Buys 25,500 acre-Ajax Resources

Diamondback Energy (ticker: FANG) announced second quarter results today, showing net income of $219 million, or $2.22 per share.

Diamondback produced 112.6 MBOEPD in Q2, up 10% sequentially and 46% year-over-year. The company is increasing production guidance slightly, and is now predicting overall 2018 output of around 117 MBOEPD.

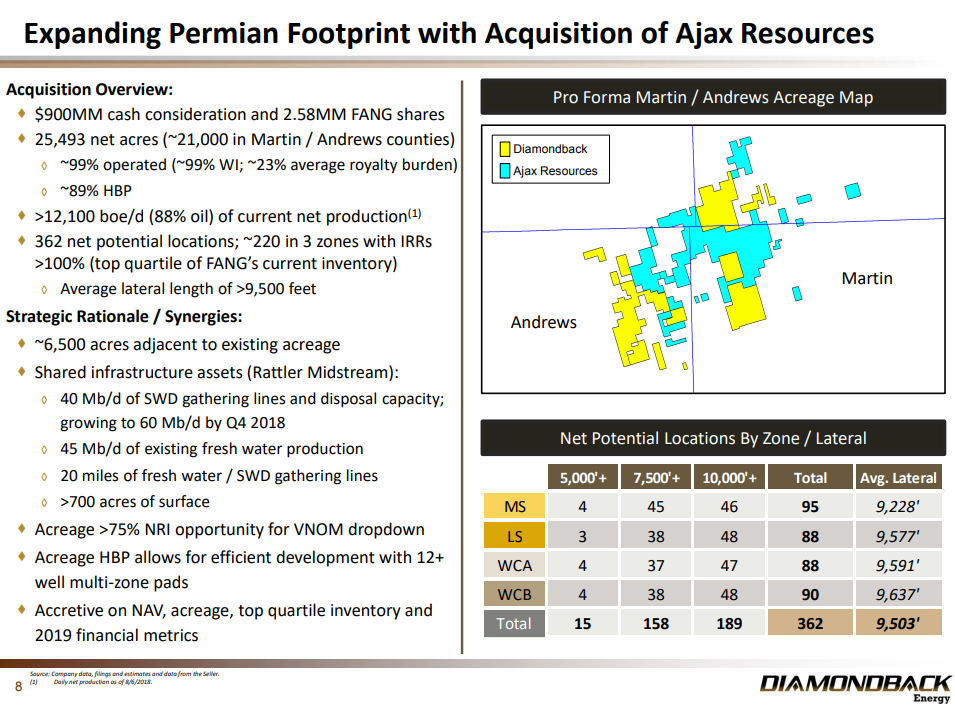

The company also announced a major acquisition today, Diamondback’s largest since it purchased Brigham Resources in late 2016. Diamondback will acquire private equity-backed Ajax Resources in a cash and stock deal, increasing the company’s Midland Basin presence.

Ajax holds just under 25,500 net acres in the Permian, primarily in Martin and Andrews Counties. The company is currently producing about 12.1 MBOEPD from these assets, 88% of which is oil. This acreage is very close to existing Diamondback holdings, and much of it is directly adjacent. This will allow Diamondback to optimize its infrastructure in the area, building gathering lines to the entire area.

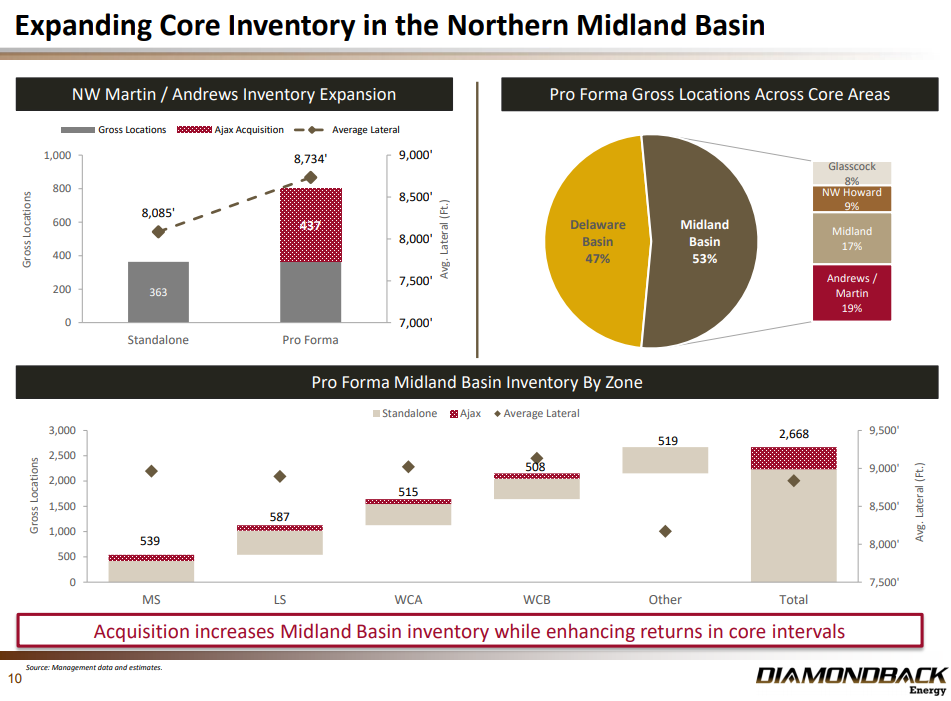

Diamondback estimates there are 362 net potential drilling locations on the acquired acreage, 220 of which have IRRs in the top quartile of the company’s current inventory. The vast majority of the acreage is held by production, so Diamondback may develop the area as it sees fit, primarily with large multi-zone pads.

Diamondback will pay $900 million in cash to Ajax, plus an additional $345 million in shares, a total of $1.245 billion. This equates to a valuation of $48,835 per acre, on the high end of recent Permian transactions. However, production from the assets is higher than seen in many other Permian deals, and if the purchase price is adjusted for production Diamondback paid about $27,000 per acre. Diamondback will likely need to tap capital markets for the cash portion of this purchase, likely in the form of a debt issue.

All FANG production will be at Gulf pricing after 2020

Diamondback also shored up its takeaway agreements in Q2, making several moves. The company has secured firm oil transportation out of the basin at fixed discounts of Gulf pricing, meaning that this oil will not be exposed to the growing Midland differential. These agreements cover an estimated 70% of the company’s production but the remaining volumes are priced at Midland. The situation will be similar in 2019, with most oil subject to discounted Gulf pricing and the rest priced at Midland market.

At current prices, Diamondback predicts realizing $12-$26 below WTI in the second half of 2018 and $2-$6 below WTI in 2019.

Diamondback’s long-term plans rely on the pipeline projects currently under construction. The company recently acquired a 10% equity in the EPIC Crude Oil Pipeline project, which increases Diamondback’s commitment on the line from 50 MBOPD to 100 MBOPD. Diamondback also has 50 MBOPD on the Grey Oak line, and predicts that all its output after 2020 will be subject to Gulf pricing.

Q&A from FANG conference call

Q: On the Ajax deal, when you’re talking about the accretion behind this, can you talk about how you’re thinking about besides the 12,000 barrels a day of existing production, could you maybe talk about some color about how quickly you all intend or believe you can ramp production around this, as I believe you said there was already a potentially a 6-well or soon to be 12-well pad and – as well as kind of how many rigs you plan on running down the area?

FANG: When you look specifically at the asset, and what’s going on, now there’s one rig that’s operated by Ajax. Again, we don’t close the acquisition till the 31st. And working with the Ajax team, they’re on fourth well of the pad, and we’re going to get them to continue drilling up until you get a 12-well pad.

So this rig will stay operating through the first quarter on that pad of 2019, and we’ll look into 2019 and potentially picking a second rig up on this acreage depending on rest of our capital allocation decisions based on our cash flow. So the volume impact ramping from here will be a 2019 event.

Q: While the midpoint of 2018 CapEx guidance moved up, it was pretty modest relative to some of your peers and seem to actually be more kind of midstream focused. Can you speak to what kind of pricing pressures you’re seeing in the field, and if you think that’s sustainable for Diamondback to continue to hold the line on cost relative to peers?

FANG: Well, certainly Diamondback always maintains pressure on costs, whether it’s relative to peers or not, that’s just the way that we operate our business. But when you look specifically at what happened in the quarter, on the Midland Basin side, our cost quarter-over-quarter were actually down $50 to $60 a foot, primarily on the completion side due to the full scale implementation of regional sand. And that’s going to continue in the back half of this year, and we’re beginning testing in the Delaware Basin side also on the regional sand.

So even though, quarter-over-quarter in the Delaware, costs are flat. If regional sand continues to work in the Delaware, we could probably see some downward pressure on pricing. Also, I know that just from a surplus availability, primarily on the pressure pumping that we’re certainly not dialing in any cost increases on the back half of this year, and I think, our operations organization continues to push the envelope on efficient execution of our development plan and holding costs. So we feel really comfortable about our cost projection. And you’re right, it was – 2Q was heavily dominated by infrastructure costs, and that’s not an equally quarter-loaded event. So we’ve taken all that into account in our latest CapEx guide.

Q: After the Ajax deal here, do you look to hit the pause button on the M&A front? Are you still very active assessing deals there? And then just, you laid out too that there might be some transactions here, a potential debt raise to fund this. Are you contemplating any equity alongside that too? We’ve gotten that question this morning. Thank you.

FANG: No, we’re not contemplating any equity associated with this trade. You’ve heard me say multiple times that in the business development, in the M&A world, you’re either in the game or you’re out of the game. And I think it’s fair to say that Diamondback’s going to remain in the game. And if we can find acquisitions like this Ajax trade that touches all the levers we care about, we’re going to continue to bring that value forward to our investors.

I mean, if you look specifically at the Ajax trade, the geos or geoscience team, they loved it because there’s a sweet spot for the Wolfcamp A and the Middle Spraberry in addition to the Lower Spraberry, which we already knew about it. The operations guys love it because it’s the easiest drill in our portfolio, and it’s physically adjacent to 6,500 acres of our stuff, which makes all the facilities easier. The Viper guys love it, because not only do they have a new playground to go buy minerals underneath Diamondback now, there’s also a couple of percentage points above the 75% that represent additional drop down.

And the Rattler guys love it because there’s new surface facility that get included in their toolbox. And then this wasn’t a brokered deal, and as I mentioned, we’re not doing equity, so everybody loves it because there’s not going to be any banker fees associated with this trade. So those are the type of things that we’re going to continue to look for.