Darwin’s current production will run dry by 2022

ConocoPhillips (ticker: COP) is considering expanding its Darwin LNG facility, taking advantage of nearby undeveloped gas fields. A feasibility study has been commissioned to examine different LNG process technologies and production volumes to support a second LNG train at the Darwin facility.

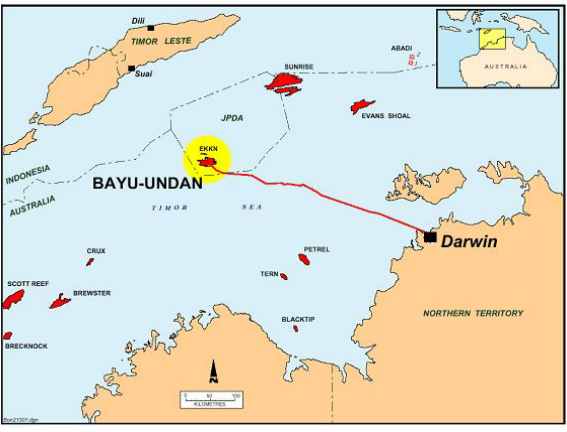

The Darwin LNG facility began operations in 2006 with an estimated 420 Mcf/d of capacity. Current operations are fueled by the Bayu-Undan field, a major offshore gas field. While initial estimates put Bayu-Undan reserves at 3.4 Tcf of gas, production will not be enough to supply Darwin by 2022.

ConocoPhillips is currently considering developing the Caldita-Barossa gas field, located northwest of the Darwin facility. According to the Australian, developing this field would be a $10 billion investment. However, current plans would only provide backfill production, only enough to keep Darwin running. Additional fields, like the Poseidon field in Northeast Australia, would also be needed to support the studied expansion.

Development is highly dependent on the Australian government’s position, however. ConocoPhillips has stated that if changes were made to the Petroleum Resource Rent Tax that prevented Barossa going ahead, Darwin LNG could be mothballed.

U.S. LNG becoming major competitor

First construction on Darwin LNG began in 2003. Since then the global LNG market has changed profoundly. Worldwide, there were only 80 MTPA of liquefaction capacity when Darwin came online. Many major LNG projects have come online in recent years, with more planned. According to Tellurian CEO Meg Gentle the U.S. alone will have 70 MTPA of capacity by the end of this round of construction. Sabine Pass and other terminals like it mean any future LNG development will have to compete with low-cost gas from U.S. shale.

Gorgon LNG Trains coming online

Another major Australian LNG facility, Chevron’s Gorgon LNG has also seen activity recently. The facility’s third and final Train reported first gas on March 28, ahead of the expected Q2 startup. Chevron is also in the process of restarting production from Train 2, which shut down in late March for repairs and improvements.

Gorgon has a massive capacity and a price tag to match. Chevron reports that the plant has a capacity of 2.6 Bcf/d of gas and 20 MBOEPD of condensate. According to Platts, the overall Gorgon project cost $53 billion, but analysts for Sanford Bernstein claim that cost could be as much as $60 billion.