The Federal Reserve Bank of Dallas is populated with smart people who track the comings and goings of all the factors affecting the energy industry, not just in Texas but globally.

Dallas Fed SVP and Research Advisor Mine Yücel discussed oil prices and global supply conditions and economic effects of price shocks in a presentation at the EnerCom Dallas investment conference last week.

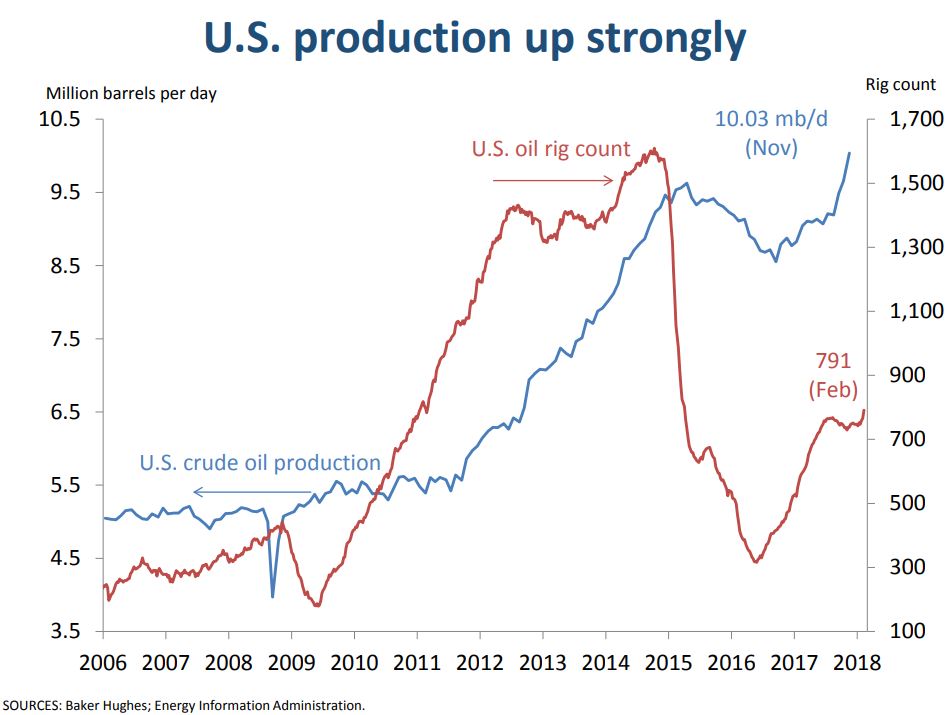

Yücel traced the struggle of oil prices from the $40s in 2016, into the $50s in 2017 and now into the low-$60s in early 2018. Yücel said, “Despite these ‘mediocre’ prices, U.S. shale output has more than gone up by 1.3 million barrels per day last year, and everybody thinks we’re actually going to beat our record of 1970.”

Yücel referenced the OPEC/Russia self-imposed lid on production, the agreement to cut 1.7 million barrels per day from global oil supply, and the “OPEC and friends” group is currently at 121% compliance, she said. “OPEC is of course being helped by robust global growth and that boosts demand for oil,” Yücel said.

Yücel said that in 2018 “we are going to beat the oil production record,” based on the EIA’s latest Short-Term Energy Outlook that estimates the U.S. output will be 10.6 MMBOPD at the end of 2018. “With that number the U.S. would surpass Saudi Arabia as the second largest producer of oil, but that is because the Saudis are cutting about a half million barrels. They have about two million barrels of excess capacity, so if they wanted to turn on the taps they could very well do that, but for now we will be the second largest producer.

“We had flat rig count but production going up—how did that happen,” Yücel asked. “Because of the efficient rigs, as you all know, and also because of the high flow rates from shale wells.”

Yücel set the stage for natural gas with the fact that gas production has set a record in the U.S. every year since 2007. She referenced changes in the market for gas going from regional for the U.S. to a more global market with the traditional long-term gas contracts moving away from pricing based on oil toward spot market contracts, and the growth of global LNG trade. “Going forward gas is going to grow in importance for the U.S.”

Oil prices: an asymmetric effect on the economy

On the topic of oil prices and their effect on the U.S. economy, Yücel said, “In general the U.S. economy should benefit from lower oil prices. With lower oil prices the consumer has higher disposable income, and they can spend that on other things, so it puts more money into the consumer’s pocket.”

Yücel said people were spending the extra money in restaurants and on healthcare in the oil downturn of 2015 and 2016 when oil prices lowered prices of refined products including gasoline and diesel.

“People were buying more trucks, people were driving more, and auto sales really went up in 2015. That’s on the consumer side,” she said. But on the oil company side, “we did see a lot of layoffs, CapEx declines and bankruptcies,” Yücel said. “In fact, in Texas the energy industry lost about 100,000 jobs in 2015 and 2016.”

Yücel said the timing may be asymmetric between the price drop in an oil downturn and the effects. “What I mean by that is we may be seeing the negative effects first. We get the declines in energy activity, we get the layoffs. Then the investment by companies that are helped by lower energy prices comes in with a lag, Yücel said. “You see the cost first and the benefits [to the rest of the economy] later, so there is some asymmetry in the timing of these effects.”

“You may know that 10 of the 11 post-World War II recessions followed oil price shocks,” Yücel said. “The majority of the current research points to an asymmetric relationship. And what that means is when oil prices go up the impact is higher than when oil prices fall.”

Here is how that works, Yücel said. “When oil prices change there are two effects. One is a price effect, the other is an allocation effect. When oil prices go up, the price effect is negative, but the allocation effect is also negative. And what that means is the relative prices have changed from inputs that go into production, so people reallocate resources. And that has a cost to it.

“When you have a decline in oil prices, the price effect is positive, but there is still that reallocation cost because the relative prices have changed and you’re still reallocating resources. So when you put them together that offsets some of that positive price effect. That is how you get the asymmetry. The effects are smaller when the prices go down than when they go up for oil.”

Exports and Imports

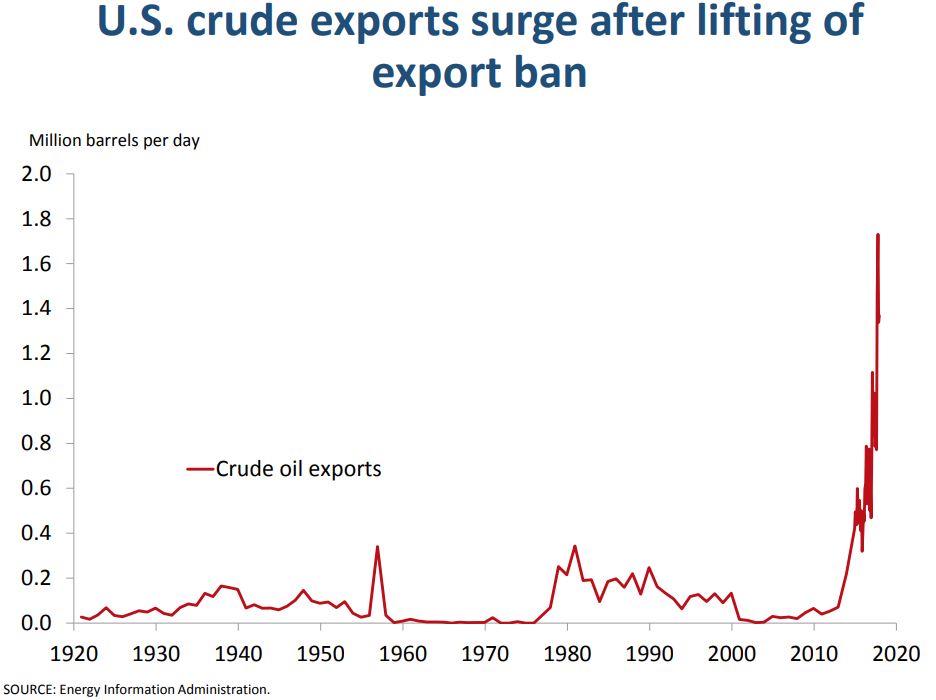

Yücel pointed out that even though the U.S. oil export ban was lifted in December 2015 and U.S. oil exports have jumped up to about 1.72 million barrels per day as of October 2017, we are still importing 7.5 million barrels per day. But the U.S. imports have started coming down with increasing shale production. Yücel said imports of heavy oil has been going up while light crude imports have gone down and that exports of refined products, mainly diesel and gasoline, have also increased.

Looking at natural gas, Yücel pointed out that the U.S. exports a lot of natural gas—about 8 Bcf/day or nine percent of total production is exported, with 80% of the exported natural gas going to Canada and Mexico via pipeline. The U.S. also imports natural gas from Canada by pipeline, destined for the East Coast. Yücel talked about the new phenomenon of growing LNG exports from the U.S., with half going to China and South Korea.

The Goldilocks price

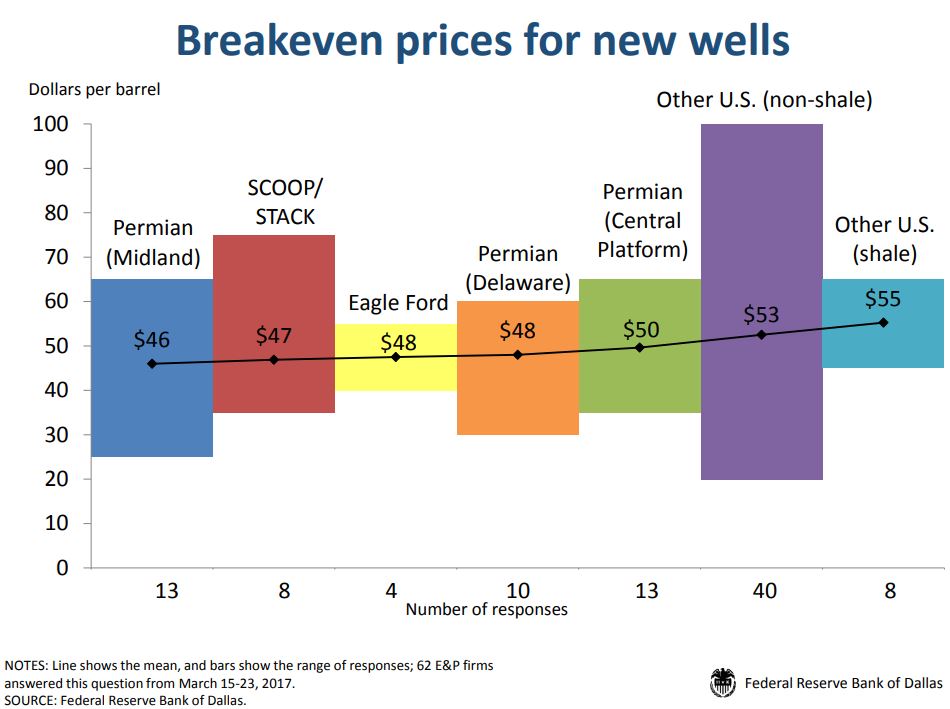

Yücel said that in the Dallas Fed’s most recent industry survey of executives from oilfield service companies and E&Ps, the majority of respondents said the best oil price for them was between $61 and $65. “So they call that the Goldilocks price,” Yücel said.

“And why do they call it the Goldilocks price? Because it’s the price that the majority, or a significant number, can make money, but it’s not high enough that you’re going to have a gush of oil coming into the market and depressing prices,” Yücel said.

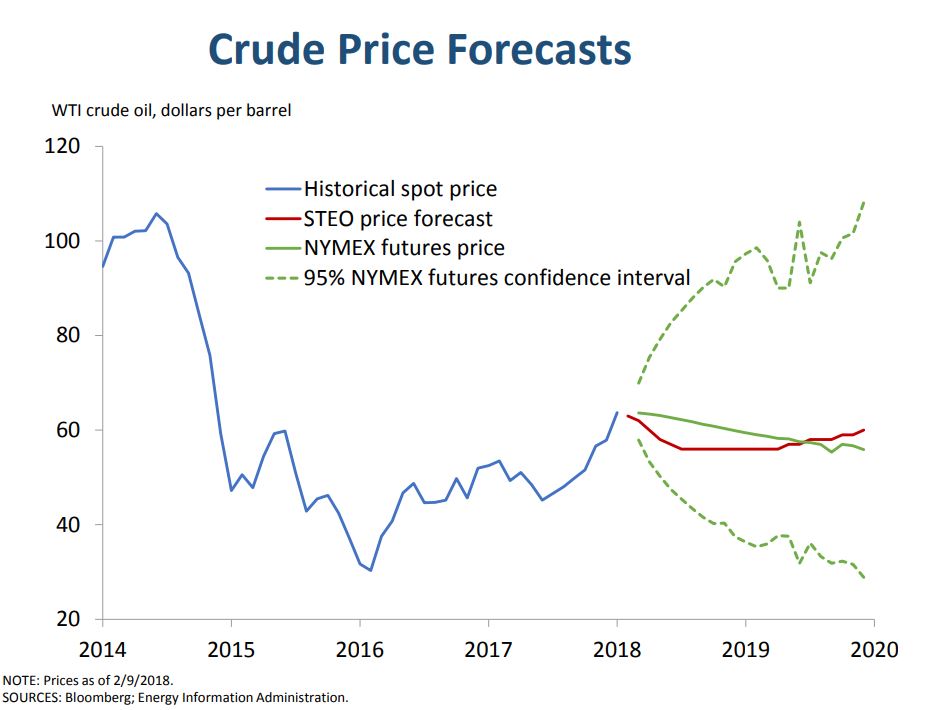

Yücel brought up the EIA’s price projections for oil. “The EIA is thinking that by the end of this year we’re going to have oil at about $59, by the end of 2018, and about the same by the end of 2019.”

But she said the futures market is looking at oil prices differently. “The NYMEX has come down. They are thinking $58 by the end of this year and $54 by the end of 2019. So the futures market maybe is factoring in an increase in U.S. production more than expected or maybe a breakdown in the OPEC agreement. But those dotted lines on the chart are the 95% confidence bands. Those tell you they are very confident—95%–that the price is going to be between $95 and $37.”

That line resulted in a lot of laughs from the room. “That tells you there’s a lot of uncertainty in the market,” Yücel said.

Yücel said that NYMEX futures are not a good price forecaster for the long term, “because whenever you get new information it’s going to change—it moves up and down. But today this is the best information that people in the market have.”

She pointed to “lots of risk.” On the downside the risks include higher shale growth, breakup of the OPEC agreement, output growth in Libya and Brazil more than expected. She said the upside risk is higher prices could result from higher global growth, sanctions on Iran, ME geopolitics or a faster decline in Venezuela.

With the advent of exports of both oil and natural gas, Yücel said the U.S. is becoming a major global player in both the oil and gas markets, “so we’re looking forward to a pretty good year for oil and gas producers in the U.S.,” she concluded.

Mine Kuban Yücel is senior vice president and senior research advisor at the Federal Reserve Bank of Dallas. She joined the Bank in 1989 and has previously served as director of research, head of the micro/regional/energy group and director of publications. She is an expert on regional and energy issues and has published numerous articles on energy and regional growth.

Yücel is president of the National Association for Business Economics. She serves on the board of the Global Interdependence Center, and the University of Texas at Dallas Energy Board. She was president of the International Association of Energy Economics (IAEE) in 2011 and past president of the United States Association of Energy Economics (USAEE). She received the USAEE Senior Fellow Award in 2007, the Energy Journal Best Paper Award in 2009 and the Outstanding Contributions to the IAEE Award in 2015. Before joining the Federal Reserve Bank of Dallas, she was an assistant professor of economics at Louisiana State University. She has a BS and MS in mathematics from Bogazici University in Istanbul, Turkey, and a PhD in economics from Rice University in Houston.