Expected EUR up 12%

Continental Resources (ticker: CLR) announced second quarter results today, showing a net loss of $63.6 million, or ($0.17) per share. After adjusting for impairments and other special charges, the company’s adjusted net loss is $1.8 million. These results both exceed Continental’s Q2 2016 results, which were a net loss of $119.4 million and an adjusted loss of $65.9 million.

Second quarter production averaged 226.2 MBOEPD, up 6% from first quarter levels. Most of this growth came from Continental’s operations in the North Dakota potion of the Bakken, which added 11.4 MBOEPD sequentially.

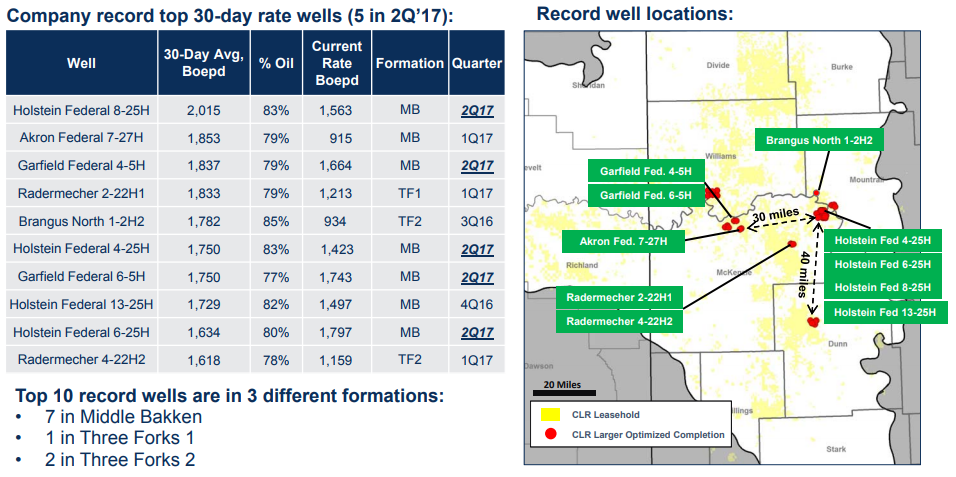

Continental reports that it completed 100 gross (38 net) Bakken wells during Q2, with a further 205 gross DUCs remaining at the end of the quarter. The company has been using optimized completions in the Bakken, with more intense fracturing treatments. These efforts have been successful, and five of the second quarter wells rank in Continental’s top 10 all-time Bakken wells, based on the first 30 days of production.

ROR more than double previous type curve

These results have led Continental to increase its type curve EUR to 1,100 MBOE per well, with an expected 24-hour IP of about 1,500 BOE. This means a $7.5 million 2 mile lateral well will yield an 82% ROR at $50/bbl WTI and $3.25/Mcf. This is more than double the ROR of the previous type curve, illustrating how the improved completions have boosted economics.

Updating guidance: producing more, spending less

Continental has announced changes to its full-year guidance, increasing production and decreasing costs. Continental’s expected annual production has increased by 10,000 BOEPD, to a midpoint of 235,000 BOEPD. Production at the end of the year has increased even more, to a midpoint of 267,500 BOEPD. This will be achieved despite a reduction in capital expenditures, from $1.95 billion to a midpoint of $1.85 billion. Expected LOE and other operating costs have also decreased, by a combined $1.85 per BOE.

$147.5 million in sales

Continental also announced two separate acreage sales today, divesting non-core assets. One transaction involves the sale of 6,590 acres in the STACK to an undisclosed buyer for $72.5 million. The second sale divests 26,000 acres in the Arkoma basin of Oklahoma for $68 million. In addition, Continental is selling oil-loading facilities in Oklahoma for $7 million. According to Continental, the sold properties are non-strategic and include minimal proved reserves. Funds from the sales will be used to reduce debt.

Q&A from CLR Q2 conference call

Q: It seems like we’re clearly seeing the uplift and enhanced completions, are you all done kind of tweaking and found the recipe what other things that you are already still trying to experiment?

A: And so you’ve seen our results from 2017 and if you we look at the wells that we put on first production that average characteristics for the completions are still at 40 stages and about 1,250 pounds of sand per foot lateral and one of the things we’ve been testing more recently, but we don’t have a lot of wells on yet, is even tighter stage spacing where we made test – we are testing 60 stages for two miles instead of 40s. And so that’s a big additional upside for us.

In addition to that, on the production side, we’re continuing to test higher capacity artificial lift and we’re also looking at more ways that we can get more aggressive with our facility designs also. So we’re working on both the completion and the production side.

Q: Does the new D&C design you guys have implemented with an increased focus on stimulation in your wellbore, encourage you to revisit the existing spacing assumptions. I know volume metrics tend to suggest water, but is this science or effective half lengths or just tighter?

A: That’s part of our analysis that what our teams will be looking at and so it’s very early and we’ll be looking at what type of optimum spacing there’ll be, we’ll always be looking at maximizing our rate of return.

And what’s great is when you move the type curve up like that in early time, that really solidifies your rig return for the next few years, no matter what it does at the far end on inventory. And so, that’s something our teams update usually in between mid-year and year end reserves and we’re working on, look at that right now.

When we’re seeing this tighter stage spacing wells coming on extremely strong, it’s clear that we are tying into reservoir rock that we did not tie into before. So, we’re distributing the sand along the wellbore in a much more effective manner and not maybe reaching out as far.

And so, I agree totally with what you are thinking is that, is there a change in density either greater density on those perhaps, yes, but I think greater density, because you’re more effectively stimulating the rock around the wellbore. And I think that we’re very keenly monitoring and looking at that as one of the options in here.