Updated 2015 Guidance is 31% Below 2014 Expenditures

ConocoPhillips (ticker: COP) has revised its capital plan to $11.5 billion per year through 2017, according to a news release issued on March 17, 2015. COP had originally set its 2015 budget at $13.5 billion in a December 2014 announcement but trimmed the estimate to $11.5 billion in its Q4’14 results. The flat expenditure levels through 2017 has not previously been announced, and are designed to “Position the company for lower, more volatile prices for the foreseeable future,” said Ryan Lance, Chairman and Chief Executive Officer of ConocoPhillips. The updated guidance is 31% below 2014 expenditures of $16.7 billion.

The company plans on divulging additional details in its Analyst and Investor Meeting on April 8, 2015, in New York City.

COP Plans

The more selective expenditure sheet comes less than one week after the company reportedly cancelled a $2.1 billion project in the North Sea. Reuters says development plans were on track to be submitted in 2016, but COP has not publicly commented on the issue. Programs in North American unconventional plays will be “significantly” reduced, and less spending will be required for major projects since several are nearing completion. COP management said there is flexibility and “sound economic rationale” for slowing North American development.

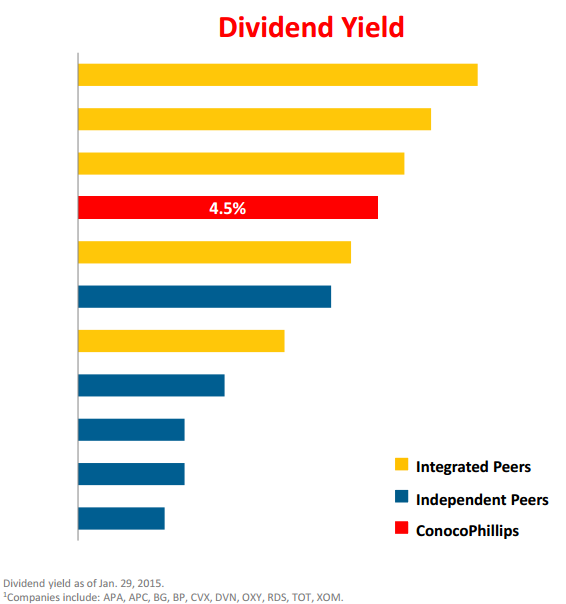

“Our new plan will continue to focus on delivering a compelling dividend, while also achieving sustainable, modest volume growth and competitive returns,” said Lance in the latest release. When discussing its initial capital plans on COP’s Q4’14 conference call, Lance said the dividend was a major factor in reducing capital costs year-over-year. “The dividend remains our top priority for capital allocation, the next highest priority remains getting to cash flow neutrality in 2017,” he said. “With these priorities in mind, we’re going to use our capital and our balance sheet flexibility to manage through this downturn.”

A total of $3.5 billion was used on dividends in 2014 on overall earnings of $6.8 billion. The company operated at a loss of about $0.5 billion on the year due to the commodity downswing.

COP expects total production to reach 1,700 MMBOEPD in 2017, which is roughly 10% above 2014’s average volume of 1,532 MBOEPD (excluding Libya). Volumes for fiscal 2015 are expected to be 2% to 3% higher than 2014, which would place midpoint production at 1,570 MBOEPD – roughly equal to the average volumes in Q4’14. In all, volumes increased on a year-over-year basis in 2014 by 3%.

Balance Sheet

Management said anywhere from $9 to $10 billion is required to keep production flat, and $5.1 billion was on its balance sheet at the end of 2014. There are no scheduled debt maturities in 2015, and COP has $6 billion available on its credit facility. Jeff Sheets, Executive Vice President of ConocoPhillips, said its debt continues to trade between those of A and AA rated companies, and its current debt-to-market cap ratio is roughly 30%. “We’re willing to let that rise, if necessary, as we move the company to a balance of cash flows, capital expenditures and dividends in 2017.”

The debt is favorable when compared to its peers in EnerCom’s E&P Weekly database. The median debt-to-market cap of the 22 large caps is 32%, while the overall ratio among the 87 listed companies is 62%. ConocoPhillips is the largest listed E&P in the database, with a market cap of more than $75 billion.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.