Decreasing production in 2016 not enough to dethrone U.S. oil and gas industry

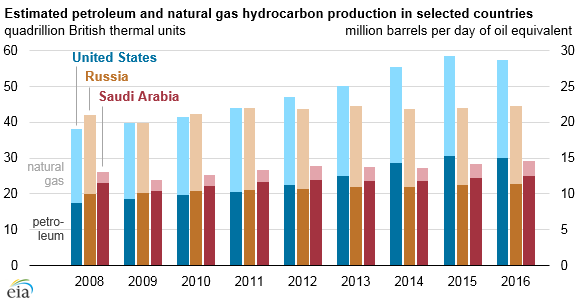

Despite the lowest commodity prices in 13 years, U.S. oil and gas production in 2016 continued to outpace all other nations, according to a note from the EIA.

The United States has been first in the world in natural gas production since 2009, when American output surpassed Russia. U.S. production of “petroleum hydrocarbons” (a catch-all term the EIA uses to account for crude oil, condensate, bitumen, natural gas plant liquids, biofuels and others) exceeded that of Saudi Arabia in 2013.

Low prices decreased oil, gas production

WTI prices in 2016 dropped to a bottom of $26.05/bbl in intraday trading in February, the lowest price seen since mid-2003. These low prices in the beginning of the year understandably depressed oil activity last year, and U.S. petroleum production fell by about 300 MBOPD.

In the U.S., crude oil and condensate only accounts for about 60% of total petroleum hydrocarbons production. Saudi Arabia and Russia produce significantly fewer NGPLs and biofuels and have smaller refinery gains, meaning that in these countries this percentage is much higher.

U.S. natural gas production in 2016 faced similar challenges to oil production. According to the EIA, strong growth in gas production in 2015 and a mild winter meant average gas prices in 2016 were the lowest seen since 1999. These low prices caused natural gas production to drop by 2.3 Bcf/d in 2016.

Russia, Saudi production grew in 2016

The U.S. remains the largest hydrocarbon producer in the world, even with low prices. America’s dominance is even more impressive because both Saudi Arabia and Russia saw production increase in 2016.

According to the EIA, Russian oil and gas companies have been increasing CAPEX recently, which has pushed up production. Russian tax regimes are highly favorable, and exchange rates also encourage further activity. Russian oil production broke records in late 2016, before the production cut took effect. Natural gas production also rose, as European OECD countries saw gas demand increase by 6% in 2016.

Saudi Arabia also saw production increase in 2016, before the country agreed to production cuts late in the year. The EIA estimates that total Saudi hydrocarbon production rose by 3% last year.

U.S. dominance to continue thanks to shale ramp-up

The U.S. is likely to remain the foremost hydrocarbon producer in the future as well, as shale companies continue to ramp up activity. The EIA estimates that U.S. petroleum hydrocarbons production will grow by about 0.8 MMBOPD in 2017 and 1.1 MMBOPD in 2018. This growth is significantly higher than expected growth from Russia or Saudi Arabia, particularly because both countries agreed to extend production cuts through March 2018.

U.S. natural gas production is predicted to grow by about 1 Bcf/d in 2017 and 3.3 Bcf/d in 2018.