ConocoPhillips said Tuesday it aims to keep its capital spending at an average of less than $7 billion per year through 2029, including selling a 25 percent stake in its large Alaska business in order to keep costs down.

The Houston oil and gas producer only wants to see spending rise a bit from its estimated $6.1 billion in 2019 capital expenditures. ConocoPhillips is sticking with its conservative, Wall Street-friendly approach to keep spending down and profit when oil prices are higher or lower. The goal is to maintain resiliency from the ups and downs of the industry’s cyclical nature.

In wooing investors, ConocoPhillips plans to spend $30 billion on share buybacks over 10 years and $20 billion in dividend payouts to investors. The company intends to generate $50 billion in free cash flow to fund these programs.

“Over the past few years, we have successfully transformed ConocoPhillips to position the company for consistent, predictable performance across the inevitable price cycles of our industry,” said Chief Executive Ryan Lance. “We believe that we offer the market a compelling, long-term E&P investment that provides downside protection and full exposure to the upside.”

By outlining a broad a 10-year plan on Tuesday to energy analysts, ConocoPhillips aims to build confidence with shareholders and attract back more general investors who have soured on the oil and gas sector.

The largest independent oil and gas firm may produce less oil and have fewer employees than it did a few years ago, but now it’s more profitable and more efficient.

[contextly_sidebar id=”ZUfTJjAjMQ9aR6Otaw23346ThnUYZuMV”]

The company still aims to grow its production volumes by more than 3 percent a year.

In October, ConocoPhillips announced a nearly 40 percent increase in dividend payouts to investors to help instill confidence in the company on Wall Street amid subdued oil prices and a slowing energy sector. In 2015 – near the bottom of the last oil bust – ConocoPhillips slashed its quarterly dividend from a high of 74 cents a share down to 25 cents. But the new level of 42 cents is its highest since 2015.

Still, ConocoPhillips’ stock has fallen by more than 10 percent this year, even though that’s better than the 20 percent plunge from the S&P 500’s index of oil and gas producers.

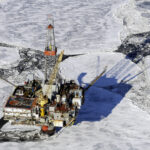

In the third quarter, the Houston firm said its production from the top U.S. shale plays — the Permian Basin, Eagle Ford shale and North Dakota’s Bakken shale — jumped 21 percent from last year. Those three basins represent nearly 30 percent of ConocoPhillips’ total production. Other key regions include Alaska, western Canada, Australia, Norway, Qatar and Malaysia. ConocoPhillips also just sold a portion of its Australia business, but that deal hasn’t closed yet.

But its future exploration is focused on areas outside of U.S. shale, instead exploring in Alaska, Canada, Colombia, Argentina, Norway and Malaysia.