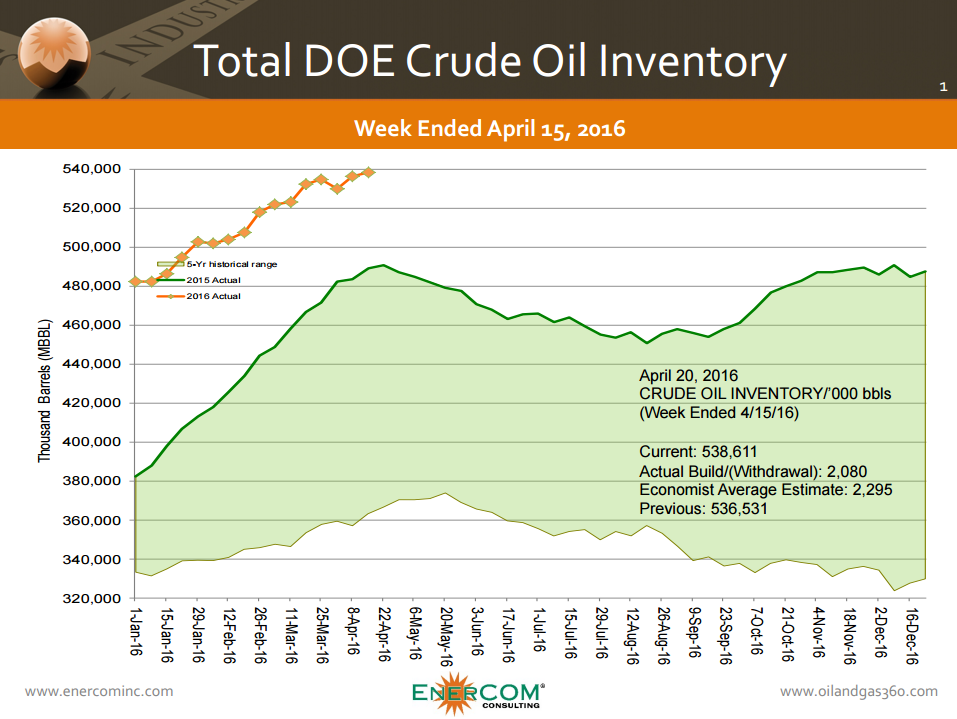

April 20, 2016

CRUDE OIL INVENTORY ‘000 bbls (Week Ended 4/15/16)

Current: 538,611

Actual Build/(Withdrawal): 2,080

Economist Average Estimate: 2,295

Previous: 536,531

Analyst Commentary on Today’s Build

Crude Inventory WoW Build Below Expectations on Lower Imports and Higher Refinery Util Rate – UBS Investment Research

Crude stocks rose 2.1 MMBbls WoW to 538.6 MMBbls (near consensus of a 2.4 MMBbls build), a smaller build than last week’s as demand recovered increasing by 0.2 MMBbld WoW to 16.1 MMBbld and refinery utilization increased. The lower WoW inventory build occurred despite imports rising by 0.2 MMBbld WoW to 8.2 MMBbld. Production declined slightly WoW to 9.0 MMBbld and is down 4.4% YoY. Cushing inventories fell by 0.2 MMBbls WoW to 64.3 MMBbls. Crude stocks remain well above their 5-year range.

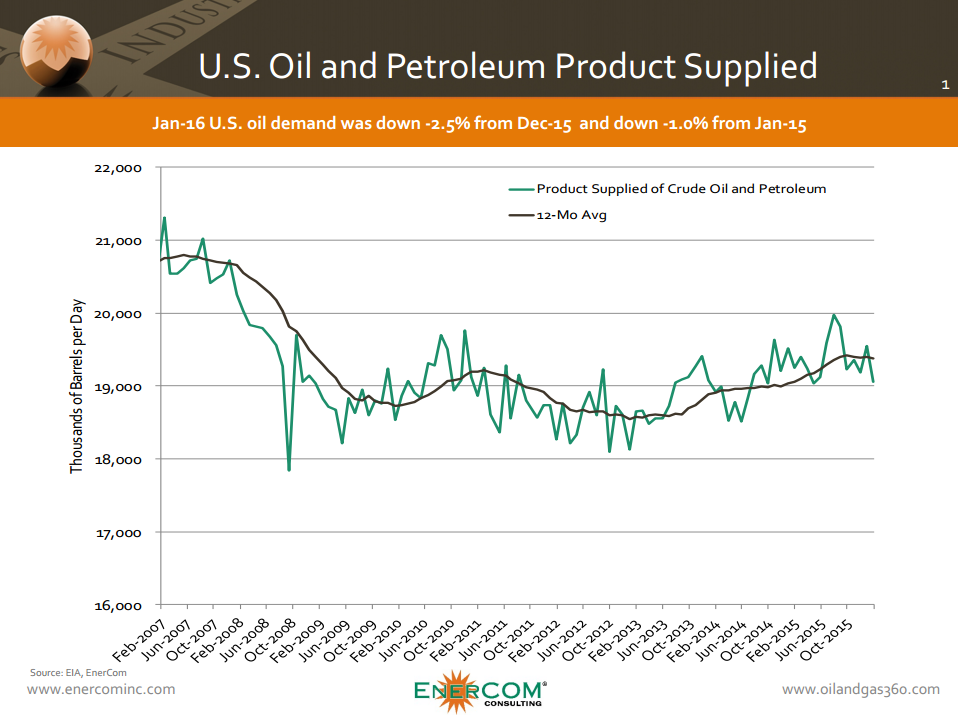

Crude Stocks Build Less Than Expected – KLR Group

Demand of ~20.2 Mmbpd increased fractionally w/w, and the four-week moving average increased ~140 bps to ~4.2% higher y/y. Gasoline demand of ~9.4 Mmbpd was down ~2% w/w, while distillate demand increased ~11% to ~4.3 Mmbpd. In ’16, we expect U.S. demand to increase approximately 0.8% (~0.16 Mmbpd) y/y to ~19.6 Mmbpd.

Sanchez Energy Corp. (SN): First Look: Strong 1Q Production Beat – Stephens

SN pre-announced a strong 1Q production beat as well results continue to outpace the Company’s expectations. Economics are improving as well with well costs approaching $3 mil. and a shifting focus to the South-Central region of Catarina, which is showing stronger results than in the Western region. SN will spend ~70% of 2016 Capex in 1H16 prior to laying down a rig by the end of 2Q16. While SN has performed well YTD, we believe that higher outyear prices are needed for the stock to maintain its momentum. As a result, we reiterate our EW/Vol rating and $5 PT.

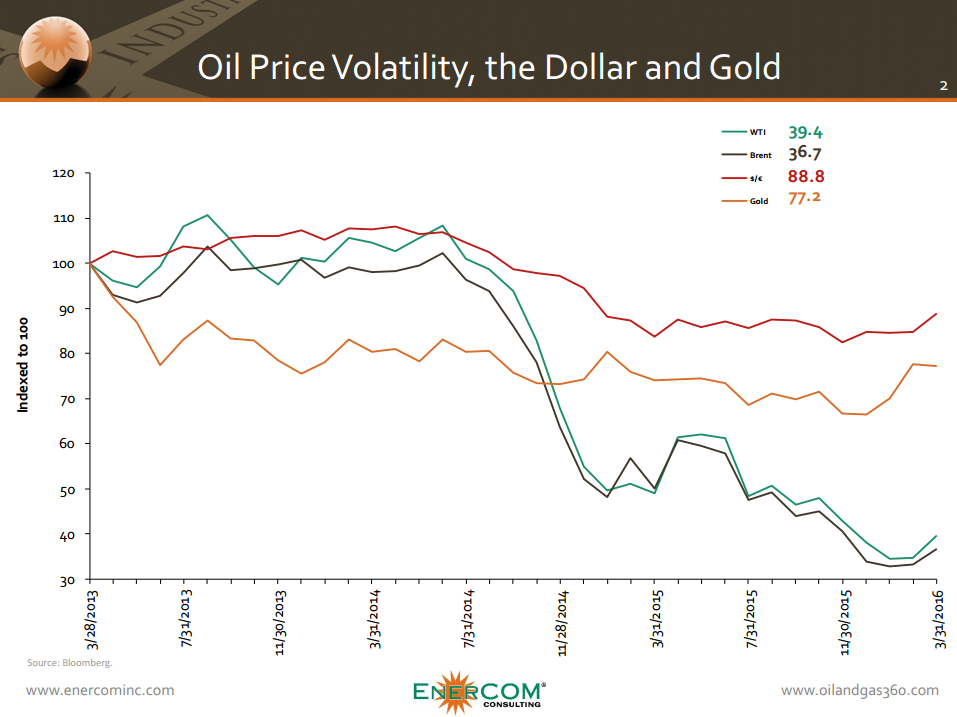

1Q16 Earnings Preview: Near-Term Challenges Persist Despite Recent Improvements – Stephens

In 2016, we have finally witnessed a meaningful domestic supply response which has somewhat improved near-term pricing. This fundamental improvement has been a welcome relief for the sector, however, ongoing international market-share battles within OPEC and Russia have created further uncertainty on the sustainability of a prolonged global supply response. In addition, given recent cost improvements domestically, we are seeing shale producers hedge ’17 production further and contemplate increasing activity levels which could slow the pace of recent supply responses. Due to these factors, we still see near-term uncertainty within commodity markets and maintain our conservative bias towards stocks that have high asset quality, and have protected the balance sheet.

Crude Build Below Expectations; Production Continues to Trend Lower – BMO Capital Markets

The U.S. Energy Information Administration (EIA) reported a build in U.S. crude oil inventories of 2.1 million barrels last week, below the expected build of 3 million barrels due primarily to lower production and higher refining utilization. With a 24,000 b/d drop week over week, production continues to trend lower. The largest week-over-week change came in PADD IV with a build of 1.9 million barrels. Cushing inventories fell by 248,000 barrels, contrary to expectations for a 70,000 b/d build, to 64.3 million barrels versus a working capacity of roughly 73 million barrels. U.S. gasoline inventories fell by 110,000 barrels, below the forecast draw of 1.8 million barrels due primarily to lower implied demand and higher imports. The largest week-over-week change came in PADD II with a draw of 1.1 million barrels. Distillate stocks fell by 3.6 million barrels, contrary to the forecast for flat inventories week over week primarily due to higher implied demand and lower imports. The largest week-over-week drop came in PADD III with a draw of 2.2 million barrels. Gasoline inventories are now 5% above last year’s levels, while U.S. distillate stocks are 24% above last year. Overall, key petroleum product inventories fell by 3.9 million barrels primarily due to higher implied demand.