Two of the major DJ Basin producers, HighPoint Resources (stock ticker: HPR) and Bonanza Creek Energy (stock ticker: BCEI) held earnings calls last week, discussing prevailing views in one of the country’s premier shale basins.

By Richard Rostad, analyst, Oil & Gas 360

On potential new regulations

[EDITOR’S NOTE: both earnings calls were held prior to the proposed new energy bill for Colorado’s introduction in the Colorado legislature, which occurred in the afternoon on Friday, Mar. 1.]

Q: Any thoughts on what we might expect from this omnibus bill? I mean, obviously, there’s been some conflicting media reports out there.

Bonanza Creek Energy: The conversations I have with peers and others in the trade groups seems to indicate to me that we can expect maybe two dimensions to an omnibus bill. It’s always a little risky to speculate on legislation while it’s still pending, but there seems to be two common themes in all the conversations that I’m having with peers and others.

The one element is around the COGCC posture and maybe nuance changes to the language of the act. I think there’s going to be perhaps a little less emphasis on fostering of oil and gas development in the mission of the COGCC and perhaps a little more emphasis on balancing development of oil and gas resources with the impacts on the community vis-à-vis environmental, safety and health. That, as you recall, was the key pillar to Colorado Rising’s arguments leading up to Proposition 112.

And so, that also flows into kind of the second element we would expect to see and that is an element of local control. And we think that local control is going to have a subpart to it that probably allows for very small municipalities to opt out and defer back to the COGCC, because it’s a sophisticated agency with lots of technical and on-the-ground expertise. And a lot of these small communities, 1,000, 2,000, 5,000 people, they just don’t have the resources for undergoing significant and/or sophisticated siting evaluations. So, I would expect those two or three major parts to come out. But again, it is a little risky, because it’s not out yet and it may still be undergoing modification, but that’s what I’m hearing now.

Q: Scot, always appreciate your political commentary. I just wanted to check in with you to hear your thoughts maybe regarding this bill we keep hearing about that’s sponsored by Speaker of the House and also the governor that is expected sometime soon. I just want to get your thoughts on that and give us the temperature of the current climate?

HighPoint Resources: I guess what I would probably say is, obviously, the industry has been engaged with the newly elected leaders and there’s been a lot of discussion back and forth over the last several weeks. And I guess I would say that it, in my opinion, has been pretty productive. We haven’t seen any reactionary things about drilling bans and moratoriums and huge setbacks and all those types of things.

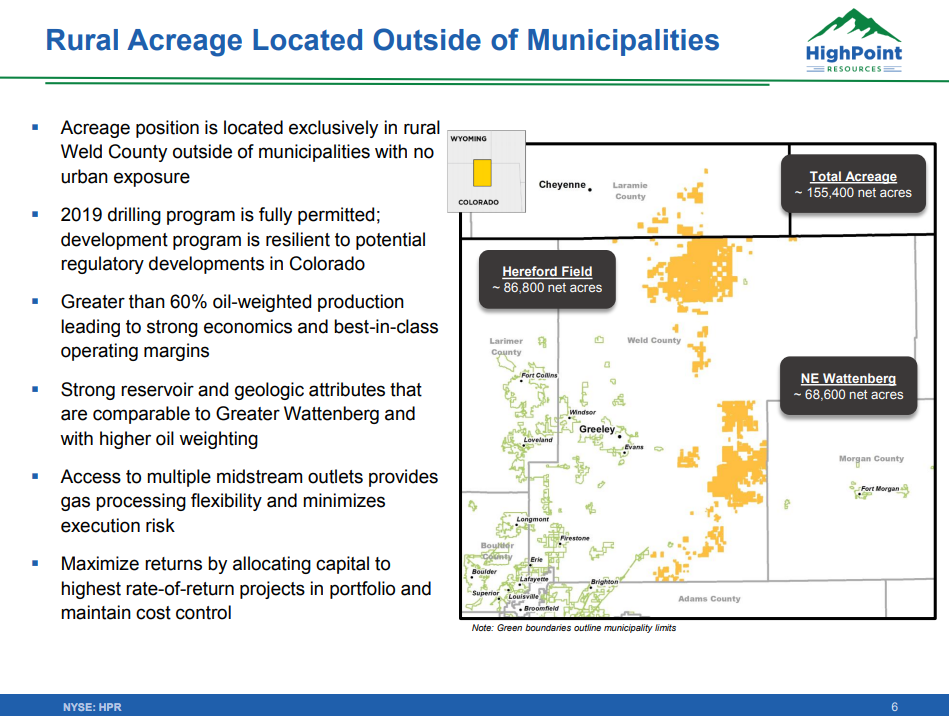

I really think that the new leadership here in Colorado is really aimed at trying to do a productive long-term solution. And so, we’re trying to work with them to get to a long-term focus productive solution. It seems like they’re still kind of focused on a couple of things; local control is probably one of the ones that’s top of their list. And, just for reference, obviously, we updated a slide in the presentation on page 6, and we’ve kind of shown the slide in different variations of this before.

But, if you look at page 6, you see our acreage footprint and then, in the green, we’ve outlined the actual municipalities in the State of Colorado and you can see that we are totally outside any municipalities. And so, when we think about local control, when we think about new regulations in Colorado, leads us to believe that we should be pretty resilient to any new changes that come about.

Obviously, we’re all anxious to see the bills as they come out.

Q: Just a question, a little bit bigger picture on regulatory impact. First, do you notice any difference in the actions between your big company neighbors and some of the smaller companies with regards to activity with the regulatory overlay?

Bonanza Creek Energy: We sit with the big operators at COGA, I sit on the board of directors at COGA. And in terms of their interest and our interest, they’re perfectly aligned. They’re great people. They’re very smart. They bring a lot of resources. We don’t see much difference in the way they’re looking at the surface political and cultural environment from – in terms of correlation between size of the company. Where we do see the difference is in terms of their exposure to, for example, lots more municipal or urban exposure versus lots – a lot less, for example, Bonanza Creek has no overlapping municipalities with our acreage.

And so, that really seems to be where the difference is in the way companies view their posture. But one of the things I was really pleased to see was the solidarity leading up to November and the vote. And really that solidarity and alignment of interests has carried through right up to today. When we have these conversations, there’s not much bifurcation between the companies. It’s really a strong alignment of interests and solidarity within the companies to ensure that we do as good a job as we possibly can, because we think that’s going to allow the industry to arrive at the right outcome.

On M&A opportunities

Q: How does the political environment impact M&A discussions?

Bonanza Creek Energy: It increases or encourages more activity because there’s more pressure. People are more perhaps under more pressure to act when the multiples are depressed the way they are today in the DJ, and that’s largely a function of the political and cultural overhang.

The problem is it’s difficult to do when you’re talking about publics and privates because of the bid/ask spread, right. The publics are mark-to-market and the privates tend to have a much higher value on their assets that feels more like an NAV. And so, there’s a big spread between how the seller who might value his asset and the buyer might be willing to pay.

And so, that provides a constraint on it, but we really do believe the environment is right. There is no question that scale benefits the efficiency of an operation and we care a great deal about scale and efficiency. It really is something we spend a great deal of time and energy and attention on working to maximize. When we think about scale, we think scale means cash flow. And so, that informs the way we look at the universe.

On 2019 plans

Q: Can you talk a little bit to the cadence of the growth in 2019? Obviously, it’s down a little bit in 1Q, but maybe a 4Q 2019, 4Q 2018 growth rate or kind of how you’re seeing the back half shape up? I mean, I guess I’m just – I’m looking for a trajectory into 2020.

HighPoint Resources: Overall for that, you know the program is somewhat frontloaded as we go through the years. So, we’ve got about a flat trajectory through some point in the second quarter and then as we bring those wells on, ramping across the year into the fourth quarter from a rig standpoint that development is across the asset position at the beginning of the year. By mid-year we’ve moved the rigs up to Hereford and continuing the development up there.

Q: You guys have a 2019 guide out. Can you maybe talk a little bit to kind of exit to exit or 4Q to 4Q, just to kind of help us modeling how that flows through the year?

Bonanza Creek Energy: So, the way we’re thinking about this, if you look back at 4Q 2018, we invested about $100 million in CapEx in 4Q 2018 and you would anticipate that begin to show up in kind of the sequential quarter and in fact that’s about what we’re expecting. We’re looking at 1Q 2019 mid-teens growth over 4Q 2018. And then, you can expect that to begin to decelerate kind of in Q2 and just decelerate down into maybe mid-single-digits sequentially Q2, Q3 and Q4. And then, of course, as we pick up the [ph] half and net (00:12:31) rig in French Lake in early-2020, you would anticipate that beginning to build again, but most of the results of that continuing drilling and completions investment in 2020 rolling on into 2020, basically into 2021 as you see more of the production uplift flow in.

On price sensitivity

Q: My question relates just how sensitive you are to changes in oil prices, both on the upside and downside, relative to accelerating activities. Do you need to see a month, a quarter or two quarters kind of either way before you put more money in the ground? Thanks.

HighPoint Resources: I would say that when you look at our hedge position for 2019, I’m not sure any change is near-term and commodity prices would make us change really our capital plan. The company really tries to look out 12 months or 18 months and tries to hedge. So, we can kind of secure these rates of return. So, I don’t think you’ll see us real reactionary one way or the other to add or subtract.