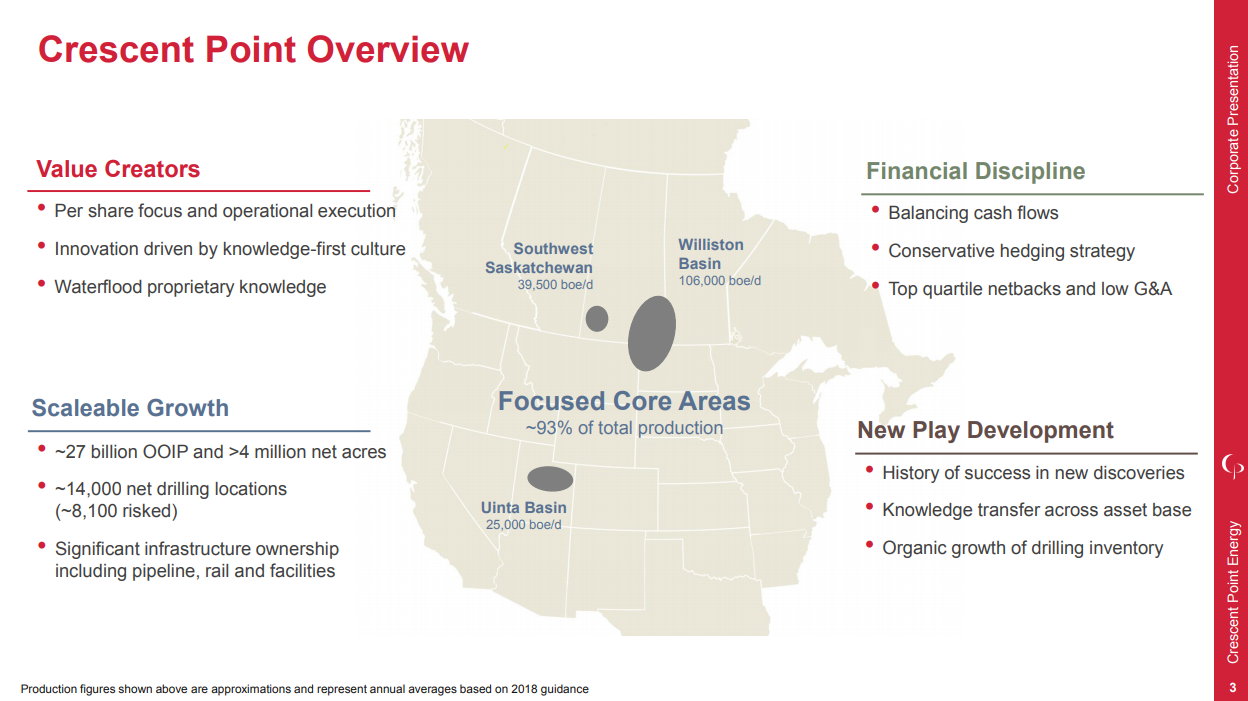

Crescent Point Energy Corp. (ticker: CPG) said its Q1 2018 production and cash flow from its U.S. assets have grown year-over-year by approximately 60% and 175%, respectively. Additionally, the company said its land position in the east shale Duvernay light oil resource play now totals over 355,000 net acres ($315/acre), or 555 net sections.

“Our U.S. assets continue to grow and exceed expectations,” said Scott Saxberg, president and CEO of Crescent Point. “Within our five-year plan, we expect production from these U.S. resource plays to more than double to approximately 80,000 BOEPD. This growth is primarily driven by our Uinta Basin play and conservatively forecasts approximately 45 net horizontal wells drilled per year.”

USA

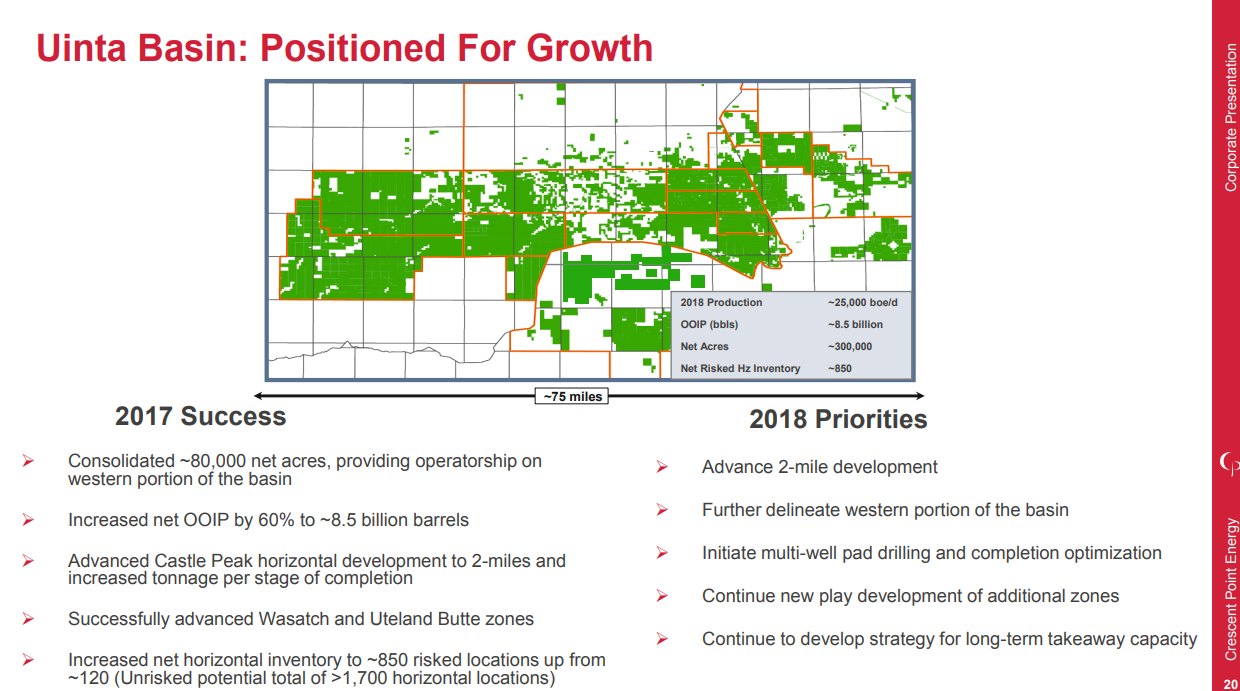

During Q1 2018, Crescent Point successfully completed its first stacked horizontal development in the Uinta Basin, targeting the Castle Peak, Wasatch and Uteland Butte zones. After completing a Castle Peak two-mile horizontal well in Q2 2017, which flowed at an initial 60-day rate of over 900 BOEPD, the company recently curtailed production in order to drill and complete a dual pad targeting the Wasatch and Uteland Butte zones within the same drilling spacing unit.

Current production from the combined Wasatch and Uteland Butte zones is ahead of expectations at approximately 3,100 BOEPD after 45 days, Crescent Point said, and is comprised of approximately 93% oil and liquids.

Production from the company’s Castle Peak well is now increasing since coming back on-line and has already produced over 205,000 BOE in less than 230 days. Crescent Point said it is currently completing another stacked horizontal development targeting the same three zones.

“Our current horizontal type wells in the Uinta Basin have attractive economics with the opportunity for improvement as we target cost reductions of over 10% through multi-well pad development,” said Saxberg. “During first quarter 2018, we completed a successful down-spacing program equivalent to an eight wells per drilling spacing unit. This highlights the potential for additional locations within our current inventory of approximately 850 net risked locations, which are primarily based on four wells per drilling spacing unit.”

Duvernay

To date, Crescent Point has participated in two gross (one net) non-operated horizontal wells in the Duvernay. The company is currently planning to drill a total of four operated net wells in the first half of 2018.

Hedging, financial balance

As part of its risk management program to protect its cash flow and the strength of its balance sheet, the company remained active on its hedging program during Q1 2018. As of April 2, 2018, the company had 53% of its oil and liquids production, net of royalty interest, hedged for the remainder of 2018 at a weighted average market value price of approximately CDN$74.00/bbl.

For the first three quarters of 2019, 35% of its oil and liquids production is hedged at a weighted average market value price of approximately CDN$75.00/bbl. Crescent Point’s commodity hedges extend through 2019, including a significant amount of natural gas production hedged at a weighted average price of CDN$2.74/GJ.

For 2018, the company said it remains committed to maintaining a strong financial position by balancing its cash outflows with inflows, including dispositions. Crescent Point is also focused on generating returns on capital employed and advancing new technologies for ongoing efficiencies.