Dallas Fed

What’s New This Quarter

Special questions this quarter focus on capital spending in 2020, the price of oil needed to cover firms’ capital spending plans next year and the main causes of flaring in the Permian Basin.

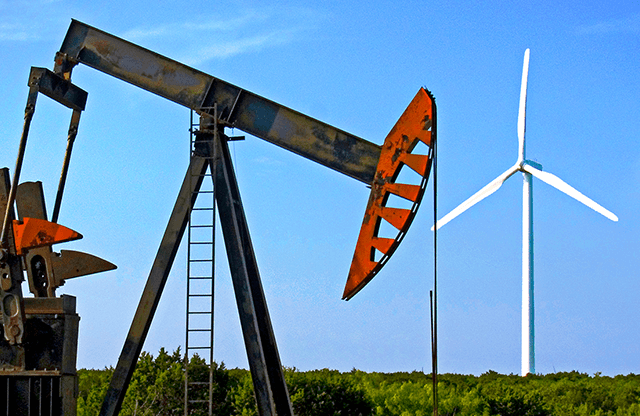

Activity in the oil and gas sector dipped again in fourth quarter 2019, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms— remained in negative territory but eased from -7.4 in the third quarter to -4.2 in the fourth, suggesting that the pace of contraction has lessened. Activity for oilfield services firms continued to decline, with their business activity index at-22.1. Meanwhile, the business activity index for exploration and production (E&P) firms indicated modest growth, rising from zero to 5.4.

Oil and gas production increased for the 13th consecutive quarter, according to E&P executives. The oil production index increased from 15.7 in the third quarter to 24.7 in the fourth. The natural gas production index also advanced, from 6.5 to 15.6. Both indexes suggest that oil and gas production rose at a slightly faster pace relative to last quarter.

Most indexes pointed to worsening conditions among oilfield services firms. The equipment utilization index was largely unchanged at -25.8 in the fourth quarter. Upward pressure on input costs abated in the fourth quarter, with the index falling from 5.6 to 1.7. Meanwhile, the index of prices received for services slid further into negative territory, from -18.5 to -24.5. Given flat input prices and lower selling prices, the operating margins index plummeted from -24.0 to -39-7.

[contextly_sidebar id=”hLVcvk5zurlAeZvRAddKgxlcAolvHdfS”]

The aggregate employment index posted a third consecutive negative reading, dipping from -8.0 to -10.0. Also, the aggregate employee hours worked index fell from -2.4 to -7-7, signaling a further drop in employee hours. The index for aggregate wages and benefits edged up from 6.2 to 8.2.

The company outlook index for E&P firms increased from 7.6 to 15.4, while the company outlook index for oilfield services firms decreased from -14.8 to -22.4. This suggests modest improvement in outlooks for E&P firms and worsening outlooks for oilfield services firms. While uncertainty remains elevated, slightly fewer firms noted rising uncertainty this quarter than last, and the aggregate index fell by 12 points to 26.

On average, respondents expect a West Texas Intermediate (WTI) oil price of $58.54 per barrel byyear-end 2020, with responses ranging from $48 to $75 per barrel. Survey participants expect Henry Hub natural gas prices to be $2.51 per million British thermal units (MMBtu) byyear-end. For reference, WTI spot prices averaged $60.19 per barrel duringthe survey collection period, and Henry Hub spot prices averaged $2.28 per MMBtu.