“M&A activity is as fundamental to Diamondback Energy as the air that we breathe”: Stice

Diamondback Energy (ticker: FANG) announced first quarter results yesterday, showing net income of $163 million, or $1.65 per share. The company produced $340.7 million in adjusted EBITDA, nearly double the $175.3 million the company produced in Q1 2017.

Diamondback produced 102.6 MBOEPD in Q1, up 10% sequentially and 67% year-over-year. The company expects to continue this rapid growth, and has one of the most ambitious growth plans of any large cap E&P this year. Diamondback expects to reach yearly production growth of 43% in 2018, averaging 113 MBOEPD.

50,000 BOPD Gray Oak pipeline agreement

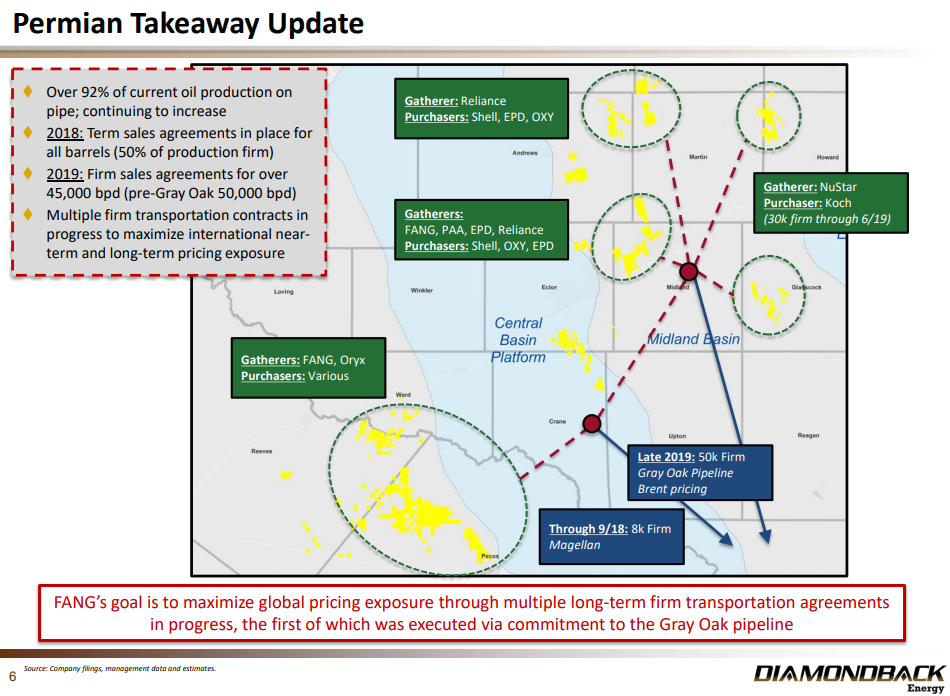

As one of the most prominent Permian operators, the current takeaway issues in the basin are very important to Diamondback. The company gave an overview of its current agreements, showing how it is dealing with the spreading differentials seen in the basin. Diamondback reports it has over 92% of current production on pipe, and that share is continuing to increase.

The company recently signed a 50,000 BOPD agreement to be a firm shipper on the Gray Oak pipeline, giving it significant future sales agreements. However, Gray Oak is not expected to come online until late 2019, so this move will not relieve the current stress.

However, Diamondback CEO Travis Stice reports the agreement will help alleviate current tightness, saying “Because of the attractive nature of the Gray Oak project, we’ve been able to leverage our substantial multiyear firm commitment of 50,000 barrels delivered to the Gulf Coast in exchange for near-term flow assurance and Gulf Coast pricing solutions.”

Diamondback drilled 41 gross wells in the quarter and completed 35, with these split between 20 in the Wolfcamp A, nine in the Lower Spraberry, four Wolfcamp B wells, and one in the Middle Spraberry and Third Bone Spring.

Record margins, 83% of realized prices

The Midland differentials did not weigh on the company’s margins this quarter, as Diamondback reported the highest realized cash margin in its history. The company saw margins of $42.13 per BOE, 83% of the realized price.

Diamondback’s subsidiary Viper Energy (ticker: VNOM) completed its transition to a taxable entity today, completing a process that was first announced in late March.

Travis Stice gave his overview of the quarter, saying “Diamondback remains committed to capital discipline by continuing to grow production at industry leading rates within cash flow and achieving an annualized return on average capital employed of over 13% in the first quarter, well above our estimated cost of capital. The execution of our forward operating plan while maintaining best in class operating metrics is the primary focus of our organization in an increasingly active Permian Basin.

“We have made significant progress on our Permian Basin takeaway strategy, with the 50,000 barrel per day commitment to the Gray Oak Pipeline being the first step of many as we work to increase our exposure to international pricing away from the Midland market. Additionally, Diamondback will continue to be active, yet selective, in our acquisition strategy, with accretion and full-cycle economics remaining key drivers of our decision making process. Our disciplined approach to all facets of the business, from day-to-day operations to longer-term strategic decisions, is evidenced by Diamondback’s significant Adjusted EBITDA per share growth since going public just over five years ago.”

Q&A from FANG conference call

Q: Specifically looking at your slide 6 here and the comment that 50% of the production is firm in 2018 in terms of I guess firm transport, and then in 2019 45,000 barrels are firm. Can you give us some details or a little bit more color around exactly what those contracts look like and the destination for that crude?

FANG: These are all Midland-based prices. I think the term firm has been thrown around a lot lately. We have access via all the in-basin pipelines to get our barrels where they need to go and have deals in place for all barrels for third-party marketers to market downstream. In this case, these contracts are a little stronger than your traditional term sales agreement. It’s a firm sales agreement. And what we’re trying to do here is, these are exposed to the Midland market, but we will be adding deals that are exposed to other markets over the near and long-term.

Q: And not to press too hard on something you probably can’t share too much details on, but any color you could share. You mentioned the ability to maybe use the Gray Oak contract or leverage the Gray Oak contract to secure near-term capacity. Just trying to understand, would you be looking at swapping out some of the firm commitment you’ve put in place there? Or through the relationship with the folks at Gray Oak, does that help you secure potential available capacity that in your words is term versus firm from some folks potentially?

FANG: I’ll put it a little differently. Diamondback – we’re not a marketing company, but what we did with the Gray Oak pipeline is we’re essentially taking our barrels one step further. So at the end of the day, those barrels need to be marketed by one of the larger international marketing firms that we have great relationships with and have been doing business with throughout the last six years as a public company. So that 50,000 barrel a day commitment is a very enticing, sizable commitment for someone to market over the next multiple years after we make that commitment. So in exchange for that, we might pay up for secured firm transport in the near-term, but I’m looking to exchange that for someone to come in and market those barrels long-term for us.

Q: Given what’s happened with Mid-Cush diffs, does that potentially change sort of the dynamics of the acquisition market as we look at some people who might be suffering from compression of price realization, and maybe free up some incremental or differentiated assets that you guys would be interested over time? I’m just curious how you think this shapes the acquisition market.

FANG: As it continues to evolve, we take all that into our acquisition model as we price future cash flows and then discount them forward. So yeah, it could, but we’re just going to be continued to use our disciplined approach on acquisitions, and we’ll evaluate all the deals with what the current market conditions are, and we’ll respond accordingly as we look for accretion in these deals.

And just on the acquisitions, Diamondback currently, we’re not more interested or less interested in acquisitions than we’ve ever been in our company’s history. M&A activity is as fundamental to Diamondback Energy as the air that we breathe. It’s something that we’ve done from day one, and we’re going to continue to demonstrate that discipline in looking for accretion and looking for ways that we can deliver differential results to our shareholders. That’s one of the reasons that we put that slide in there on page 7 is to say we’ve got a good track record of doing smart deals for our shareholders. And so that’s the way we always behave.