SCOOP drilling unit comes on at 41,701 BOEPD; new Bakken completions jump IRRs 82% at $50 oil

Continental Resources (ticker: CLR) reported third quarter results today, showing net earnings of $10.62 million, or $0.03 per share.

Continental produced an average of 242.7 MBOEPD in Q3, up 7% sequentially. This growth was achieved despite unusually rainy weather in the Bakken and hurricane-related midstream curtailments in Oklahoma, which caused a combined reduction of about 3.5 MBOEPD. Continental expects significant growth in Q4, with average oil production up about 16% sequentially.

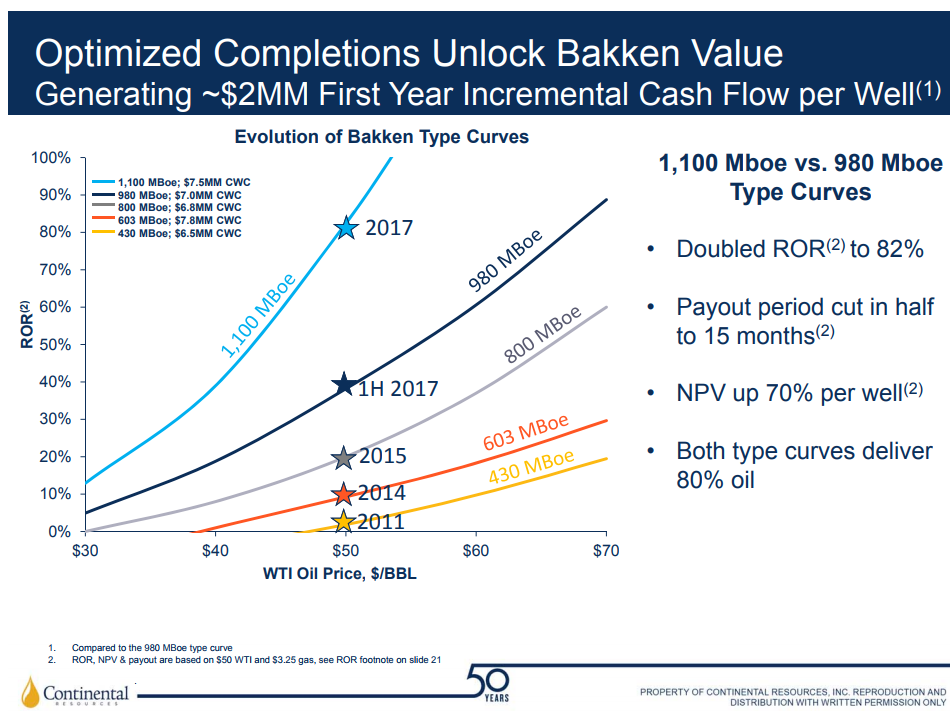

Continental has seen significant production uptick from enhanced completions designs in the Bakken.

These new designs use larger proppant loads, tighter stage spacing and diverters, along with accelerated flow backs and high-capacity lift. The company has brought on over 100-such wells so far, and results support Continental’s new type curve.

The new type curve predicts 1,100 MBOE per well, up 12% from the previous curve. The IRR is vastly improved, however, doubling from 41% to 82% at $50 WTI. New wells payout in around 15 months, half the time of old wells.

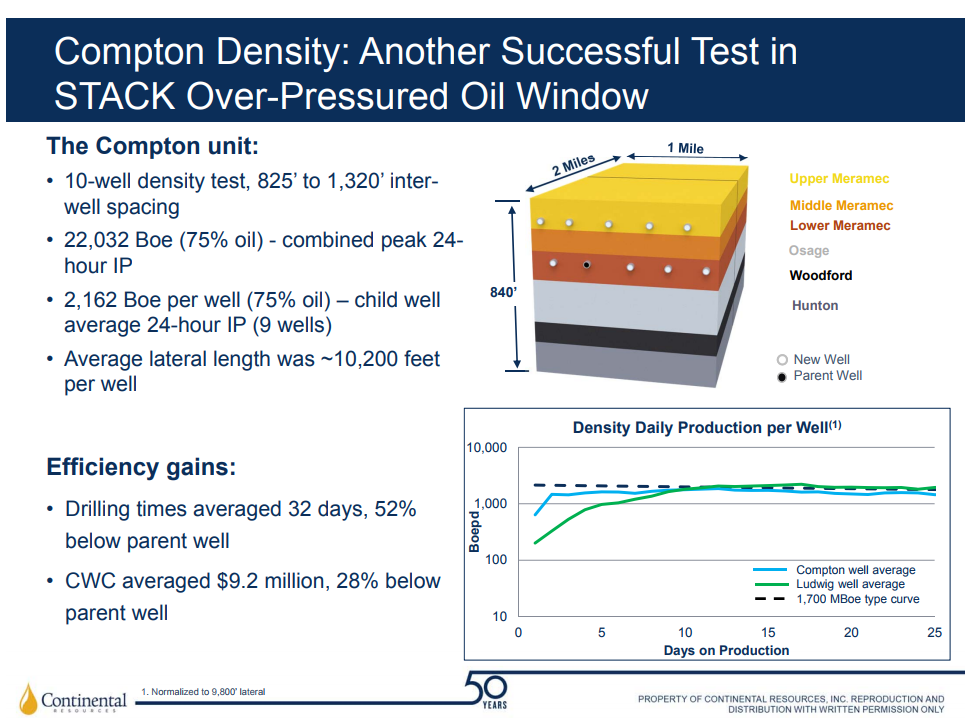

SCOOP and STACK see successful density pilot projects

The company is also testing spacing in its Oklahoma properties, developing both the SCOOP and STACK. Continental recently began flowing back a new density test in the STACK, targeting the upper and lower Meramec with 10 wells. The wells averaged 2,203 BOEPD per well, and early results track the company’s 1,700 MBOE type curve.

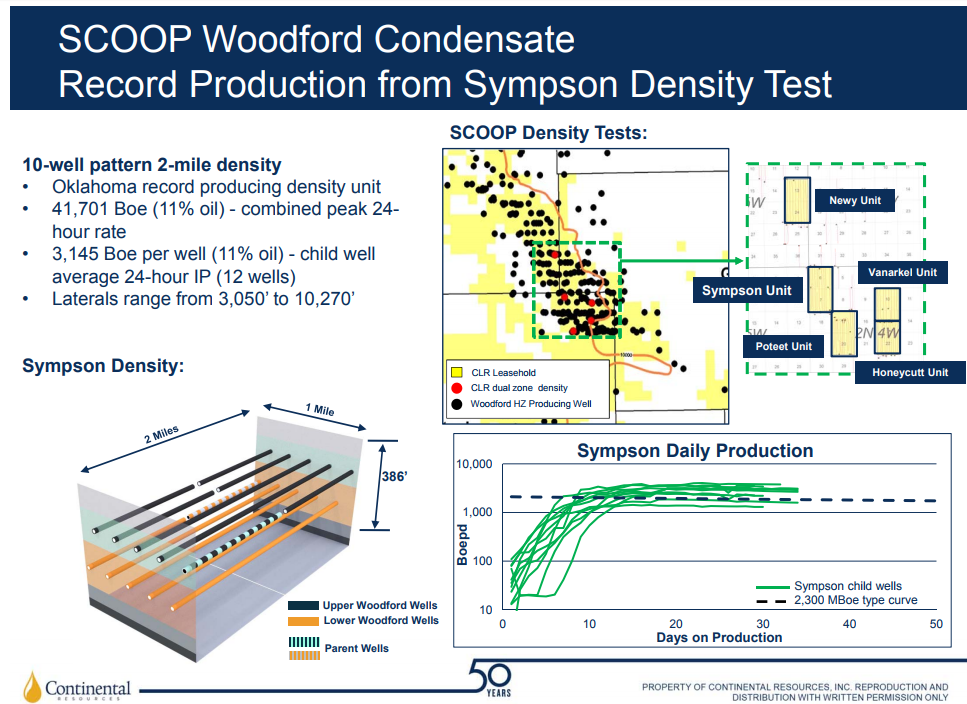

The recent density test in the SCOOP was also successful, with a 10-well pattern targeting the upper and lower Woodford. The unit produced a combined 41,701 BOEPD, setting what Continental claims is an Oklahoma record for IP from a drilling spacing unit.

EIA forecasts still too high: Hamm

Continental Chairman and CEO Harold Hamm has not moderated in his criticism of the EIA’s projections for USA production, and further discussed the agency’s forecasts during the conference call.

“Some may have expressed concern,” Hamm said, “that U.S. shale producers could spoil the party by over producing, but we just haven’t seen that happen. This is a key reason we’ve been pointing out EIA annual forecasts are too high. The most recent monthly actual report last week was 9.2 million barrels a day for August, we see only a movement from the current 9.2 million barrels oil per day to 9.35 million or 9.4 million barrels oil per day by year-end, not to 9.7 million barrels oil per day level projected by the EIA in the last report. Their overblown forecast for U.S. production tends to disadvantage the U.S. market and puts America last, not first. The EIA must take action to correct this problematic forecasting system in the near future.”

Q&A from today’s Q3 earnings call

Q: I think in the past you all talked about being cash neutral and now it’s free cash flow. I mean, we’re estimating free cash flow next year for you all. Is that just the commodity price increasing that’s driving that or with the well results that we’re seeing or that you all are seeing, is that the main driver?

CLR: Obviously, commodity price has come up over the recent few weeks here, and we think it’s going to continue with what we’re seeing in the supply and demand. But as I noted in the script, we’ve done modeling in the $50 to $55 range really toward closer to the $50 range and we were able to generate strong results below $50. So, I think the production uplift the efficiency that we’re seeing within the company enables that in a variety of pricing environments. As prices go up, the level of that positive nature continues to increase. But it is significant at 50.

CLR: I have to say a lot of it is well performance. I mean, we’re seeing, obviously, some improvement in price, but the well performance that we’re seeing is just exceptional and its – we’re seeing outperformance in all of our plays because of the stimulation work we’re doing and also from – just the profit standpoint, the efficiencies are driving cost down, still. And so, it’s a combination of all of it, but a big, big driver, especially this year, is just the outperformance of our wells.

Q: I was wondering if you could talk through just what you’re seeing on the service cost front. I know you’ve been in sort of a unique position with some of the older, long contract of rigs rolling off. But how are things looking right now, especially in the context of the big move that we’ve seen in crude?

CLR: Yes. This is Pat Bent. With respect to our rig contracts, we started the year with 18 rigs. We’ve had several roll-off contracts to market rate, and that is generally a $10,000 plus/minus per day reduction. We’re currently with the 18 rigs. We have nine on market rate and nine on long term. We’ll have one more roll-off year-end to market rate. And so, slight difference between Bakken and Mid-Con of a few thousand dollars but in that $17,000 to $18,000 range market rate.

CLR: And then on the completion side we’ve done a very good job this year just managing to the changing prices. And it’s very much driven by supply and demand, and there’s really still a lot of steam fleets that are available out there. I think about the Woodford steam fleets that shut down earlier in the year and should be coming back on the market through the combined business venture called OneStim. And so really looking forward to additional fleets being put to use, and that’ll help our cost stay down.