Middle Eastern tensions endanger oil highways

Some of the most important routes for global oil trading are becoming uncertain, as tensions flare and security becomes shaky.

While pipelines are a major component of oil transportation within a country, they often have limited usefulness in international oil transportation. Major oil producers are often thousands of miles away from major demand centers, distances that typically make pipelines impractical. Instead, the majority of oil is shipped to customers.

The EIA estimates that about 61% of global oil supply travels via seaborne trade, and oil tankers account for 28% of all global shipping. The confines of geography, though, mean oil shipping is subject to major bottlenecks, as certain straits transport enormous amounts of oil.

The vulnerability of these bottlenecks has been on display over the past several weeks, demonstrating how reliant oil markets are on a few small locations.

Saudi Arabia avoiding Bab el-Mandeb

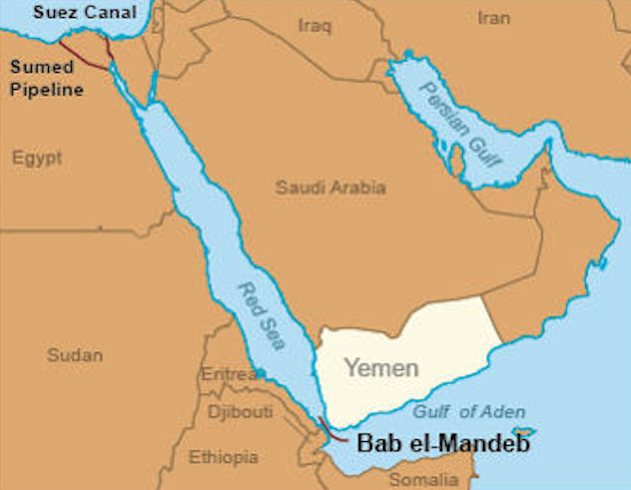

Saudi Arabia announced a major decision yesterday, the country will temporarily suspend oil shipments via the Bab el-Mandeb strait. Bab el-Mandeb is the 18-mile-wide strait on the southern tip of the Arabian Peninsula, between Yemen and Djibouti connecting the Red Sea and the Arabian Sea.

Saudi Arabia took this extraordinary step after two supertankers were attacked in the strait by Houthi forces. While there were no injuries or spills as a result of the attack, the kingdom is not taking any chances. Saudi Arabia has battled Iranian-backed Houthi rebels in Yemen for the past three years

The Bab el-Mandeb is one of the most important transportation routes for crude oil in the world, as the strait allows Middle Eastern producers to supply European markets via the Suez Canal or the Sumed pipeline, which links the Red Sea and the Mediterranean. According to the EIA the strait saw 4.8 MMBPD in 2016, the last year with reliable data. This means the strait handles about 8% of global crude oil shipments, or 5% of total global oil trade. Saudi Arabia is uniquely able to bypass the strait though, so suspending shipments through the area is possible.

The massive East-West pipeline transports oil from producing fields in the western portion of the country to a Saudi port on the Red Sea, allowing ships to load crude oil without ever transiting the Bab el-Mandeb. The East-West line has a capacity of nearly 5 MMBOPD, so avoiding the strait should not impede Saudi Arabia’s ability to export oil.

Other Middle Eastern countries are not so lucky. According to Reuters, Kuwait is also considering avoiding the Bab el-Mandeb, and other countries may follow. Shippers that do not transit the strait must instead travel all the way around Africa to reach markets, a trip that adds both time and expense.

Bypassing the strait is feasible, however, something that is not possible for the other strait experiencing uncertainty, the Strait of Hormuz.

Iran threatens Strait of Hormuz

The Strait of Hormuz is the most important chokepoint in global oil trade, handling exports from many major producers. The EIA estimates that 18.5 MMBOPD traveled through the area in 2016, a number that has likely risen in the past year.

With shipments from Saudi Arabia, Kuwait, UAE, Iraq and Iran moving through the bottleneck, the Strait of Hormuz handles nearly 30% of all maritime oil trade, and 20% of total petroleum supply. Qatari exports of LNG, 30% of global supply, also travel through the strait. The area’s importance cannot be overstated.

This makes recent Iranian threats to close the strait extremely concerning. Recent Iranian pronouncements have stated that Iran will prevent any oil traffic through the strait if recent American sanctions hinder Iranian exports. This is not the first time Iran has threatened traffic in Hormuz, but the importance of the area means the possibility cannot be ignored.

The effects of blocking the strait are difficult to precisely predict, but global oil markets would be thrown into turmoil. Nobody knows how high oil prices would rise during the crisis, but most estimates predict oil would reach at least $100/bbl, and likely would break the all-time record of $145/bbl set in mid-2008.

If Iran did close the strait, the U.S. military would certainly move to reopen it. While all agree that the U.S. would be able to force the strait, how long this would take is uncertain. Analyst estimates range from a few days to several weeks.

Fortunately, according to analysts at Stratfor Iran is unlikely to actually close the strait, as doing so would alienate global public opinion and guarantee a military response.