Continental Resources CEO Harold Hamm says the company is aiming for balanced growth

Oklahoma City-based Continental Resources (ticker: CLR) announced its second quarter earnings this week, reporting increased production guidance for the year, lower production costs, and a $281 million deal to pay down debt. Continental reported a net loss for the quarter totaled $119.4 million, or $0.32 per share.

During the company’s conference call, Continental CEO Harold Hamm said the company’s goal for the time being would be cash flow neutrality.

“We continue to see world oil markets rebalancing throughout 2016,” said Hamm, discussing the background against which CLR is setting its goals. “Short term, there’s some market volatility as the inventory overhang of crude oil and refined product begins to diminish and traders respond to reduced seasonal demand period with OPEC production running flat out.

“Continental is dealing with this new market reality, as are others in the industry, by curtailing oil production and drilling and completion activity in certain areas,” continued Hamm. “The current environment underlines more than ever the importance of the company’s discipline and strong execution. Our priority remains cash flow neutrality, no new debt and balancing capital spending with cash flow through the second half of this year, while maintaining production and building proved reserves.

“We’re working to improve the company’s leverage metrics including reducing level of long-term debt on our balance sheet. Our target is a number of $6 billion or less, our primary opportunity in this period is through non-strategic asset sales followed by increased cash flow as oil and natural gas prices do recover.”

Continental Resources currently has $7.1 billion in outstanding debt.

Paying down debt

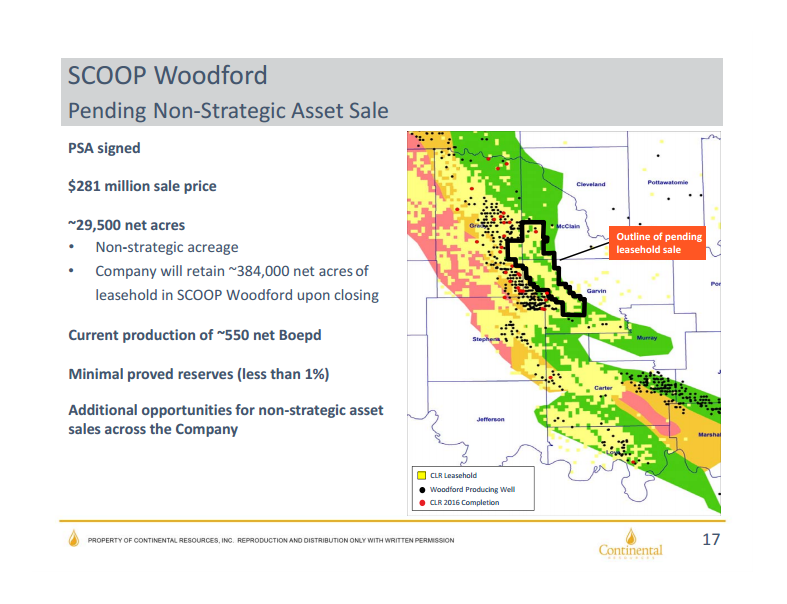

Continental announced that the company signed a purchase and sale agreement to monetize 29,500 acres of its SCOOP Woodford assets. Current production from the SCOOP acreage is about 550 net BOEPD, according to Continental, implying a deal value of $510,909.09 per flowing BOEPD, or $9,525.42 per acre.

Continental also sold 132,000 net acres of leasehold in the Washakie Basin in Wyoming for $110 million earlier this year, bringing total asset sales to $391 million. The next maturity Continental faces is a $500 million term loan due in 2018.

“We have additional opportunities to monetize non-strategic assets, especially for undeveloped leaseholds outside our 10-year drilling plan,” Hamm said on the call.

Improved well results

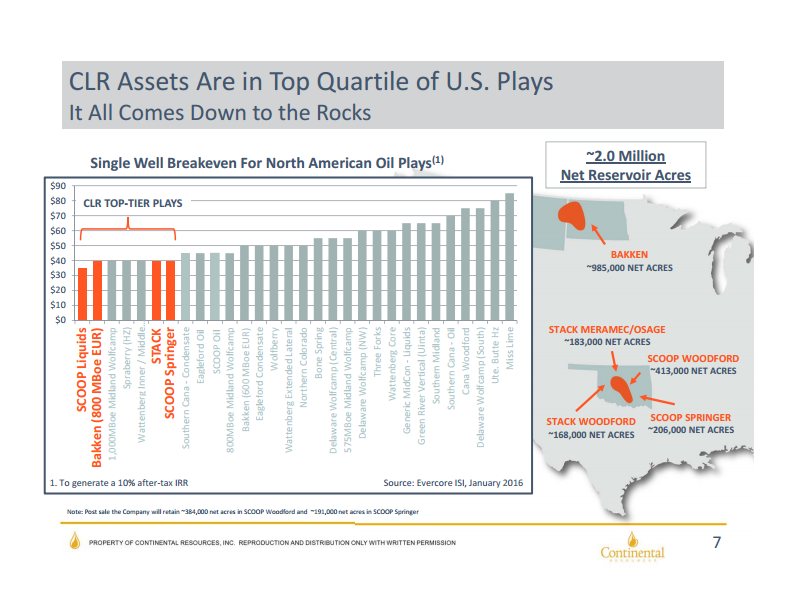

While Continental continues to look for non-core assets to sell in order to pay down the company’s debt, CLR is also enjoying improved well results that will make Hamm’s goal of cash flow neutrality more attainable.

In the company’s financial results, Continental reported production expense on a per BOE basis is down $0.67 year-over-year. G&A costs per BOE were down 36% from the company’s previous guidance as well, coming in at $1.40 at its mid-point.

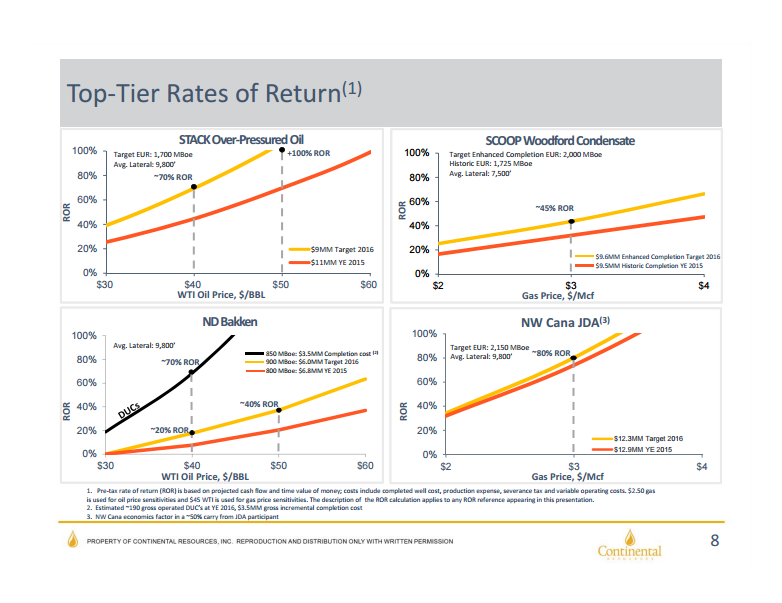

In the company’s STACK/Northwest Cana acreage, Continental reported production of 14.6 MBOEPD, a 31% increase from the first quarter. In its press release, CLR said it is targeting an average completed well cost of $9.0 million in the over-pressured oil window of STACK, $500,000 less per well than its previous year-end 2016 target. “At this targeted cost, Continental estimates a well in the over-pressured oil window should deliver more than an 85% rate of return at $45 per barrel WTI and $2.50 per Mcf of gas, based on an EUR of 1.7 MMBOE per well,” Continental said in its Q2 results.

For the company’s SCOOP Woodford wells, Continental reported that EURs for tis 2-mile laterals increased approximately 30% to 1.3 MMBOE per well. At a targeted completed well cost of $9.8 million, and assuming the company’s new 1.3 MMBOE EUR, CLR believes its SCOOP wells will yield a 32% rate of return at $45 WTI and $2.50 gas.