Devon Energy Transfers VEX Ownership to Enlink Midstream

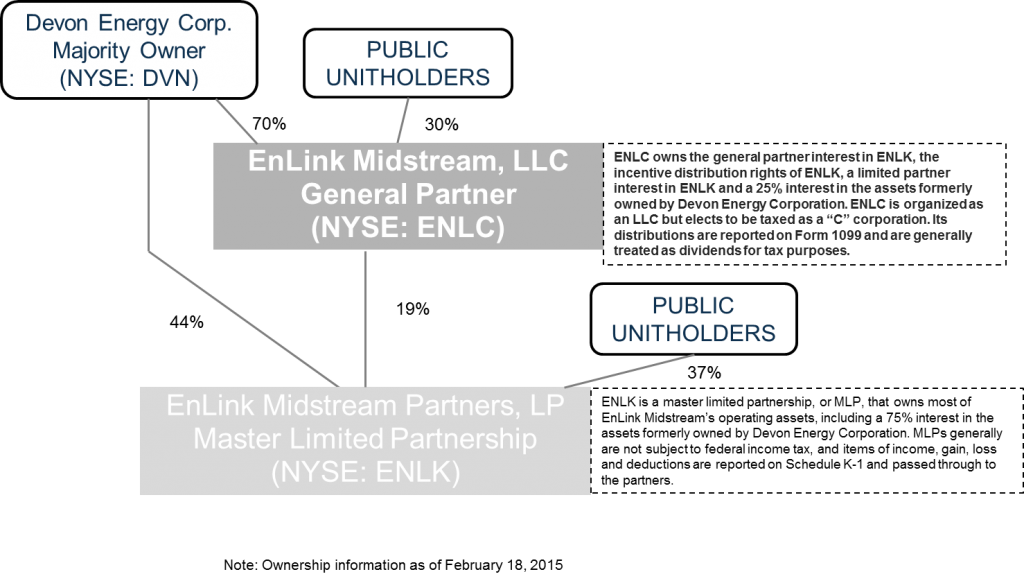

Last week Devon Energy (ticker: DVN) completed a dropdown of its Victoria Express Pipeline (VEX) to Enlink Midstream Partners (ticker: ENLK). Devon will receive $280 million from ENLK and EnLink Midstream LLC (ticker: ENLC), in which it owns a 34% and 70% interest, respectively.

The VEX pipeline is a 56-mile multi-grade crude oil pipeline with a current capacity of approximately 50 MBOPD and, following completion of currently-underway expansion projects, will have capacity of approximately 90 MBOPD, according to an EnLink press release. Other VEX assets at the destination of the pipeline include an eight-bay truck unloading terminal, 200 MBO of above-ground storage, of which 50 MBO are under construction, and the rights to barge loading docks. Also included in the transaction are facilities near the origin of the pipeline that are currently under construction, including an eight-bay truck unloading terminal and 160 MBO of above-ground storage.

In EnerCom’s MLP Weekly for the week ended March 27, 2015, EnLink’s debt-to-market cap ratio is 33%, while the median for the 59 MLP group is 40%. The company’s net debt-to-EBITDA ratio is also lower than the group median at 3.2x compared to 4.5x. The MLP’s dividend coverage ratio matches the group’s median at 0.8x.

Devon set to excel

The VEX dropdown will keep the company on track to reaching its goals. In a recent company conference call, Howard J. Thill, Senior Vice President of Communications at DVN, said that the VEX dropdown was one of two the company hoped to complete this year. “Then [there is the] Access Pipeline … [We] have a 50% ownership in Canada servicing our SAGD operations up there that will drop either late this year or into next year is the expectation.”

In a note issued following the announcement of the VPX dropdown, Raymond James analyst Andrew Coleman said that the firm expects Devon to excel, even in the current price environment. In his note, Coleman said that the company’s strong balance sheet, divestitures of non-core assets, and top-tier asset portfolio position the company very well to weather the price downturn. “We believe the majority ownership stakes in both entities gives Devon significant incentive to maximize the value of each,” says the note, which also expects DVN to be cash flow neutral in 2015 pro forma the transaction.

Based on information from EnerCom’s E&P Weekly for the week ended March 27, 2015, Devon has a debt-to-market cap of 46%, while the median debt-to-market cap for the 88 companies is 66%. The company’s debt-to-trailing twelve month (TTM) EBITDA is 1.2x, lower than the group median of 2.1x.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.