The market is underestimating production growth. East Daley’s 2020 U.S. production forecast calls for annual average crude production to hit 13.0 MMb/d (up 0.8 MMb/d Y-o-Y), natural gas to average 98.3 Bcf/d (up 6 Bcf/d Y-o-Y), and NGL supply from processing plants to average 5.4 MMb/d (up 0.5 MMb/d Y-o-Y). The Permian Basin will lead the charge with an average crude oil production increase of 16% from 2019 to 2020.

The market is underestimating production growth. East Daley’s 2020 U.S. production forecast calls for annual average crude production to hit 13.0 MMb/d (up 0.8 MMb/d Y-o-Y), natural gas to average 98.3 Bcf/d (up 6 Bcf/d Y-o-Y), and NGL supply from processing plants to average 5.4 MMb/d (up 0.5 MMb/d Y-o-Y). The Permian Basin will lead the charge with an average crude oil production increase of 16% from 2019 to 2020.

- Midstream companies providing G&P, NGL transportation, and fractionation in associated gas basins like the Permian and Bakken will enjoy EBITDA growth in 2020 that outpaces production growth and market expectations.

- In the Permian, companies like Targa, Energy Transfer, and Enterprise Products will realize average G&P and NGL downstream growth of 21% and 25%, respectively.

- In the Bakken, OKE will be the largest benefactor of ethane recovery in the Williston, generating up to $424 million of fee-based revenue on an annualized basis in 2022, filling the Elk Creek pipeline sooner than the market might expect.

- Investors are overestimating the near-term value of owning Permian long-haul pipelines given the impending overbuild of crude oil pipeline capacity out of the Permian and Cushing will negatively impact marketing earnings as well as walk-up (spot) shipments for legacy pipelines. The Dirty Little Secret is that these two categories make up approximately half of all forecasted EBITDA declines for assets under our coverage totaling about $2.6 billion.

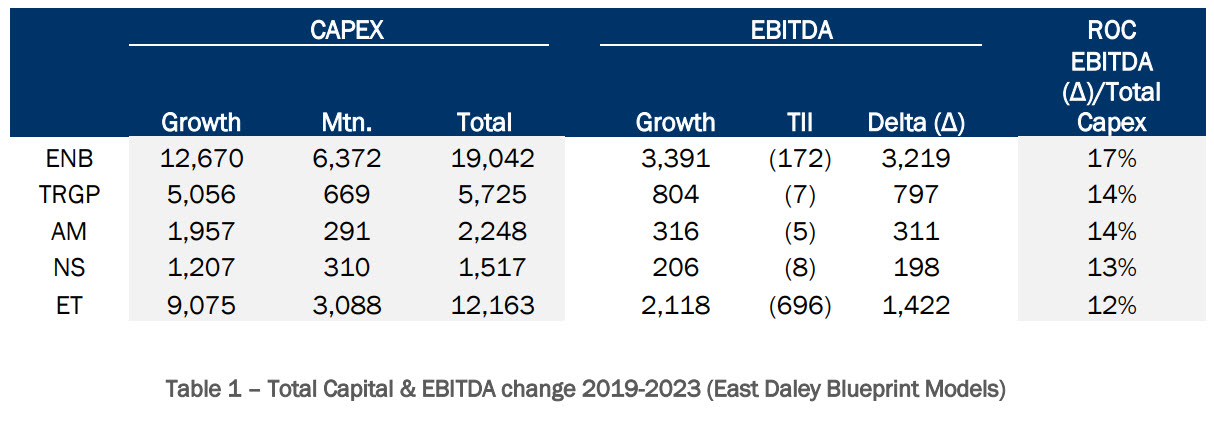

- There is unrealized opportunity for those companies that can avoid the near-term steep inclines on the Treadmill Incline Intensity (TII). East Daley shows companies like Enbridge (ENB), Targa (TRGP), Antero Midstream (AM), NuStar (NS), and Energy Transfer (ET) will be able to grow earnings most efficiently

THE SECRET INGREDIENT

Sometimes, one or two key ingredients is enough to make or break a recipe. The same can be said about one or two significant risk exposures making or breaking a year in the energy markets. Being right about a couple factors can be enough to tilt the odds in favor of those who are forewarned. 2020 will be no different, there will be a few important ingredients that could make or break an investor’s year or set in motion a new midstream corporate strategy following the recent capital spend boom cycle.

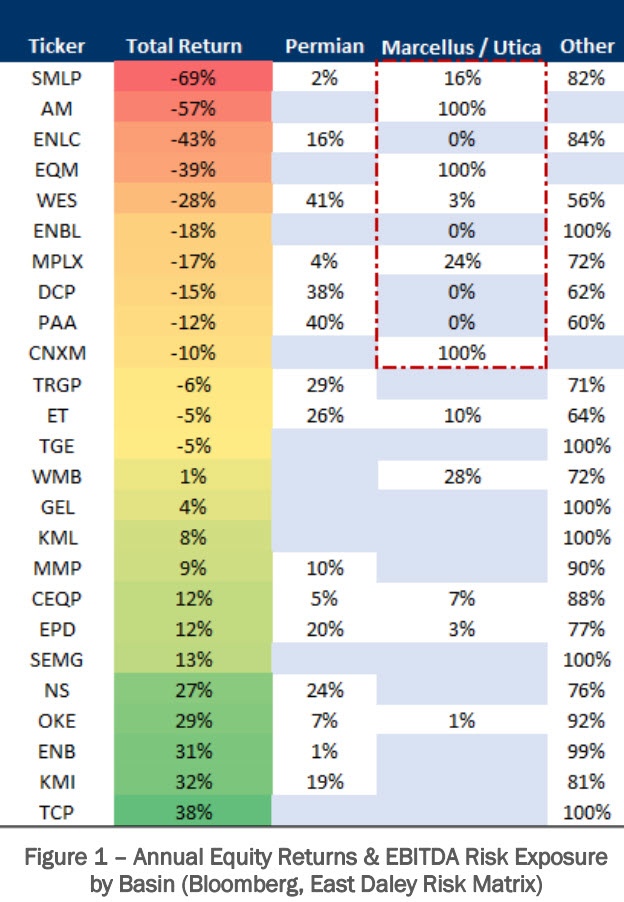

There is certainly no shortage of noise in the energy markets such as sentiment, technical factors, and corporate governance concerns, all of which are valid points. However, market fundamentals are again expected to be the most important ingredient for success. In 2019, avoiding or mitigating exposure to the Marcellus- Utica would have proved valuable as midstream equities linked to that basin significantly underperformed (see Figure 1).

Last year’s Dirty Little Secrets Report called out risk of Northeast producer growth expectations given the natural gas supply glut caused by strong growth from both oil and natural gas basins. Indeed, 2019 proved to be an inflection point where an increase in supply overwhelmed new demand, causing natural gas prices to tumble. The market reacted to these lower natural gas prices by sucking growth premiums out of the Northeast midstream equities and ratcheting up discounts for exposure to Northeast E&P counterparties.

While there are many important ingredients capable of influencing the players in the midstream market, there is usually one or two fundamental factors that casts a disproportionate influence. That question is, what will those factors be in 2020?

A RECIPE FOR SUCCESS IN 2020, UNDERRATED AND OVERATED INGREDIENTS

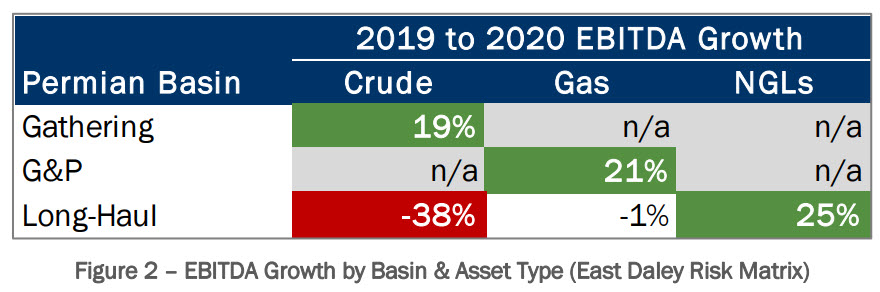

In East Daley’s view, fear of stalling production growth in the Permian for 2020 is overblown. Producers have guided to 14% average crude oil growth from 2019 to 2020, and as East Daley outlines in Section 2.1 of this Report, our independent analysis points to 16% growth in the Permian. Supply growth in the Permian will favor midstream companies that gather molecules from the wellhead. More molecules equate to more money. Figure 2 shows 2019 to 2020 EBITDA growth for companies under East Daley coverage exposed to the Permian Basin across the value chain. Companies exposed to crude gathering, gas gathering and processing and NGL services downstream of processing plants are set to grow significantly, even more than Permian growth overall. The reason, as discussed in Section 3.4 of this report, is because vertically integrated companies compound earnings along the value chain on the way to demand markets. Having vertical integration is an expensive proposition but a key ingredient for success. Section 3 of this report outlines some levers midstream companies can pull to deliver on a vertically integrated strategy.

Surprisingly, the key ingredient is not Permian exposure. When looking at supply side economics in isolation, owning exposure to long-haul crude pipes out of the Permian appears to be good. However, when analyzing the supply side relative to oil pipeline capacity coming online, there is a mid-term issue. As discussed at length in Section 2.2 – Crude Pipes Gone Wild – midstream companies levered to the Permian will face significant risk from a pipeline takeaway overbuild that will be 6x the size of the overbuild in 2016. That means three things: 1) marketing earnings will contract from tighter Permian to market spreads, 2) re-contracting rate cuts are imminent for pipelines with contracts rolling off; and 3) utilization will be risked, something even newbuild and fully-MVC’d pipelines will be unable to avoid. The dirty little secret is the ripple effect the Permian overbuild will have for spread and flow dynamics across the country.

In East Daley’s 4th annual Dirty Little Secrets Report, we have separated the content into four sections. The first section of the report is called Midstream Equity Fundamentals. This section outlines some key metrics market participants involved in trading capital market securities including equity, debt, and commodities should focus on. The second section focuses on Commodity Fundamentals, the dynamics of which are the common language that connects equity investors and key leadership at energy companies. The third section is called Midstream Corporate Strategy, a new addition this year. This section brings the two previous sections together for strategists and executives that own and operate midstream companies and assets. The fourth section, to be released at the end of January, will go deep in the weeds to give a company by company analysis of the opportunities and risks for each company covered.

MIDSTREAM EQUITY FUNDAMENTALS

- The impending overbuild of crude oil pipeline capacity out of the Permian and Cushing will negatively impact marketing earnings as well as walk-up (spot) shipments for legacy pipelines. The Dirty Little Secret is that these two categories make up approximately half of all forecasted EBITDA declines for assets under our coverage totaling about $2.6 billion.

- Combining growth project economics with our Treadmill Incline Intensity generates Return on Capital (ROC). This figure shows which companies will be able to grow earnings most efficiently based on their capital spending. Enbridge (ENB), Targa (TRGP), Antero Midstream (AM), NuStar (NS), and Energy Transfer (ET) have the highest forecasted ROC under our coverage.

- Company-level return analysis shows that Magellan Midstream (MMP) has earned higher return on capital employed (ROCE) than Plains All American Pipeline (PAA) over the past few years. EDRM analysis indicates this outperformance is largely due to MMP’s large asset base of refined products infrastructure which and is not as exposed to the competitive market dynamics seen in the Permian crude oil long-haul pipeline business.

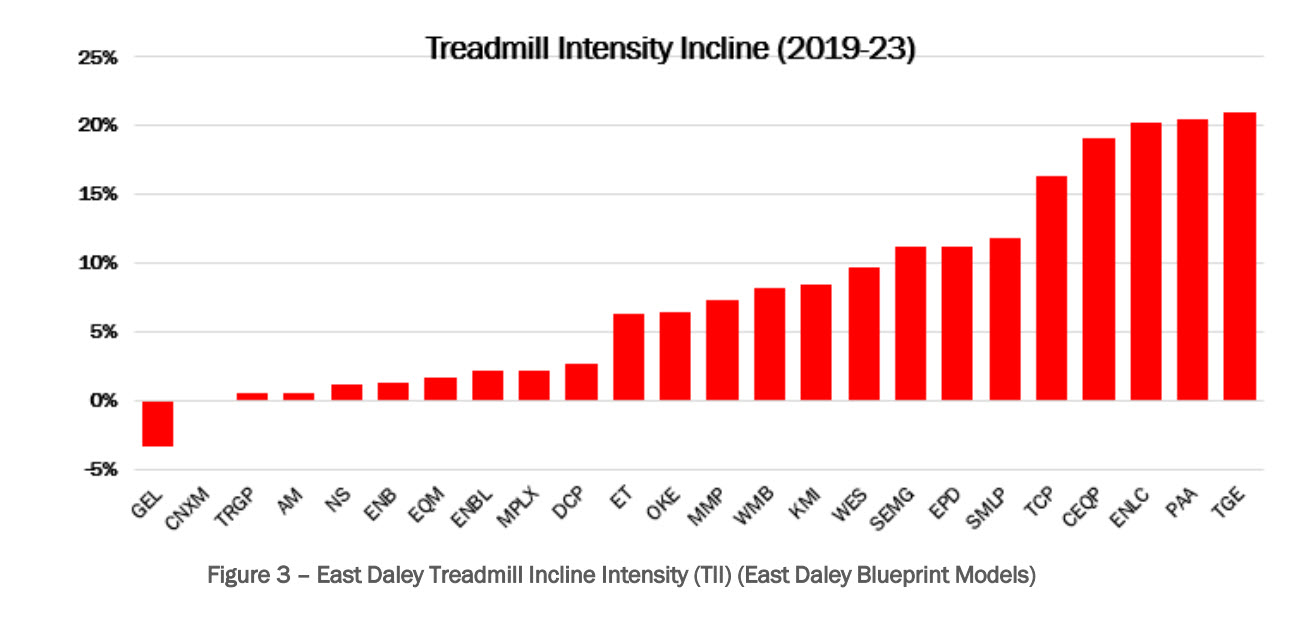

Similar to last year, East Daley sheds light on the base business risk for all 25 companies under coverage with the Treadmill Incline Intensity (TII) calculation. East Daley defines legacy cash flow risk as follows:

-(sum of EBITDA change on legacy assets from 2019 to 2023) / (2019 EBITDA)

Companies on the right side of the chart are most exposed to base business risks. In this case, names exposed to the Permian and Cushing crude takeaway overbuild (i.e. PAA, EPD, MMP, and ET) show up on the right side of the chart because they face the steepest part of the treadmill.

This TII chart also highlights companies facing minimal legacy business risk, aiding the path to future cash flow growth. The TII may be used just as much to identify opportunity as it is used to highlight risk. Table 1 below shows which companies under our coverage will realize the most incremental net EBITDA per dollar of capital spent from 2019 to 2023. We define this as Return on Capital (ROC). NuStar is well-positioned for growth given low risk to legacy assets and growth from its fast-growing Permian gathering system that feeds its downstream North Beach export terminal.

Finally, the Midstream Equity Fundamentals section of this report unveils East Daley’s return on capital employed (ROCE) measure at an asset-level, which we call the East Daley Return Metric (EDRM). We use East Daley’s database of asset -level cash flows and cost basis to explain what has historically driven company-level ROCE, and what will drive returns in the future. Specifically, East Daley uses Plains All American and Magellan to demonstrate insights gained from peeling back the onion of asset- level returns. This is especially topical considering the intense scrutiny by financial investors and corporate capital allocators to ensure adequate return on capital is earned.

COMMODITY FUNDAMENTALS

- East Daley’s 2020 U.S. production forecast calls for annual average crude production to hit 13.0 MMb/d (up 0.8 MMb/d Y-o-Y), natural gas to average 98.3 Bcf/d (up 6 Bcf/d Y-o-Y), and NGL supply from processing plants to average 5.4 MMb/d (up 0.5 MMb/d Y-o-Y). The Permian Basin will lead the charge with average crude production growth of 16% from 2019 to 2020.

- East Daley forecasts natural gas supply growth will continue to rise with 2020 exit rate production growth being led by associated gas from basins like the Permian (+1.7 Bcf/d), Bakken (+0.4 Bcf/d), and Denver-Julesburg (+0.2 Bcf/d).

- Midstream companies providing G&P, NGL transportation, and fractionation in associated gas basins like the Permian and Bakken will enjoy EBITDA growth in 2020 as production growth and reduced flaring will boost system throughputs.

In the Commodity Fundamentals section of this report, East Daley foresees continued strength in U.S. supply growth despite overrated market concerns about waning global demand and peak U.S. oil and gas supply. However, due to the volatile nature of geopolitics (e.g., the attack on the Saudi Aramco facilities in October 2019), East Daley has forecasted a low-side and high-side case for 2020 oil production to allow equity and commodity strategists to better quantify a reasonable range of risk in the coming year.

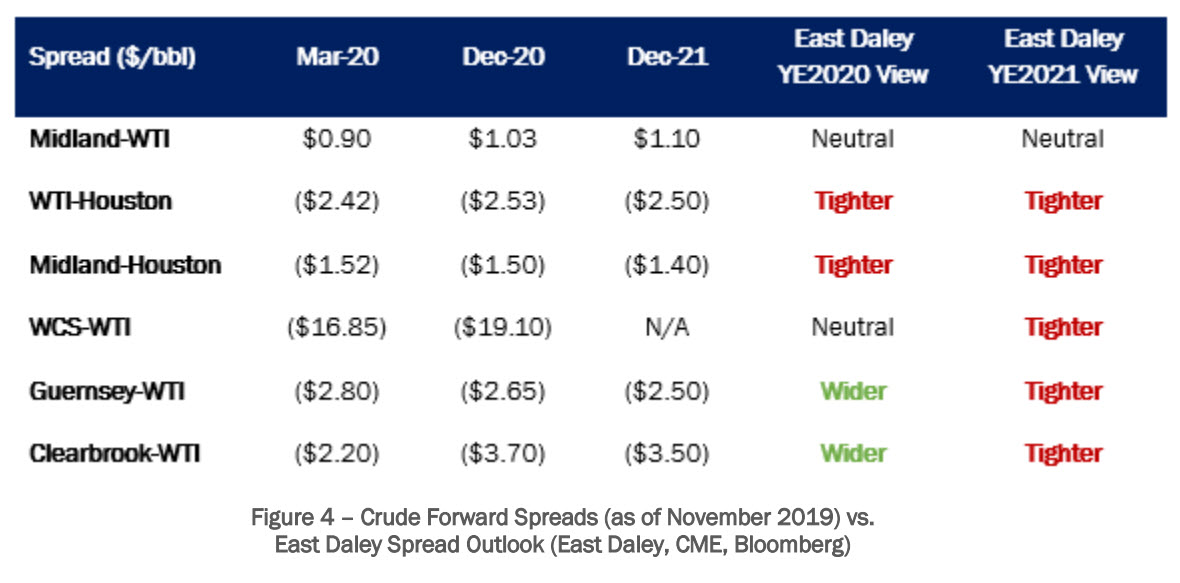

From a crude oil market point of view, major shifts in basin-level crude supply and demand fundamentals in 2019 have teed up a relatively black-and-white 2020, where basins will either settle into long-term overbuilds or short-term (year-long) constraints. The Permian is about to face a significant overbuild. Furthermore, as Midland basis begins to tighten, East Daley foresees a similar pattern of events emerging out of Cushing, except t his one the market still hasn’t figured out yet. Not only do the transportation constraints and overbuilds impact public midstream companies, they will also widen, or narrow basis differentials more than strip pricing would indicate (see Figure 4).

For the natural gas markets, Midstream companies providing G&P, NGL transportation, and fractionation in associated gas basins like the Permian and Bakken will enjoy EBITDA growth in 2020 as production growth and reduced flaring will boost system throughputs. Targa, Energy Transfer, and Enterprise Products Partners will realize more than $1 billion of EBITDA growth Y-o-Y from G&P and NGL-exposed downstream assets exposed to the Permian. In contrast, E ast Daley’s macro U.S. supply and demand balance remains tilted toward an oversupply from 2020 through 2022, putting growth at risk for gas-focused G&P systems in the Northeast and Haynesville.

While East Daley lays out the commodity market influences on company-specific EBITDA impacts for financial market participants, midstream management teams have their own set of challenges and opportunities over the next few years driven by market fundamentals discussed in the first two sections of this report.

MIDSTREAM CORPORATE STRATEGY

In the newest section of Dirty Little Secrets, East Daley displays data and analysis tailored to midstream corporate clients based on relevant topics faced management teams within the sector. A few topical issues addressed in this section include:

- U.S. midstream infrastructure is at the crest of the largest buildout cycle in history as companies under East Daley’s coverage spent $37 billion in growth capex during 2019 but are forecasted to drop that sum to a $5 billion by 2023.

- After racking up significant credit card debt and increasing leverage over the past two years from the capital spend boom cycle, midstream names are fast approaching the apex of the midstream infrastructure cycle; the Dirty Little Secret is that the key to deleveraging lies in non- core assets.

- The Dirty Little Secret for JV assets in the Permian specifically looks at the shift in the highest return pipeline assets from crude pipeline projects to NGL pipeline projects over the next several years. While some companies will continue to use JVs to fund growth and mitigate leverage, others will look to acquire non-owned JV interest to increase ownership of core assets.

- In Vertical Integration – Two (or More) is Better than One, East Daley looks at which companies benefit the most from owning a vertically integrated system and which midstream company gets the most revenue uplift per barrel as a result of owning the entire value chain (spoiler alert – it’s OKE).

- Finally, in Regulatory Risk – Underrated or Overrated – we discuss how Colorado-exposed midstream names have suffered from the unknown risks of regulatory change; the Dirty Little Secret here is that some of that fear is overstated as most oil and gas activity in the state takes place in counties that are favorable towards oil and gas development. East Daley also explains and quantifies risk associated with a potential fracking ban on federal lands.

Over the past several years the midstream sector has achieved an impressive infrastructure buildout to facilitate the movement of molecules to markets that can consume them. The cycle is now expected to crest at more than $37 billion in capex growth projects leaving investors and companies wondering what’s next. While midstream companies will redirect resources (both capital and people) to maintenance and smaller bolt-on projects, there are four other key areas that will see increased attention in 2020 and beyond. These areas are:

1) Midstream companies and private equity with money to spend will increasingly look to invest in non- core assets of highly levered companies looking to raise liquidity vis-à-vis expensive capital markets.

2) The continued use of Joint Ventures (JVs) to be used as a financing option for new projects while other companies may use liquidity from the sale of non-core assets to reinvest in current assets where ownership interest is shared.

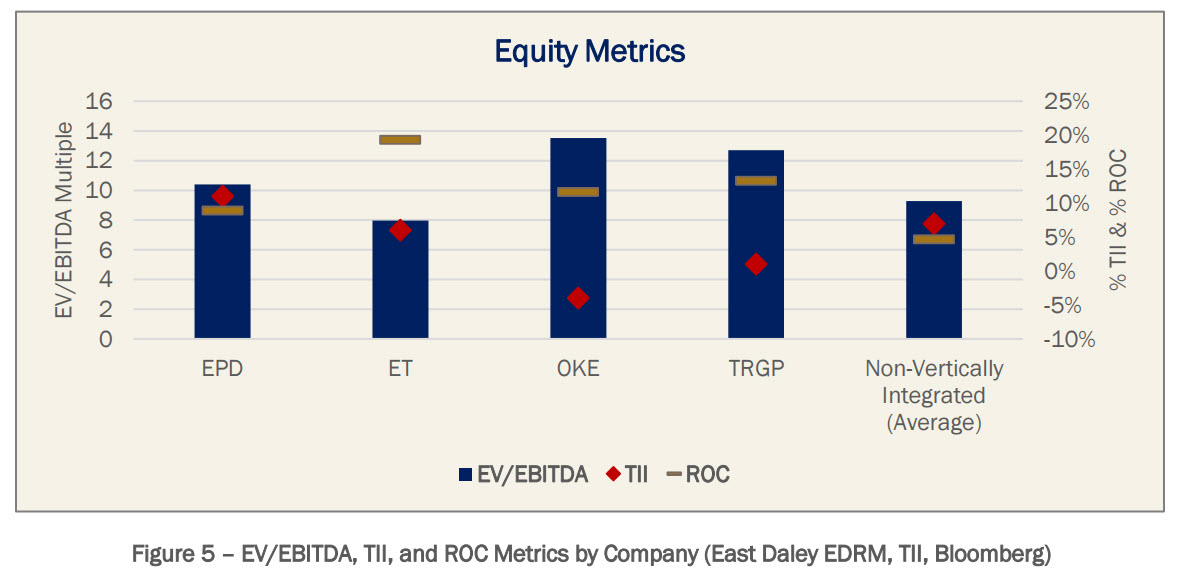

3) While competitive advantages in the midstream sector are hard to come by, the companies with asset systems most resilient to competition are vertically integrated. Vertically integrated midstream companies tend to be valued at higher EV/EBITDA multiples than their non-vertically integrated counterparts, making vertical integration a key differentiator (refer to Figure 5).

4) Regulatory issues have quickly emerged in the vernacular of company executives and there will undoubtedly be a focus on addressing both misconceptions and realities.

To facilitate both investors and midstream strategists, the report pulls together some key examples and high-level trends valuable across all energy market participants.

Please contact East Daley Capital for a PDF copy and the updates coming out in 2020. Please fill out the form below, or you can Email sales@eastdaley.com.