Oil & Gas Publishers Note: Another great industry insight article from Kevin Olson at RarePetro.

Abstract

Financial markets attempted to buoy benchmark prices as oil and gas markets became volatile in Q1 2020. This created a disconnect in the price spreads between the NYMEX WTI futures benchmark and regional spot prices. The disconnect continued to grow at the beginning of the year until it reached a tipping point in April when prices plunged. Ultimately supply and demand at the regional level through purchasers like storage companies, airlines, and refineries will be what control the true value of crude prices and bring the market back into equilibrium.

Introduction:

The RP News Team previously reported on “Crude Benchmarks and Price Spreads: How Market Intervention Creates Disconnect Between Regional and International Crude Prices.” In the past few weeks a new trend has begun to develop and important updates have occurred relating to the article. The April report focuses on the disconnect in oil prices between the United States WTI benchmark and regional areas. Unlike most products, the WTI benchmark oil price is influenced by supply, demand and market sentiment toward oil futures contracts. These contracts are traded heavily by speculators, with future “barrels” traded in multiples of actual supply. The futures contracts are what allow the market to determine commodity price while regional purchasers must still pay prices based on supply, demand, and composition of the physical product. This is significant because speculators do not have a physical position in the market but are outside investors trading paper commodities with no intent of purchasing physical barrels of oil.

When oil and gas markets become volatile, financial markets may attempt to buoy benchmark prices to ensure price stability. While successful in the short term, market fundamentals of supply and demand will eventually create a disconnect between the paper commodity and the physical product. This was exactly what happened on April 20th when WTI futures prices went negative for the first time in history. Financial markets attempted to buoy the price of the commodity until realizing the paper contract was closing and the physical market was restricted due to a lack of storage space. Since these speculators were unable to take delivery of the physical product, they had to sell contracts at steep (negative) discounts as the principles of supply and demand forced downward pressure on prices.

Ultimately supply and demand at the regional level through purchasers like storage companies, airlines, and refineries will be what control the true value of crude prices and bring the market back into equilibrium. Financial markets created a disconnect in the price spreads between the NYMEX WTI futures benchmark and regional spot prices that had been growing since the start of the year until it reached a tipping point in April. After the correction of buoyed prices devastated global commodity markets, regional supply and demand has begun to take over once again to bring price differentials closer to pre-pandemic levels.

[contextly_sidebar id=”Cd66xahs4Lj8q15NutvWFHPex2EXgpaw”]

Contract Expiration Tipping Point

A lesson in simple economics states the price of most goods is determined by the interactions of supply and demand. The same is true for commodities, such as crude oil, with a small caveat – outside speculators. At a regional level, there are much fewer speculators determining prices because regional contracts are not as heavily traded compared to an international contract like WTI. In the regional scenario, supply and demand forces set by physical purchasers drive prices while large scale international futures contracts are subject to market speculation and trading volumes. This concept is evident in the recent price crash for the May 2020 crude contract on April 20th, 2020. As demand fell due to the coronavirus and supply increased from the Saudi-Russia price war, oil storage had been filling up where physical crude was delivered. When the WTI front month contract was set to expire on April 21st, commodity traders did not want to take control of physical crude and needed to sell their positions. With low capacity for storage, supply and demand took over the commodity market, “leaving oil traders with no choice but to pay to unload their contracts and avoid having to take physical delivery, which would cost money since they’d need to pay the pipeline shipping costs as well as storage expenses (if they can find room)” [1]. After the contract expired and June 2020 became the new front month, the WTI price rebounded back into the mid-teens with the assumption that either storage or demand would be less of an issue going forward. As lockdown orders eased and travelling started to resume, demand began to return and prices have continued to increase. Before the crash, regional spot prices were showing an increasing spread between what was being traded on the NYMEX and the spot price sellers were receiving for their physical product. Since crude’s low point, regional supply and demand principles have shrunk the differential and now have more influence on benchmark commodity prices.

[contextly_sidebar id=”nlEU8ipT9rpHnhX5i5Lwl4ZByM4dmTrS”]

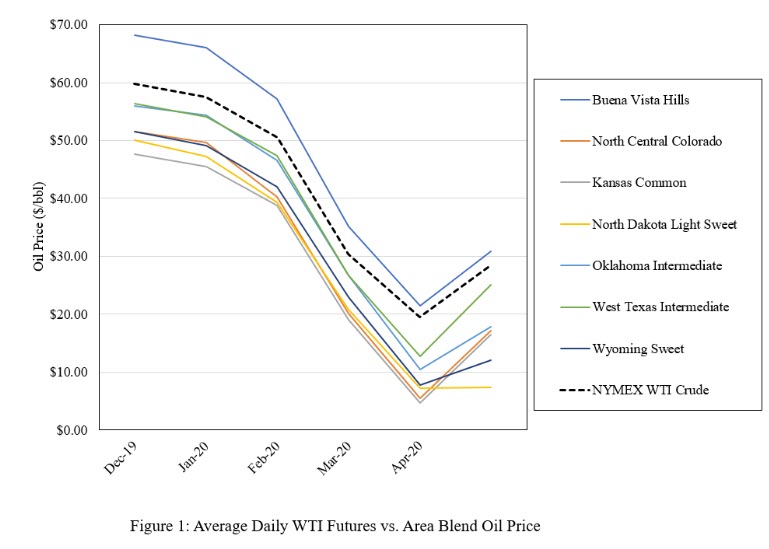

At the start of the year, prices for NYMEX WTI and regional blends of crude followed the same general trend due to supply and demand principles. Over the last three months, most blends started to diverge from the futures price and move closer to each other (Figure 1). After prices bottomed out on April 20th, most regional blends have bounced back at a quicker rate than WTI which ultimately tightened the differential gap that had been growing since the start of the global pandemic. While each blend recovered at a different rate because of regional factors, all have begun to recover since the oil price crash. As seen in Figures 1 and 2, the Rocky Mountain (Kansas and Colorado) regions and Oklahoma experienced a rapid initial recovery. Other regions like North Dakota and Wyoming have seen a lag followed by recent upticks to close the spread differential. While Figure 2 shows the differential percentage has not recovered back to pre-COVID levels, movement in that direction has begun.

Price Spreads:

Theoretically, if crude oil was based solely on supply and demand principles with the same market conditions, the price spread between regional blends and WTI should remain constant. In reality, this is not the case as different regions obviously have changing supply and demand needs independent of each other. A 7-day moving average in Figure 2 shows the percentage spread between regional blends and WTI futures price remained relatively consistent with minor fluctuations at the end of 2019 and start of 2020. The spreads began to widen in February and March until they reached the lowest point at the end of April. Prices immediately responded after reaching the price floor and the WTI futures contract is now once again priced heavily on regional storage and demand instead of financial intervention and market speculation on trading volumes. While the spreads have not quite leveled off and stabilized to pre-2020 levels, they are moving in the right direction. Figure 2 also shows the blend least affected by the price collapse was Buena Vista Hills in California. This blend historically trades at a premium to WTI, and has nearly recovered to the same percent differential seen at the end of 2019 since the April price trough.

Additionally, Table 1 shows a six month comparison of the average NYMEX WTI price against the spot price for seven regional U.S. blends. The differential between the benchmark and regional price in dollars per barrel and percentage is also shown. The events in March and April caused supply and demand fundamentals to throw commodity prices into a tailspin and financial markets had to intervene in order to stabilize prices. Unfortunately, they were merely holding off the inevitable, and when the front month contract for May expired prices plunged into negative territory. The subsequent result has forced futures prices to correct towards regional supply and demand fundamentals as opposed to outside speculators propping up the price.

In February and March as the regional prices adjusted to the supply-demand imbalance, the WTI price remained propped up by monetary influence from financial markets. Price differentials remained within 7 percent from the end of 2019. From the end of March and into April, crude supply and demand continued to grow out of balance until the tipping point was reached. In April, the percentage spread had grown by 50 to 58 percent in some areas from December levels. After the price crash, movements towards a stable equilibrium show that true oil price is determined by whether or not a buyer exists. If refineries or storage centers cannot take the physical inventory, the market will correct at the regional level and eventually force the benchmark to adjust accordingly; just like the events seen at the end of April. In May, the differential percentage has increased between 5% and 58% from six months ago, but these spreads have been shrinking since the end of May and into June.

Conclusion:

Speculator sentiment towards future pricing for commodities can create a wedge between regional and benchmark prices even though they are based on the same supply-demand principles. This spread was clearly evident from the beginning of the year when regional prices began to diverge from benchmark prices. Financial markets were initially able to buoy WTI futures prices until physical delivery of crude contracts at the end of April forced players to sell contracts at steep, sometimes negative discounts. This happened because limited storage and reduced demand for the crude squeezed supply dynamics. The realization that the commodity being traded was an actual physical product instead of a paper note forced players to dump contracts and prices to plunge. Now the pendulum has begun to swing back the other direction causing the differential for regional prices to shift closer to the futures benchmark. With less manipulation from outside speculators, futures prices have begun to follow regional price trends. True oil price is affected by whether a buyer exists for the physical crude, and ultimately the storage and demand for the final product. This is dependent on the companies buying and selling at a regional level where the fundamentals of supply and demand remain dominant. While financial markets may attempt to buoy benchmark prices to ensure price stability, the inflated price must eventually correct to represent the regional prices that ultimately control the market.

References:

[1] https://www.fool.com/investing/2020/04/21/beyond-the-negative-headlines-oil-prices-arent-wha.aspx

[2] https://www.oilmonster.com/crude-oil-prices/united-states/1