Crude by rail continues to grow alongside production in the Rocky Mountains

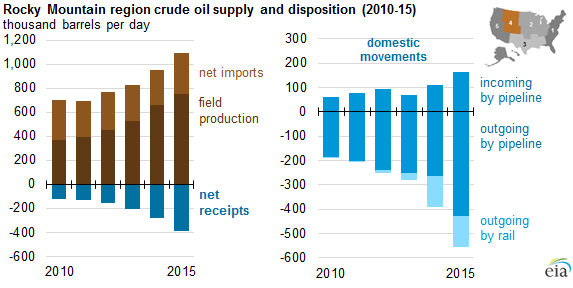

As crude oil production in the Rocky Mountains, Petroleum Administration for Defense District (PADD) 4, has steadily increased, so too has the use of railways to transport crude oil from the region. Data from the Energy Information Administration shows that 122 MBOPD of crude oil was moved by rail from PADD 4 in April 2015, accounting for 19% of total crude shipments from the region.

In 2010, just 359 BOPD was shipped by rail from PADD 4 to the Gulf Coast (PADD 3). In April, the number of barrels shipped from PADD 4 by rail had not only increased by a factor of nearly 340, the crude being shipped was reaching destinations in every PADD across the U.S.

Pipelines from PADD 4, by contrast, only move crude oil from the Rocky Mountain region to the Midwest and Gulf Coast (PADDs 2 and 3), although in much larger quantities. Pipeline shipments from PADD 4 averaged 429 MBOPD in the first four months of the year, up from 184.6 MBOPD in 2010, according to the EIA.

Despite the rise in the amount of crude oil shipped by rail from PADD 4 since 2010, the EIA anticipates that future growth may be limited. Several pipeline projects are in progress that will increase the capacity of crude that could be shipped by pipeline from PADD 4, reducing the need for greater rail capacity.

SemGroup Corporation’s (ticker: SEMG) White Cliff Pipeline will be expanded to a total takeaway capacity of 215 MBOPD and is expected to be completed in late 2015. The Grand Mesa Pipeline, owned by NGL Energy Partners LP (ticker: NGL), is being expanded to a capacity of 200 MBOPD, and is expected to come online in Q4’16. Magellan Midstream’s Saddlehorn Pipeline (ticker: MMP) is expected to be complete in the second half of next year, and will had 200 MBOPD of pipeline takeaway capacity to PADD 4 as well.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.