Crude Oil-to-Chemicals and Other Disruptive Technologies Will Have a Significant Impact on Chemical Industry, IHS Markit Says

The convergence of two significant and revolutionary technological

developments in the petrochemical industry -- crude oil-to-chemicals

(COTC) and oxidative coupling of methane (OCM) -- are poised to have a

very significant impact on the chemical industry, according to new

analysis from IHS

Markit (Nasdaq: INFO), the leading global source of critical

information and insight.

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20180613006109/en/

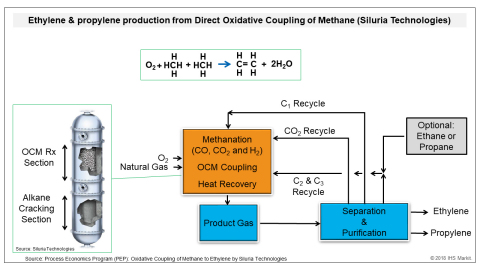

Ethylene & propylene production from Siluria Technologies' direct oxidative coupling of methane. (Source: IHS Markit 2018)

This analysis from Don Bari, vice president of chemical technology at

IHS Markit, follows on an announcement made earlier today by Siluria

Technologies, which has joined forces with Saudi Aramco Technologies: Siluria

Technologies and Saudi Aramco Technologies Company join forces to

maximize chemical production.

In the past decade or so, disruptive technology development and

deployment have been dominant on a global basis in the petrochemical

industry and largely driven by the extreme pricing dynamics of the

energy industry, translating directly to fundamental petrochemical

feedstocks; where such new technology has enabled deployers of capital

and technology to use low-cost and locally abundant feedstocks.

One of the most significantly disruptive technologies or categories of

technologies being developed, based on their sheer volume, is crude

oil-to-chemicals. These projects, in effect, merge a refinery and

petrochemical plant into one, and thus, go well beyond the

state-of-the-art refinery petrochemical integration by the

implementation of new/reconfiguring unit operations into a refinery.

The objective is to shift the product slate derived from a barrel of oil

to a range of 40 percent to 80 percent chemical feedstocks and non-fuel

products, up from the traditional range of 15 percent to 25 percent, in

order to significantly increase the value of crude oil reserves. For

example, Saudi Aramco Technologies Company publicly announced (in a

joint news release with Siluria Technologies issued earlier today, Siluria

Technologies and Saudi Aramco Technologies Company join forces to

maximize chemical production):

“Maximizing the output of high-value chemicals products from our future

crude-oil processing projects is one of the key objectives in our

downstream technology strategy, said Ahmad Al Khowaiter, chief

technology officer of Saudi Aramco.”

The Siluria Technologies process, which produces olefins directly from

natural gas through oxidative coupling (chemistry) of methane (OCM), is

expected to further allow Saudi Aramco’s future crude oil-to-chemicals

facilities to create more value by converting the very low-value

off-gases (largely methane) into higher-value olefins products, which

improves carbon efficiency and increases the volume of the barrel of oil

directed to valuable fundamental petrochemicals.

Competitive and sustainable advantages of such a fully integrated crude

oil-to-chemical facility:

-

Upgrades a lower-value stream into a higher-value product through

greater operational efficiency and optimization of assets. Greater

capital efficiency--leverages a well-integrated upstream (refinery)

with the downstream (chemicals) operations to increase efficiency of

deployed capital (maximum investment-per-ton of production capacity)

through scale; and decreases operating costs through carbon efficiency

and low fixed operating costs. (In a Reuters News article

published Jan. 18, 2018, Aramco chief technology officer Ahmad

Al-Khowaiter said the process called thermal crude-to-chemicals

technology “would cut capital costs by 30 percent compared to

conventional refining.”).

-

Sustainability gains through the reduction in the overall carbon

footprint of a facility due to integration and optimization of assets,

which become more efficient.

The “disruption” to conventional petrochemical producers would likely be

the loss of market position due to COTC’s immense petrochemical volume.

For example:

-

The global demand for ethylene and propylene are 160 million metric

tons (MMT) and 111 MMT per year, respectively, and at approximately 4

percent annual growth rate, the required global annual capacity

additions would be 6.4 MMT and 4.4 MMT of ethylene and propylene,

respectively.

-

These volumes could nearly be supplied from two large-scale 200,000

barrel-per-day COTC complexes (see analysis below and note that

multiple FCCs, cracking furnaces and cracked gas compressor/separation

trains would be required); instead of four conventional

state-of-the-art naphtha-cracking light olefins plants.

-

If multiple COTC facilities are eventually built, the export dynamics

would, over time, change significantly and put pressure on olefin and

feedstock-related derivative exports from the U.S. According to our

IHS Markit estimates, U.S. exports of these olefin and

feedstock-related derivatives will reach approximately 14 MMT by 2020.

Siluria Technologies: Addressing sustainability through carbon

efficiency—A new operational metric?

Siluria Technologies’ oxidative coupling of methane to ethylene (and

propylene) process converts methane to olefins in the presence of a

catalyst in an oxygen-rich environment. The catalyst reaction “diverts”

roughly half of the carbon to the undesirable co-products of carbon

monoxide (CO) or carbon dioxide (CO2). In this

highly exothermic (heat generating) reaction. Siluria exploits this

exotherm by injecting ethane or propane into a second reaction chamber,

where the light alkane is thermally cracked to the olefin.

Moreover, to enhance the overall carbon efficiency of the process, a

catalytic methanation step is embodied in Siluria’s process. This

reaction converts all generated CO and a portion of the CO2 oxidative

coupling reaction co-product back to methane by using the hydrogen

generated in both the OCM and the ethane/propane-cracking reaction in

the post-OCM section of the reactor.

In fact, the Siluria process design philosophy is all about less total

carbon (methane) consumed per unit of light olefins produced, because

the process is “indifferent” to methane as a feedstock, or as energy

(process utility). Therefore, one would expect that a design philosophy

that equates British thermal units (BTU) of energy savings to a

reactor-conversion-per-pass percent increase should drive that most

optimum overall process design.

Significant carbon reduction through process design

The Siluria OCM process also delivers significant reduction in carbon

emissions over traditional ethylene production processes. IHS Markit

evaluation of total carbon dioxide emissions to the production of

ethylene by various feedstock types shows that the Siluria technology is

expected to be a net-negative CO2 producer per ton of

ethylene/olefins produced because of the heat generation for the OCM

exotherm, and methane production (partly) from CO2 is

considered in our methodology as an offset to CO2 emissions.

IHS Markit estimates that the Siluria Technologies OCM process generates

negative 1 ton of carbon dioxide emissions equivalents per ton of

ethylene produced as compared to the more conventional naphtha-cracking

process for converting crude to olefins, which is estimated at greater

than 1.4 tons of CO2 produced per ton of ethylene produced.

This is a significant improvement in carbon emission reduction, while at

the same time capturing greater value from the molecules.

How can Siluria Technologies add to the impact of crude

oil-to-chemicals mega complexes?

Independent and detailed technical analysis by IHS Markit of a Saudi

Aramco-type COTC approach (as described in Saudi Aramco’s patent

literature) projects that crude oil feedstock will be converted to

chemicals at a higher intensity than conventional processes, increasing

the yields of crude oil feedstocks converted to chemicals to 72 percent.

(Note that a January 18, 2018 Saudi Aramco announcement by Reuters

states that it expects, with its developing COTC technology, “70 percent

to 80 percent of the crude intake will be converted into chemicals….”).

With the recent cooperation announcement by Siluria Technologies and

Saudi Aramco Technologies Company to work together in the COTC process

to maximize the production of chemicals from a barrel of oil, IHS Markit

speculates that if the methane off-gas and a portion of the ethane in a

hydrocracked Arab Light crude oil feedstock were to be fed to the

Siluria OCM technology, then a net increase of 300 thousand metric tons

(TMT) to 350 TMT of ethylene and 200 TMT to 250 TMT per-year of

propylene, would be generated (based on 10 million metric tons (MMT) per

year (200,000 barrels per day) of crude feed). With methane valued at

U.S. $1.25 per MMBTU in the Middle East, the Siluria OCM technology

appears to be an attractive approach to enhance the value of a barrel of

oil.

Direct oxidative coupling of methane to ethylene has been an elusive

goal

The oxidative coupling of methane (OCM) to ethylene has attracted

significant attention since its discovery in the early 1980’s.

Compelling efforts to produce ethylene directly from natural gas have

been made, yet no OCM process has been commissioned at commercial scale.

The two major companies that tried to commercialize OCM, ARCO and Union

Carbide, did extensive catalyst screening studies in the 1980’s and

early 1990’s. ARCO reviewed several transition metal oxides as oxidative

coupling catalysts. Manganese oxide catalysts on silica support where

found to be the most attractive for methane conversion to ethylene.

However, high-product yields required operating temperatures above

800°C. Higher operating temperatures led to methyl radicals forming

higher-carbon number products, and undesirable products (CO, CO2,

and coke) formed.

A similar conclusion was reached by Union Carbide. The Union Carbide

research showed that the development of more active (and selective)

catalysts potentially operating in the 400°C to 600°C range might permit

industrial operation. Although those catalysts showed promising yield

and selectivities, they were significantly hampered by long-term

catalyst stability issues, largely due to the required high-reactor

inlet temperatures.

Siluria has developed and scaled-up a proprietary commercial,

low-temperature OCM catalyst that can operate adiabatically with fewer

stages at several hundred degrees °C lower inlet temperatures, and at

higher pressures. This catalyst produces a favorable yield and has a

standard lifetime for a commercialized process; and it has a relatively

high-space velocity. According to U.S. provisional patent applications,

Siluria’s proprietary catalyst is based upon mixed-metal oxide nanowires.

The heart of Siluria’s process technology is a two-stage adiabatic

reactor. Within the reactor, heat recovery is a significant technology

feature, where the exothermic heat from OCM is used to thermally crack

the by-product and fresh ethane and propane to ethylene and or

propylene. As previously mentioned, a methanation step is employed to

convert co-product CO, CO2 and H2 back to methane,

and to enhance overall carbon and energy efficiency of the process.

To enhance the overall carbon efficiency of the process, a catalytic

methanation step is included in Siluria’s process. This reaction

converts all generated CO, and a portion of the CO2 OCM, back

to methane by using the hydrogen generated in both the OCM and

ethane-propane cracking-reaction sections of the post-OCM section of the

reactor.

The product gas from the OCM reactor moves downstream to the generally

conventional olefins cracking separation, recovery and fractionation

steps. However, Siluria has developed proprietary separation and

recovery technology, including optimizing system hydraulics,

thermodynamics (pressures and temperatures) and heat integration, to

minimize energy consumption.

This is especially necessary given that the methane-per-pass-conversion

is relatively low due to the thermodynamic limitations of the OCM

adiabatic-reaction design. The low methane-conversion-per-pass means

that a large amount of methane must be recompressed and cryogenically

cooled at great capital and energy expense, to recover the olefin

products.

In short, the intersection of a global hydrocarbon resource powerhouse

such as Saudi Aramco, with Siluria Technologies, a small, but

innovative, process-technology company, is expected to yield significant

returns for both entities, but also drive the industry forward in

process improvements, greater carbon efficiency, capital efficiency and

value creation. While these technologies are capitally intensive, the

commercial application of these two revolutionary technologies not only

enables greater carbon efficiency, flexibility and value to the

petrochemical producers, but also a significant route to greater carbon

emission reduction, which has an untold value to chemical producers and

to the sustainability of the industry. This sustainability value will

likely only continue to increase as more consumers, investors and

regulators seek greater environmental stewardship from petrochemical

producers.

For more information on the Siluria Technologies OCM process, the crude

oil-to-chemicals technologies, the IHS

Markit Process Economics Programs (PEP) covering these and other

disruptive technologies, or to speak with Don Bari, please

contact: melissa.manning@ihsmarkit.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information,

analytics and solutions for the major industries and markets that drive

economies worldwide. The company delivers next-generation information,

analytics and solutions to customers in business, finance and

government, improving their operational efficiency and providing deep

insights that lead to well-informed, confident decisions. IHS Markit has

more than 50,000 business and government customers, including 80 percent

of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its

affiliates. All other company and product names may be trademarks of

their respective owners © 2018 IHS Markit Ltd. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180613006109/en/

Copyright Business Wire 2018