Oil & Gas 360 Publishers Note: We have been seeing that ESG is being tied to capital, investor confidence, and public opinion. We also see that if you do not have a well articulated ESG program you (as a corporation) may not survive in this current business environment. Contact Dan Genovese at dgenovese@enercominc.com for questions on an ESG plan and what it takes to survive.

Dominion Energy Inc. pointed to the growing importance of environmental, social and governance practices as one of the “key considerations” in weighing the sale of its midstream gas assets and narrowing its focus on cleaner energy resources.

Dominion announced the sale of its natural gas transmission and storage business to Berkshire Hathaway Energy on July 5 in a deal with an enterprise value of about $9.7 billion, including the assumption of $5.7 billion of debt.

Source: Dominion Energy Inc.

Dominion Energy Inc. pointed to the growing importance of environmental, social and governance practices as one of the “key considerations” in weighing the sale of its midstream gas assets and narrowing its focus on cleaner energy resources.

Dominion announced the sale of its natural gas transmission and storage business to Berkshire Hathaway Energy on July 5 in a deal with an enterprise value of about $9.7 billion, including the assumption of $5.7 billion of debt.

“In reviewing this transaction, in the context of our long-term strategic direction, we weighed several key considerations, including the value to our industry-leading ESG-focused strategy,” Dominion Chairman, President and CEO Thomas Farrell II said on a July 6 call with investors.

The subsidiary of Warren Buffett’s Berkshire Hathaway Inc. will acquire 100% of Dominion Energy Transmission Inc., Questar Pipeline Co. and Dominion Energy Carolina Gas Transmission LLC and 50% of Iroquois Gas Transmission System LP.

[contextly_sidebar id=”JG8m0bnRql41JrJ8INT0RLdsg0AtztVr”]

The deal, expected to close in the fourth quarter, also includes the sale of 25% of Dominion’s operating interest in the Cove Point LNG facility in Maryland.

“[T]his sale does highlight the growing pressure on utilities to decarbonize, particularly in a blue state like Virginia and with President [Donald] Trump trailing Joe Biden in the polls by double digits,” Height Securities LLC analyst Josh Price wrote in a July 6 report.

The move came on the same day that Dominion and Duke Energy Corp. announced the cancellation of the 604-mile Atlantic Coast natural gas pipeline project based on ongoing delays from legal and regulatory challenges as well as increasing cost uncertainty.

“Our company continues to evolve, allowing us to focus even more on serving our customers and positioning us for a bright and increasingly sustainable future,” Farrell said. “We believe that Dominion Energy offers one of the industry’s most compelling profiles for ESG-focused investors and stakeholders.”

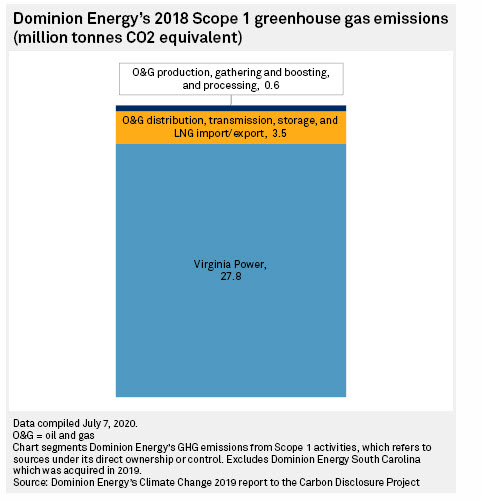

An analysis by S&P Global Market Intelligence shows that at least 40% of Dominion’s 2018 methane emissions came from its natural gas transmission, processing and storage segments.

In its 2019 methane emissions reduction report, Dominion said greenhouse gas emissions from its natural gas business “accounted for 14% of Dominion Energy’s total carbon equivalent emissions in 2018.”

Out with the coal

In February, Dominion set a net-zero emissions target for its power generation and natural gas operations and outlined plans to shut down coal plants and ramp up investments in renewables.

For the near term, the Richmond, Va.-headquartered company targeted a 65% reduction in methane emissions by 2030 and an 80% cut by 2040 from 2010 levels.

Dominion previously committed to cut methane emissions from natural gas operations by 50% from 2010 to 2030 and to reduce carbon emissions from its power plants by 55% by 2030 and at least 80% between 2005 and 2050.

The energy giant has outlined up to $55 billion in growth capital between 2020 and 2035 supportive of its net-zero emissions plan, including billions tied to the development of offshore wind.

“ESG, reliability and customer growth-driven programmatic investment will drive earnings and rate base growth, combined with continued [operations and maintenance] discipline,” Dominion Executive Vice President, CFO and Treasurer James Chapman said on the call.

Farrell also noted that growing opposition to new and existing natural gas midstream infrastructure has overshadowed the company’s plans to expand that footprint.

“To state the obvious, permitting for investment in gas transmission and storage has become increasingly litigious, uncertain and costly,” Farrell told analysts and investors. “This trend, though deeply concerning for our country’s economic growth and energy security, is a new reality which threatens the pace at which we intended to grow these assets.”

The CEO also pointed to a “significant divergence in the multiples between midstream businesses” in recent years.

“And then, the world’s changed a great deal over the last five years, too, with ESG, our state policy mandates on renewable energy that we have to move into,” Farrell said.

The Virginia Clean Economy Act, which took effect July 1, requires Dominion to retire all electric generating units in the state “that emit carbon as a by-product of combusting fuel to generate electricity” by Dec. 31, 2045. Dominion subsidiary Dominion Energy Virginia, known legally as Virginia Electric and Power Co., must procure 100% of its retail electricity from renewable resources by 2045, minus any demand met by other carbon-free resources.

Farrell said Dominion still sees “plenty of growth opportunities” with its remaining LDC and renewable natural gas businesses.

“But transforming our electric companies to more renewable energy, more robust grid protections … that’s also obviously a very large opportunity for us,” the CEO said.

‘A big step’

Scotia Capital (USA) Inc. analyst Andrew Weisel said the planned sale of the gas assets is “a big step” toward Dominion’s ESG goals, “but let’s not get too carried away.”

“We’re impressed with the immediate and planned drops in carbon emissions, but we aren’t entirely certain how big of an impact these factors will have on funds flows and thus [Dominion’s] valuation as we believe the stock has already benefitted from these trends,” Weisel wrote.

Still, with the planned divestitures, Dominion is expected to see “an immediate 50% reduction in carbon dioxide emissions,” the analyst noted.

Dominion’s announcement to sell the gas assets and abandon the pipeline project “does look like a substantial pivot toward clean energy and away from natural gas,” said Dan Bakal, senior director of electric power at Ceres, the sustainability group that is the organizer behind Climate Action 100+, an investor initiative to ensure the world’s largest corporate greenhouse gas emitters take action on climate change.

While Dominion is moving away from natural gas, Bakal suggested investors may question why Berkshire Hathaway Energy decided to buy the pipeline and storage assets. “There certainly will be increased concern around Berkshire Hathaway and the kind of role that they see for natural gas,” Bakal said in an interview. “Clearly, it’s a significant expansion of their natural gas footprint. So I’m sure investors will be paying attention to that.”

Meanwhile, Duke Energy also has outlined ESG investments and practices as an “essential component” of its strategy.

“[O]ur climate goals remain intact and … natural gas remains an essential part of our company’s clean energy strategy and our path to net zero emissions,” Duke Energy spokesperson Neil Nissan said in a July 6 email. “Without the [Atlantic Coast Pipeline], we’re planning to invest in renewables, battery storage, energy efficiency programs and grid projects. For our natural gas distribution business, we’ll evaluate multiple options to ensure the needs for eastern [North Carolina] are met in the near and long term. Options could include additional infrastructure to strengthen the eastern part of the state, and natural gas storage and compression investments.”

In a July 7 report, Moody’s said the cancellation of the Atlantic Coast Pipeline LLC project “reduces environmental and construction risks” for Duke Energy with “manageable” impacts to its balance sheet and credit metrics.

“The cancellation of the natural gas pipeline, and related plans to shift investment to renewables, battery storage and energy efficiency may also speed Duke’s transition to net-zero carbon emissions, reducing its carbon transition risk,” Moody’s analysts wrote.