4 decades later, the U.S. prepares to lift crude oil export ban

The United States Senate has passed a $1.15 trillion omnibus spending bill to keep the U.S. government up and running today. Included in the bill are several provisions concerning energy, one of which will be an end to the more than 40-year old crude oil export ban. The bill still needs to pass the House of Representatives and be signed by President Obama, both of which are expected to happen.

President Obama has previously said that he opposes a lifting of the crude oil export ban as it does not help meet environmental goals. Despite this, the president is not expected to veto the entire budget bill in order to keep the ban in place. In a bipartisan move not commonly seen in today’s polarized Congress, Senate Republicans agreed to provisions to help strengthen the renewable energy industry as well.

Oil for wind and solar

In exchange for lifting the ban, a top priority for Republicans, the bill includes an extension for wind and solar-tax credits; reauthorizing a conservation fund for three years; and excludes any measures that block major Obama administration environmental regulations.

The House is expected to vote on the omnibus bill later this week. They are expected to follow the Senate’s lead and pass the bill.

In addition to environmental groups, lifting the ban had been fought by U.S. refiners, who were concerned that the end of the ban would make it cheaper to ship oil to foreign refiners. In order to ease some of the concern from U.S. downstream, a five-year 25% tax credit will also be given to U.S. refiners to help cover the cost of transporting crude oil, alleviating some of the cost discrepancies.

[email_signup label=”Sign Up for Closing Bell – our Free, End-of-Day Oil & Gas News Report”]

Where will U.S. crude go now that the ban has been lifted?

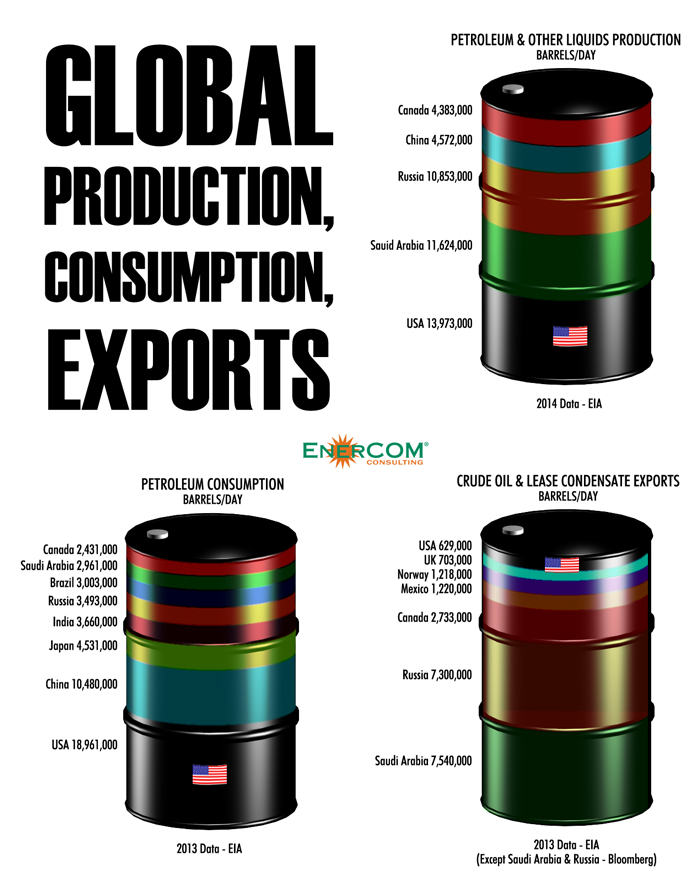

While the lifting of the U.S. crude export ban is a major political victory for the oil and gas industry, it is not expected to have much of an immediate impact. The market remains oversupplied, and the infrastructure in the U.S. is largely geared toward importing crude oil after more than 40 years of being unable to ship crude to other countries.

An analyst note from RBC Capital Markets today speculated that the likely destination for exports would be countries like Venezuela, which currently imports light sweet crude from West Africa to blend with its ultra-heavy grades, and Mexico, given that the country’s refining sector is better geared to handle light crude grades as opposed to the heavy crude produced domestically. Because there is already a global glut of crude oil, RBC expects that the U.S. will likely only increase crude exports by “a few hundred thousand barrels a day” in the short and medium term.

Increased crude oil exports to Mexico will also likely mean lower volumes of gasoline exports as well, says RBC. “Roughly half of the 450 MBOPD of gasoline that the U.S. currently exports go to Mexico,” the bank said in the research note. “Importing light crudes from the U.S. means that Mexico will be able to increase its gasoline yield at domestic refineries and, at least partially, wean itself off of U.S. gasoline.”

It could also take more than a year to work off the overhang in inventories in the U.S. as well, said a note today from Marwood Group Research. “We think it will take some time for U.S. benchmarks to revert to their historic $2 per barrel premium,” said the Marwood note. “This, combined with Saudi Arabia’s unwillingness to curtail production, could keep the price of oil under significant pressure well into 2016.”

Marwood sees lifting the export ban as a “massive political win” for U.S. oil and gas producers. Other analysts and multiple studies by various think tanks and government bodies have pointed to domestic job formation as one key benefit of lifting the U.S. crude oil export ban.