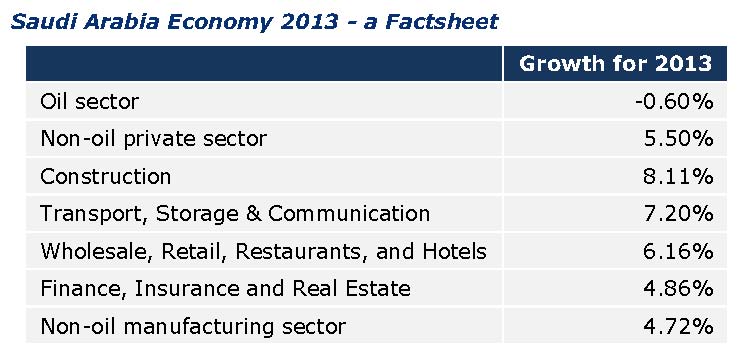

The United States’ shale boom began to worry Saudis last year. Saudi Arabia is the United States’ chief source of oil exports outside of North America, but its share of U.S. imports dropped to 4.6% in August 2014 from 7% in August 2013. The cut alarmed the Middle Eastern country, considering oil revenues account for 90% of its budget, according to Saudi-based Alkhabeer Capital. The group estimated GDP growth in 2013 slowed to 3.8%, down from 5.7% in 2012. The drop was attributed largely to a “slowdown in the oil sector,” which actually showed negative growth on the year. The table on the right shows the prominence of oil in the Saudi markets, considering an oil slowdown of (0.6%) slowed overall GDP growth by nearly 2% even though every other sector reported growth of at least 4%.

Al-Badri said the previous Brent price of $85 “would take 50% of tight oil out of the market” in an October meeting. “In the longer term, OPEC must be ready to produce. Around 2018-2020, US tight oil will slow down,” he said. “By 2020, OPEC must be ready to produce 40 MMBOPD of oil, and 50 MMBOEPD of liquids, that’s crude and natural gas liquids.”

A Two-Pronged Attack?

Forbes suggests Saudi Arabia is implementing a two-pronged attack, with U.S. shale and Iran on the receiving end of the price cuts. Iran said it lost 30% of its crude revenue from slashed oil prices and its global market is already limited due to sanctions from the West.

OPEC is scheduled to meet on November 27, 2014. The group previously convened on June 11, 2014, when Brent prices closed at $109.95. Less than one week later, Brent prices reached its yearly high of $115.16, more than $30 higher than today’s closing price.

U.S. Bulls Reaffirm the Markets

Production volumes are automatic questions for energy companies as we continue through earnings season, and several industry icons are adamant that WTI prices will recover. Harold Hamm, Chief Executive Officer of Continental Resources (ticker: CLR), refused to acknowledge the possibility of an oil glut in a recent CNBC interview. Dave Lesar, Chief Executive Officer of Halliburton (ticker: HAL), expects the prices to climb in 2015 and current demand is slowly increasing. HAL, the world’s largest supplier of hydraulic fracturing services, generates about half of its sales in the U.S.

“You can slow the energy boom down, but prices will come back up,” concluded Pickens in his CNBC interview. “The supply side is tough right now… but United States energy is still the cheapest in the world. So take advantage of it and play the demand side.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.