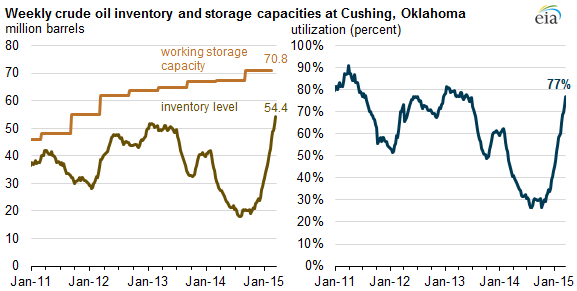

Oil inventories are at an all-time high at the Cushing delivery point in Oklahoma. Fortunately, working storage capacity is also at its highest on record, but the available space is filling up fast.

In the Energy Information Administration’s (EIA) Today in Energy brief for March 23, 2015, the article details the builds in Cushing working storage capacity along with the utilization rates since 2011. Cushing is currently at 77% capacity – the highest in roughly two years, but short of the record of 91% in early 2011.

The volumes arriving at Cushing, however, are definitely the sharpest in recent months. Both inventory levels and capacity has more than doubled since October 2014, when Cushing was at only 27% utilization. The delivery point, known as “the pipeline crossroads of the world,” is the main target for futures contracts. Volumes have risen dramatically as E&Ps are opting to sell their product on the futures arrangement to lock in a few additional dollars. Current contracts hold a premium of $6 and $10 for October 2015 and June 2016, respectively, compared to today’s West Texas Intermediate price of $47.30.

Can Cushing Top Out?

Yes, and some analysts believe it will happen sooner than later. Alan Greenspan, former Federal Reserve Chairman, told The Wall Street Journal that Cushing could be maxed out by the end of April if builds continue at their current rate. Tamas Varga, an analyst at PVM, believes mid-May is a more likely timeframe.

Other firms like Societe Generale believe such a scenario is unlikely, considering production growth is expected to stall and April is generally a positive month for oil demand considering refinery maintenance season has ended. Societe Generale also estimates total storage is at 63% capacity, despite estimations from the EIA that place total working storage capacity at 88%. Additional supply in pipelines and lease stocks (produced products that have not been entered into the supply chain) are not included in the estimates.

Other firms like Societe Generale believe such a scenario is unlikely, considering production growth is expected to stall and April is generally a positive month for oil demand considering refinery maintenance season has ended. Societe Generale also estimates total storage is at 63% capacity, despite estimations from the EIA that place total working storage capacity at 88%. Additional supply in pipelines and lease stocks (produced products that have not been entered into the supply chain) are not included in the estimates.

As evidenced in OAG360’s Chart of the Week, crude oil inventories have climbed every week in 2015 and set a new record every week since January 23, 2015. Its total working storage capacity of 521,000 MBO is at 88% capacity, while Cushing is holding 54,400 MBO of its 71,800 MBO capacity. Industry analysts polled by Bloomberg expect a median gain of 4,750 MBO in the next release on March 25, 2015.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.