Decreased price spread and new pipelines are decreasing crude by rail shipments

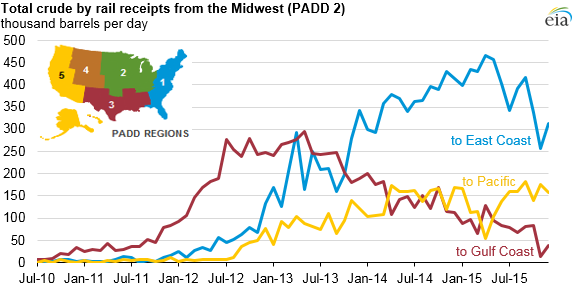

The movement of crude oil by rail is down in the United States. Crude by rail shipments reached a peak in October 2014 at 928 MBOPD before trending downward, according to the EIA. Most of the shipments originated in the Midwest and went to the East Coast, West Coast, and Gulf Coast. The volume of shipments by rail has decreased with the arbitrage between domestic and international crude grades narrowing, in the case of the East and West Coasts, and more pipeline capacity becoming available, in the case of the Gulf Coast.

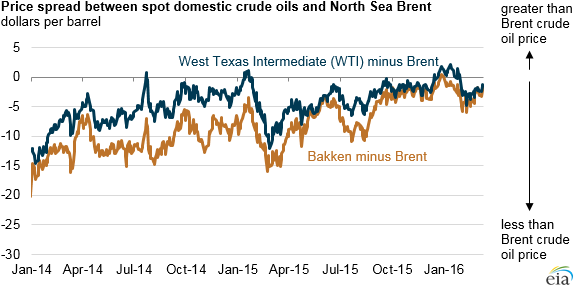

The largest reason for crude oil shipments by rail has been the discount between domestic crude grades compared with international crudes imported on the coasts. The spread between domestic crudes like WTI and Bakken has closed against international benchmark Brent crude, leaving little incentive for refiners on the coasts to purchase domestic crude.

Crude by rail shipments from the Midwest to the East Coast continue to be the largest rail movement , accounting for 50% of the total volume of crude shipments on rail in December 2015, the latest month with available data. Shipments to the East Coast have been declining from a peak of 465 MBOPD in April 2015. Refiners on the East Coast have been increasingly importing crude from countries in western Africa, according to the EIA, as the price differential becomes more favorable.

Shipments to the West Coast dipped following outages at refineries, both planned and unplanned, but averaged 139 MBOPD throughout 2015, roughly the same as in 2014, according to the EIA.

Crude by rail to the Gulf Coast has been on the decline since 2013 as pipeline capacity has expanded. Rail shipments to the Gulf made the largest portion of crude by rail shipments between regions in the U.S. from 2011 to 2013, but dropped to 38 MBOPD in December 2015, 75 MBOPD less than in the previous year.

While crude by rail shipments have steadily declined to the Gulf Coast from the Midwest, no crude oil pipeline infrastructure currently exists to move crude to the East and West Coasts from the Midwest. Because of this, the volume of crude shipments by rail to the East and West Coasts will depend largely on the price differential between domestic and international crudes.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.