On day three of EnerCom’s The Oil & Gas Conference® 21, a panel of experts talked about the Permian basin and the rapid growth in activity it has seen in the past three years. Panelists were Jeb Bachmann of Scotia Howard Weil, Will Green of Stephens Inc. and Bill Davis of Vaquero Midstream.

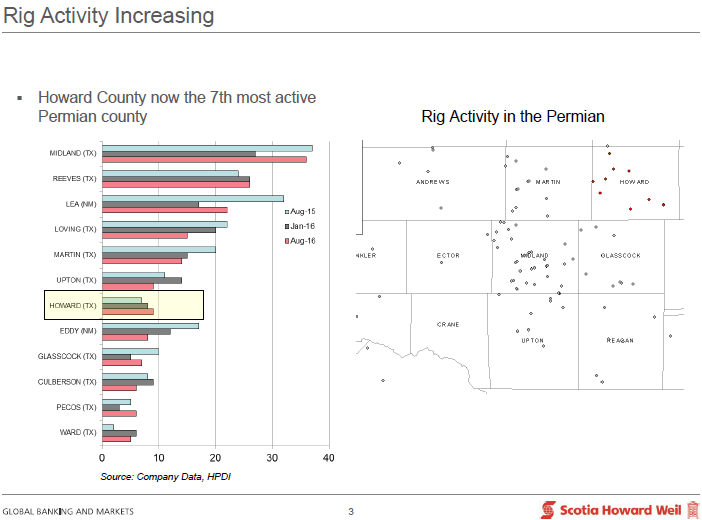

Scott Rees, Chairman of Netherland Sewell, started things off with some stats about the current activity in the Permian. “Fifty percent of the rigs drilling for oil today are in the Permian,” Rees pointed out in his introduction.

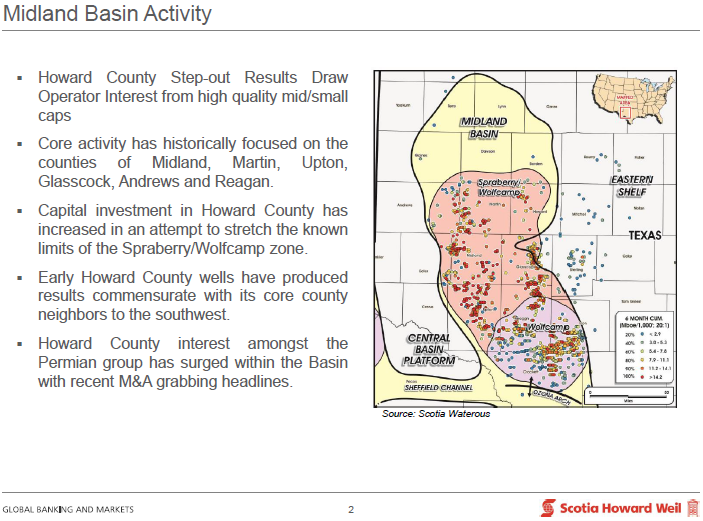

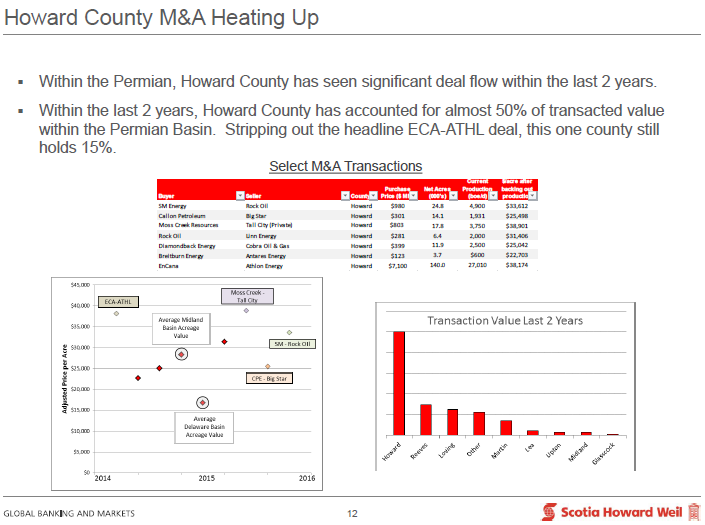

Bachmann said it’s “a play that has already become the best in the U.S.” Bachmann focused his remarks primarily on Howard County and the growing activity level there, discussing the Wolfcamp and the Spraberry, outlining permitting activity and company well results. A key focus was on the M&A activity heating up in the basin. The panelists referred to Encana’s acquisition of Athlon—a $7 billion deal.

“A lot of deals are in the Delaware side of the basin,” Bachmann said. “Guys are running out of opportunities on the Midland side; people are looking to the Delaware to expand their positions.”

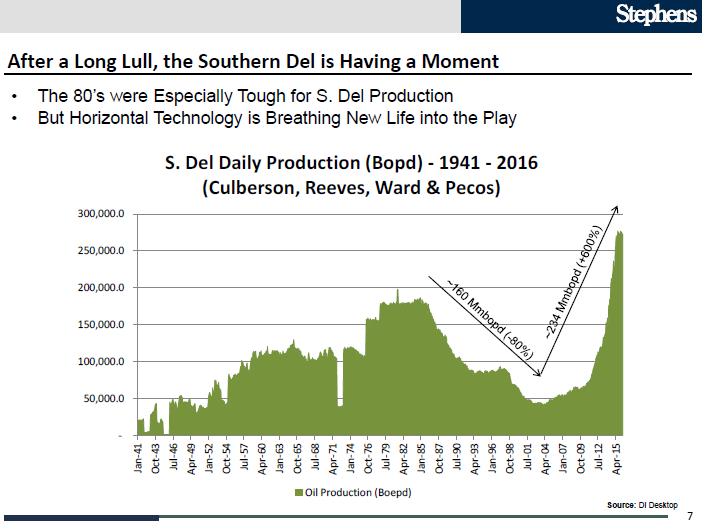

Will Green’s presentation was called “The Rise of the Southern Delaware.” He started off by calling the Permian “the gift that keeps on giving.” Green went through some of the early history of the basin—long before the advent of horizontal drilling: “The 1980s were especially tough for the southern Delaware.” Green said “horizontal technologies are breathing new life into this play.” Green said that pre-2005, horizontal activity was next to nothing, “no major trends.”

Green said the biggest reason for recent success has been “a step change in completions in 2013 and beyond.” Bachman said about the targets in the play that the Wolfcamp A is becoming very well known by producers, “but we’re still figuring out the Lower Spraberry.”

The final speaker was Vaquero Midstream founding partner Bill Davis. Davis said the three company founders’ experience and knowledge of the Southern Delaware was the impetus to launch a major natural gas gathering, processing and transportation operation in the basin, to give operators access to sell their gas. Davis said the Delaware was attractive because it presented huge horizontal drilling opportunities with multiple pay zones and there was a need for infrastructure. “All of the wells have associated rich natural gas, and the tolerance for flaring gas will begin to decline as prices for NGLs rise.”

Vaquero began work on its processing plant in 2014 and the first phase became operational in 2016 with a 200 MMcf/day capacity, expandable to 1 Bcf/day.

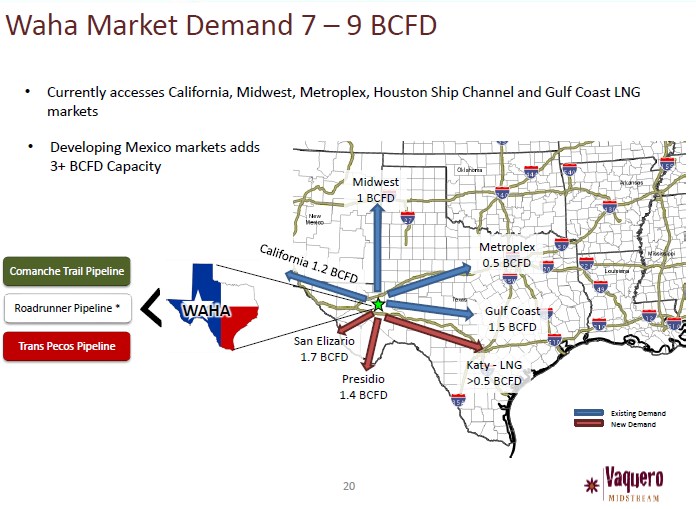

The company focused on locating near the markets for the gas, with Mexico as a new attractive buyer for U.S. natural gas, as it shifts from oil and diesel-fueled electrical power generation to natural gas. “We have access to a dozen different markets,” Davis said.