Moving from Defense to Offense: industry learned how to work effectively, how to innovate during the downturn, now let’s produce

The presentation room at the Tower Club for EnerCom Dallas was overflowing Wednesday morning by the time WPX Energy (ticker: WPX) Chairman and CEO Rick Muncrief took the microphone a 8:00 a.m. and laid out his company’s stark turnaround.

In his presentation Muncrief discussed how WPX used $6.5 billion in A&D activity to convert the company from a natural gas-focused operator to a Delaware basin-focused oil/liquids producer tightly focused on only three assets—Delaware, Williston and San Juan basins. “We built a brand new company.”

The room was jammed for presentations by Range Resources (ticker: RRC) Chairman and CEO Jeff Ventura, Earthstone Energy (ticker: ESTE) President and CEO Frank Lodzinski and Core Laboratories (ticker: CLB) Chairman and CEO David Demshur.

Completions are in the Stone Age

Core Lab CEO David Demshur talked about the results his company has produced in the past few months along the road of developing and field testing some new technologies designed to boost recovery from oil and gas reservoirs, a project the company started during the downturn.

Demshur said Core’s scientists in the lab have been able to increase recovery rates from 9% to 15%. Demshur talked in detail about Core Lab’s goal of altering the decline curve by injecting associated gases into reservoirs. “To do this we had to invent some technology.”

Core’s CFO Dick Bergmark echoed Demshur’s comments about the company’s unique focus on reservoir optimization. “We don’t generate revenue when you’re drilling; it’s when you’re doing completions.”

In the Core Lab breakout session an investor asked, “Who’s your number one competitor?”

Demshur responded: “Inertia.”

Switching from defensive mode to offensive mode

Whiting Petroleum’s Senior VP of Planning Pete Hagist was another presenter who discussed how evolving completion design has served a major oil company with much improved return rates. Hagist gave credit to his company’s use of diverting agents to distribute the sand up and down the wellbore. He said Whiting was tracking some individual well’s EURs toward 1.5 MMBOE with the bigger sand loading, compared to an average of 900 MBOE.

After a detailed discussion of factors that are boosting capital efficiency for the leading Bakken oil producer, such as cutting drilling time, enhanced completion design, improvements in technology, and “eliminating a whole string of casing,” Hagist said his company “is switching from being in defensive mode of the past couple of years to offensive mode.”

A Permian gorilla for lunch

Pioneer Natural Resources (ticker: PXD) EVP Ken Sheffield was the lunch presenter on March 1 at EnerCom Dallas. Sheffield addressed a completely full dining room. Sheffield’s focus was strictly on the Permian basin.

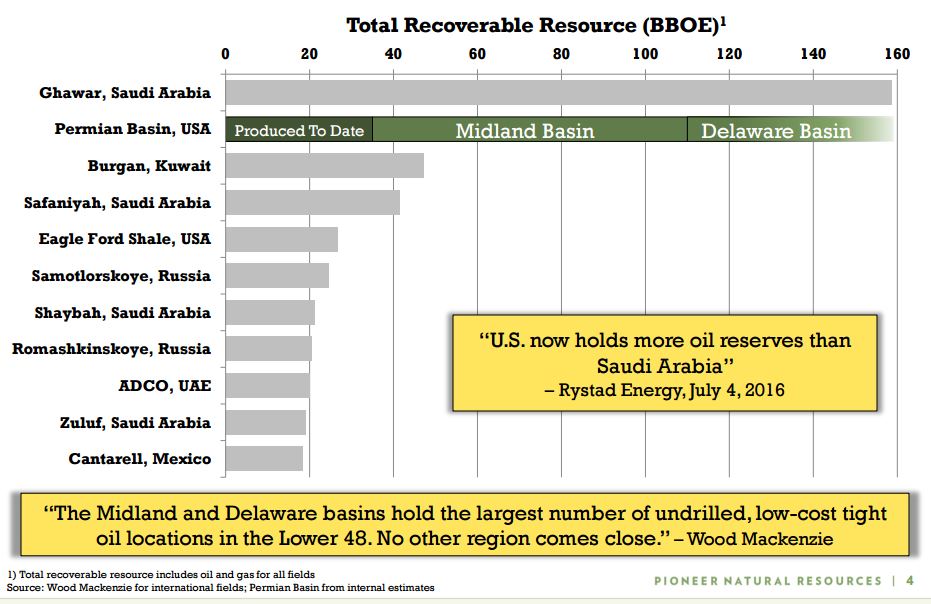

To give an idea of its potential reserves, Sheffield said early in his career he worked on the Prudhoe Bay field in Alaska, which is estimated to hold 14 billion BOEs and at the time it was discovered was one of the world’s largest fields. “Today it’s not big enough to make the chart.”

Sheffield pointed to the Permian basin’s estimated 150 billion BOE recoverable resource—putting the Permian “in the same league as the Ghawar field in Saudi Arabia,” but without the production yet. Sheffield said the Permian is the only growing oil shale play in the U.S. He said that Pioneer produced 31% of the horizontal production of all the oil produced in the Midland basin.

Sheffield also hit the completion optimization topic in detail and said the company would be doing more of the larger, more intense completions in 2017, in selected areas. He said that there is a higher cost of doing the “2.0-3.0” completions of $500,000 to $1.5 million per well, but the uplift in ultimate recovery is well worth the price.

In his breakout session, Sheffield said that Pioneer’s depth of inventory is so large that there is no fear of running out of drilling inventory in a ten year time frame.

Responding to the question, what is Pioneer doing to keep cost per well down?, Sheffield said number one is vertical integration: “We have our own pressure pumping company and we have our own sand mine.” He also said that the company is “leveraging automation.”

Numerous other companies presented on Day One of EnerCom’s inaugural Dallas investment conference and 19 presentations are scheduled for March 2. Complete information, webcasts and presentation downloads are available at the EnerCom Dallas conference website.

EnerCom Dallas is sponsored by Credit Agricole, Netherland Sewell & Associates, Preng & Associates, Hein & Associates, PLS, Wundelich, Fifth Third Bank, DNB, Haynes and Boone, MUFG and CIBC.