Cove Point ships out its first LNG cargo, making Dominion officially the second U.S. LNG exporter leading the new wave of U.S. natural gas global takeaway opportunities – 2 years after Cheniere started the charge

On March 1, 2018, Dominion Energy’s (ticker: D) Cove Point LNG export facility in Lusby, Maryland, secured two places in the record books.

On Thursday Dominion Energy’s Cove Point export facility became the second U.S. company since 2015 to load and send off an LNG tanker filled with U.S. liquefied natural gas. That first shipment from Maryland also gives Cove Point the distinction as being the first U.S. LNG export facility to ship an LNG cargo from the U.S. east coast.

For the past two years, Cheniere Energy’s (ticker: LNG) Sabine Pass facility on the U.S. Gulf coast has single-handedly enjoyed the limelight for success cranking out shipments of liquefied U.S. natural gas to markets abroad. Cheniere was the first U.S. LNG exporter since Conoco Phillips (ticker: COP) exported its last cargoes from the Kenai LNG plant in Alaska in 2015.

When ConocoPhillips was winding down its LNG export operations at Kenai, Cheniere was in commissioning, preparing to ship its first cargo. Since then Cheniere steadily ramped up operations. Cheniere announced its 100th cargo from Sabine Pass in April of 2017, 13 months ago.

Dominion’s official announcement about Cove Point said “a transport ship carrying the first cargo of liquefied natural gas produced for export departed from the Cove Point LNG terminal March 1, 2018.” Dominion said the newly constructed liquefaction facility is undergoing final commissioning and that Shell NA LNG is providing the natural gas needed for liquefaction during the commissioning process. Dominion said Shell is off-taking by ship the LNG that is produced at Cove Point.

Dominion said it wants to operate Cove Point 24 hours a day, seven days a week, and its new plant has a nameplate capacity of 5.25 mtpa of LNG, equivalent to approximately 8.3 million gallons of LNG per day. When commissioning is complete, Cove Point will produce LNG for ST Cove Point, which is the joint venture of Sumitomo Corporation and Tokyo Gas, and for Gail Global (USA) LNG, the U.S. affiliate of GAIL (India) LTD under 20-year contracts.

The $4 billion Cove Point export project began construction in October 2014. Dominion said Cove Point is its largest construction project to date, with a payroll of $565 million. Cove Point will add natural gas export volumes to Dominion Energy’s portfolio of 26,000 megawatts of generation, 14,800 miles of natural gas pipelines, 6,600 miles of electric transmission lines, and approximately 1 trillion cubic feet of natural gas storage capacity.

Who’s in the race for third/fourth company to export U.S. LNG?

Cheniere in position to take 3rd with Corpus Christi

Cheniere Energy’s Corpus Christi, Texas LNG export terminal, also on the U.S. Gulf coast, now under construction, could be on track to produce LNG in 2018, according to Reuters. If that occurs and Cheniere gets a shipment out of Corpus Christi before the end of the year, Cheniere’s Corpus Christi plant will own the third export spot on the list.

Cameron LNG

Another Gulf coast project–Cameron LNG–targets its first train to be operational in 2019.

Cameron LNG is an LNG import/export project located in Cameron Parish, Louisiana, that is jointly owned by affiliates of Sempra LNG & Midstream, ENGIE (formerly GDF SUEZ), Mitsui & Co. Ltd. and Japan LNG Investment, LLC, a company jointly owned by Mitsubishi Corporation and Nippon Yusen Kabushiki Kaisha (NYK).

The Cameron LNG project is located on the Calcasieu River, 18 miles north of the Gulf of Mexico. The Cameron partners secured the purchase of a 432-acre tract of land directly north and adjacent to the existing import terminal, making for a total footprint of 502 acres. The price tag is $10 billion to construct a liquefaction facility at the site. Construction is underway, according to the company.The three-train project has an authorized annual export capacity of 14.95 Mtpa.

In July of 2016, Cameron LNG had received regulatory approvals needed to expand its base 3-Train project. The “Expansion Project”, if undertaken would include two additional liquefaction trains (Trains No. 4 and No. 5) and up to two additional full containment LNG storage tanks. The expansion project is capable of increasing LNG production capacity by 9.97 million metric tons per annum (Mtpa) of liquefied natural gas (LNG), or 1.41 billion cubic feet per day (Bcfd). If constructed, Cameron LNG’s export capacity will be 24.92 Mtpa, or 3.53 Bcfd.

In December 2017, Cameron LNG announced that it has reached a settlement agreement with CCJV regarding the construction of the three-train LNG liquefaction project in Hackberry, Louisiana. CCJV is a joint venture between affiliates of Chicago Bridge & Iron Company N.V. and Chiyoda Corporation.

“The settlement … better positions the parties in achieving the joint goal of having all three liquefaction trains producing LNG in 2019,” the company said in a statement.

The settlement falls within the existing construction budget and financing commitments for the project and creates a constructive path for all parties to focus on placing the project into service with incentives for the contractor to achieve the schedule. “We are pleased to have resolved all outstanding matters with CCJV so all efforts can be focused on the safe and successful completion of the project as we get closer to commissioning and start of operations,” said Farhad Ahrabi, Chief Executive Officer of Cameron LNG, in a press release.

If 2019 does become the year that Cameron begins to export cargoes, it’ll take fourth place in the growing list of U.S. LNG export facilities.

Kenai LNG plant not exactly in the current race, but Alaska wants to get the project there

The Kenai LNG plant in Alaska, which was 100% owned and run by ConocoPhillips until Jan. 2018, began operating in 1969 and was the only LNG export plant of domestic gas production in the United States for more than 40 years. In 2011 ConocoPhillips announced that it would be ceasing LNG exports from Kenai and preserving the plant for potential future use, but a change in market conditions caused the company to make further LNG shipments in 2012. The plant made its last LNG export shipments in 2015.

In 2016, ConocoPhillips announced that it was putting its liquefied natural gas plant in Kenai on the market. But without a buyer, “a company spokesperson said it’s going to save expenses by mothballing the facility this fall (2017),” the Peninsula Clarion reported last summer.

Rosetta Alcantra, an AGDC spokeswoman, told KTVA in January of 2017 that the ConocoPhillips facility could potentially replace a larger LNG facility that would have to be built under original Alaska LNG pipeline (AKLNG) project plans, for which AGDC is the sole remaining applicant. But that deal didn’t come to fruition.

Alaska LNG had been described as a “gigaproject” by those involved, with an estimated price tag of $45 to $65 billion. The Alaska LNG project until Jan. 1, 2017, involved a partnership of energy majors including BP (ticker: BP), ExxonMobil (ticker: XOM), ConocoPhillips (ticker: COP), and TransCanada (ticker: TRP). All the partners, except AGDC, have since pulled out of the expensive project.

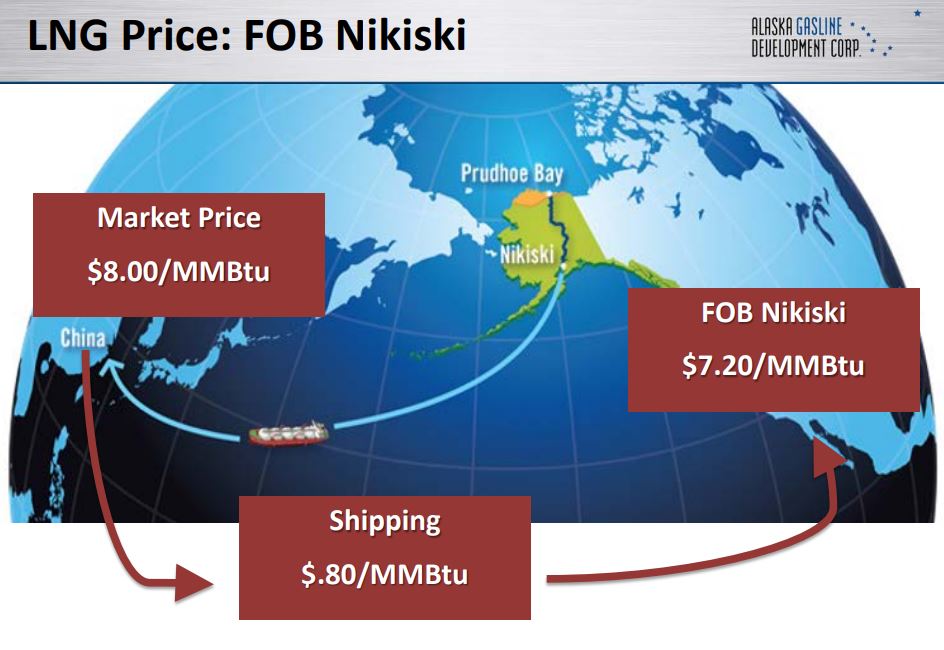

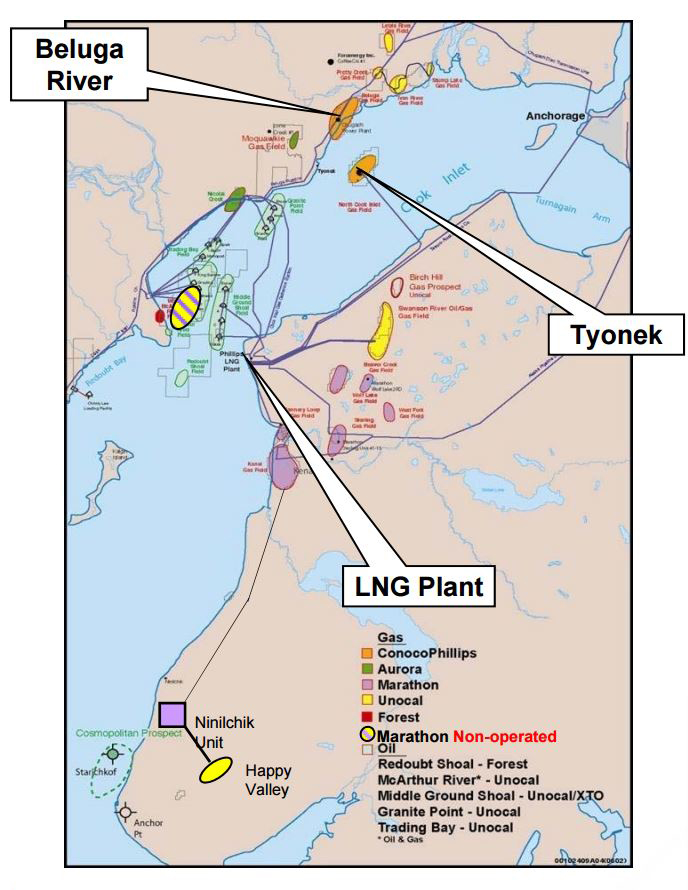

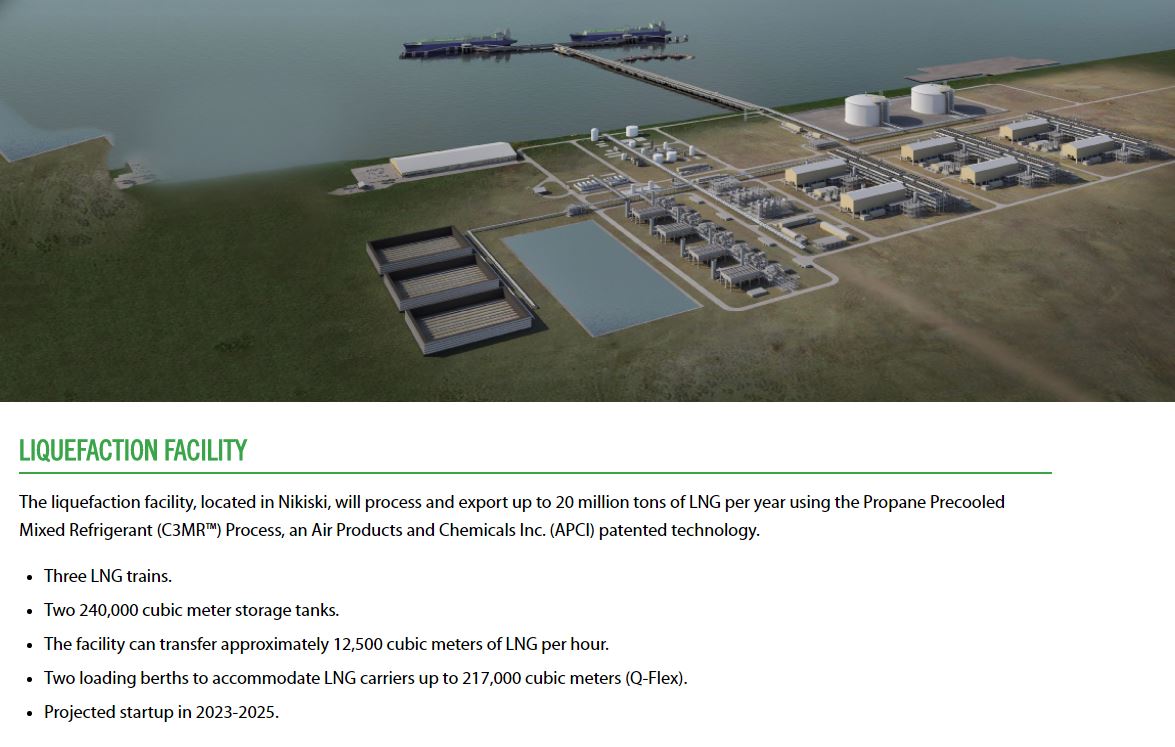

On its project website, AGDC summarizes the project as follows: “[It] will move North Slope natural gas through the resource-rich center of Alaska providing clean-burning natural gas to fuel local markets, mining, and industrial needs. A new liquefaction facility built in Nikiski (North America’s longest serving LNG export location) will provide access to the expanding LNG market.

“The Prudhoe Bay and Point Thomson fields anchor the project on the North Slope. These fields will produce, on average, about 3.5 billion cubic feet of gas per day with approximately 75 percent from the Prudhoe Bay field and 25 percent from the Point Thomson field.

“This integrated natural gas project is one of the most important projects being built in the United States. It is Alaska’s priority project and has been widely studied by stakeholders, federal agencies, and state regulators,” AGDC said.

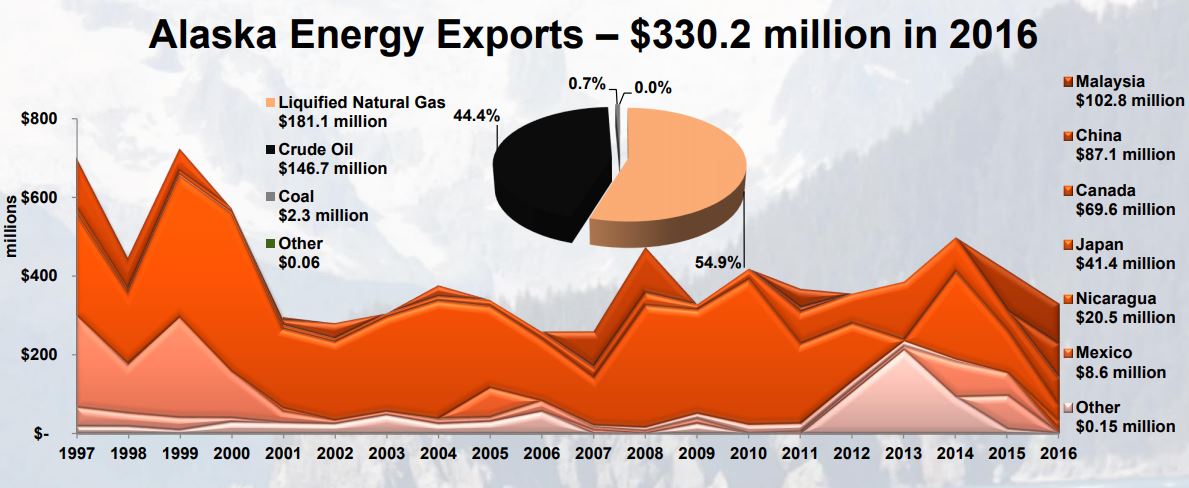

In 2017, Alaska’s Gov. Bill Walker and Alaska Gasline Development Corporation officials made road trips to Asia to sell potential Asian customers on the idea of importing Alaska’s ample natural gas supplies.

ConocoPhillips sells Kenai plant to Andeavor

Reuters reported in early February 2018 that U.S. refiner Andeavor had acquired the liquefied natural gas facility in Kenai, Alaska, from ConocoPhillips and that ConocoPhillips said that the sale of the facility had closed and the operation had been transferred to Andeavor on Jan. 31. The companies did not announce terms.

“This acquisition further strengthens our integrated value chain by optimizing our operations in Kenai and providing low-cost fuel for our refinery to produce fuels,” spokesman Scott LaBelle said via email, according to a report by Platts.

According to the Alaska Journal of Commerce, the Kenai LNG plant was the world’s largest when it opened in 1969 and has served as a means to strengthen the trade relationship between Alaska and Japan, where most of its cargoes landed. ConocoPhillips said the Kenai plant exported 1,300 shipments of LNG cargoes over its almost 50 years of operations.

LaBelle could not say whether Andeavor would consider resuming LNG exports from the plant, which last occurred in 2015, Platts said. The plant has the capacity to produce about 1.6 million mt/year of LNG. “We are still considering our options,” he said.