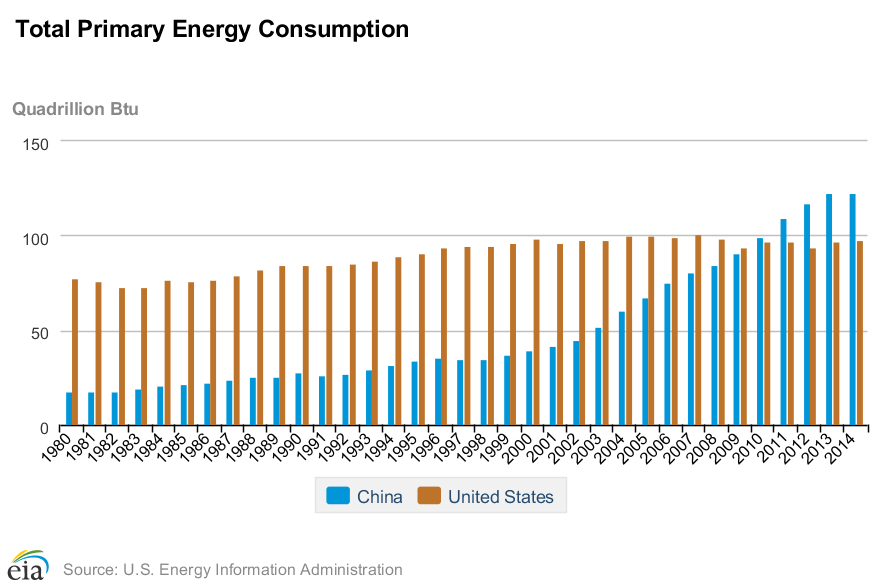

China world’s largest energy consumer

A new deal between China and the U.S. has thrown open a door for U.S. LNG producers to export the country’s vast energy supplies to China. It’s the first step for the U.S. to become a key supplier that fuels the world’s biggest energy consumer.

Among other provisions, the recently-unveiled trade deal invites Chinese companies to import American LNG and negotiate long-term contracts to ensure future supply.

The deal affirmed China’s status as a potential LNG destination, despite the lack of a free-trade agreement with the country. In general, LNG exports to FTA partner countries are approved without extensive review, while exports to non-FTA countries must be in the national interest.

The trade deal affirms that China will be treated “no less favorably than other non-FTA trade partners with regard to LNG export authorizations,” drawing contrast with the previous administration’s reluctance to deal with China directly. In total, the U.S. Department of Energy has authorized 19.2 Bcf/day of natural gas exports to not-FTA countries in the form of LNG. Other non-FTA trade partners include many major countries such as Japan, the UK and Germany.

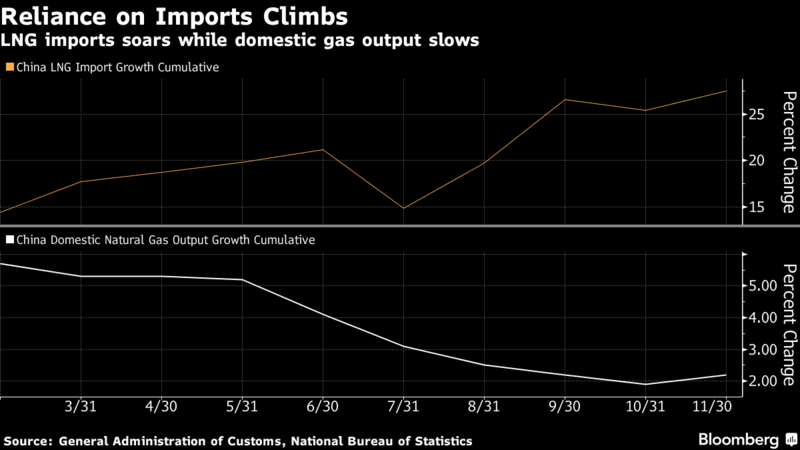

U.S.-China LNG exports are small now but are expected to grow fast as LNG export facilities come online, imported LNG could be 40% of China’s natural gas supply by 2020–Bloomberg

While this deal is certainly a positive for U.S. LNG, its effect may be minor initially. According to IHS, China imported 26.1 million tons of LNG last year, up 32.6% from 2015. However, Australia and Qatar supplied a combined 65% of that total, while IHS reports that the U.S. supplied only 1% of China’s imported LNG for 2016.

This number is growing quickly, however, as U.S. LNG export capacity increases. Wood Mackenzie estimates that the U.S. supplied 7% of all Chinese LNG imports in March. The research firm believes that Chinese LNG demand will triple by 2030, reaching 75 million tons per year.

According to Bloomberg, imported natural gas may account for 40% of China’s total natural gas consumption by 2020, up from one-third today. U.S. LNG exporters who tap into the Chinese gas market now could find it a tremendous opportunity for growth as their capacity grows.

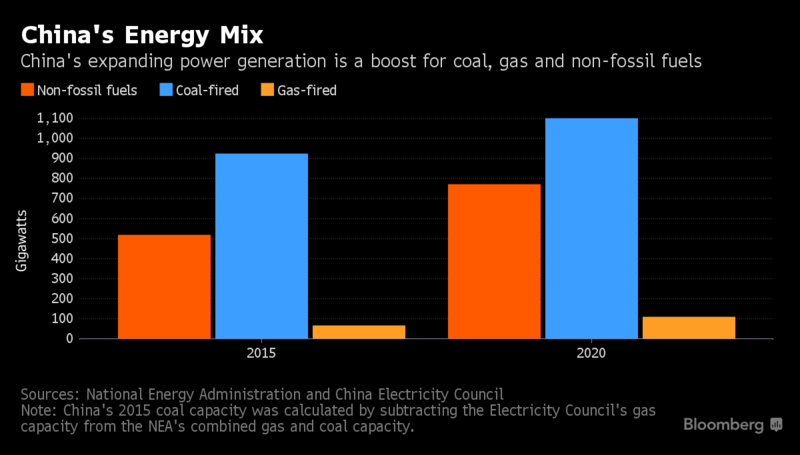

Coal still dominates

However, China has not backed away from other energy sources. According to Bloomberg, China’s coal power generation capacity may grow as much as 19% in the next five years. The country recently canceled 120 gigawatts of additional coal power plants, but still plans to grow coal-fired power plants to nearly 1,100 gigawatts of power—the same generating power as 1,000 nuclear power stations, which typically produce 1,100 megawatts each. This is three times the present coal-power capacity of the entire U.S. coal fleet.

LNG markets right now are flapping in the wind; China’s potential LNG demand could tighten the sheets

This trade deal comes as Asian LNG markets are beginning to change. Chafing under restrictive contract terms, Korean, Japanese and Chinese firms formed an LNG buyer’s club in March. This agreement has been formed to extract concessions from producers to give consumers supply flexibility. These firms desire the ability to re-sell imports to third parties, something they are currently unable to do under so-called destination restrictions.

Petronas, the world’s third-largest LNG exporter is currently considering shorter-term contracts and smaller cargo sizes to allow buyers greater flexibility. Japan’s contracts with Petronas will expire next year, meaning these changes may be seen in new contract terms.

A spokesperson for Tellurian (ticker: TELL), developer of the 3.4 Bcf/d Driftwood LNG project, told Oil & Gas 360 “In terms of contracts, we expect to have a variety of contract term lengths, beginning with what the customer needs.”

The door is officially open—now what will happen?

Actions covered in the U.S.-China trade agreement were formally released last week in a joint U.S.-China press release sourced by the U.S. Department of Commerce. Specific text regarding LNG trading reference in the press release included the following language:

“Companies from China may proceed at any time to negotiate all types of contractual arrangement with U.S. LNG exporters, including long-term contracts, subject to the commercial considerations of the parties.”

If U.S. LNG producers can craft firm supply deals with China and successfully build out trains to deliver the product, it could result in long-term business that would satisfy the takeaway needs of many U.S. natural gas producers, the growing cadre of LNG exporters and what may potentially end up as the world’s largest end user. This deal may create a lot of jobs and commerce on both sides of the Pacific for a very long time.