Cenovus to become largest Canadian thermal oil sands producer

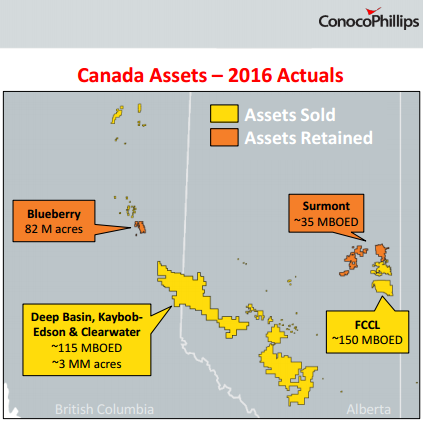

ConocoPhillips (ticker: COP) announced the sale of its Canadian oil sands and Deep Basin gas assets Wednesday, in a $13.3 billion transaction. Cenovus Energy (ticker: CVE) will purchase most of ConocoPhillips’ Canadian assets to become a major oil sands player.

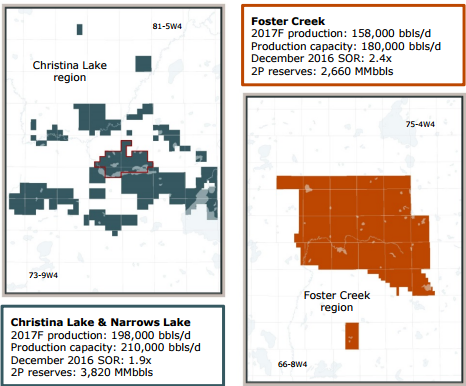

ConocoPhillips is selling its 50% stake in the Foster Creek Christian Lake oil sands, which is currently producing a gross 356 MBOEPD. The facility has a regulatory approved capacity of 735 MBOEPD gross, and about 6.5 billion barrels of gross 2P reserves. This transaction will instantly make Cenovus the largest Canadian thermal oil sands producer, with 390 MBOEPD of oil sands production.

Cenovus plans to expand the FCCL facility, with several phases planned. Foster Creek phase G, a 50,000 BOPD expansion, is already in progress, while Foster Creek H and Narrows Lake A are in planning. These two phases have capacities of 30,000 BOPD and 45,000 BOPD, respectively, making total planned expansion 125 MBOEPD.

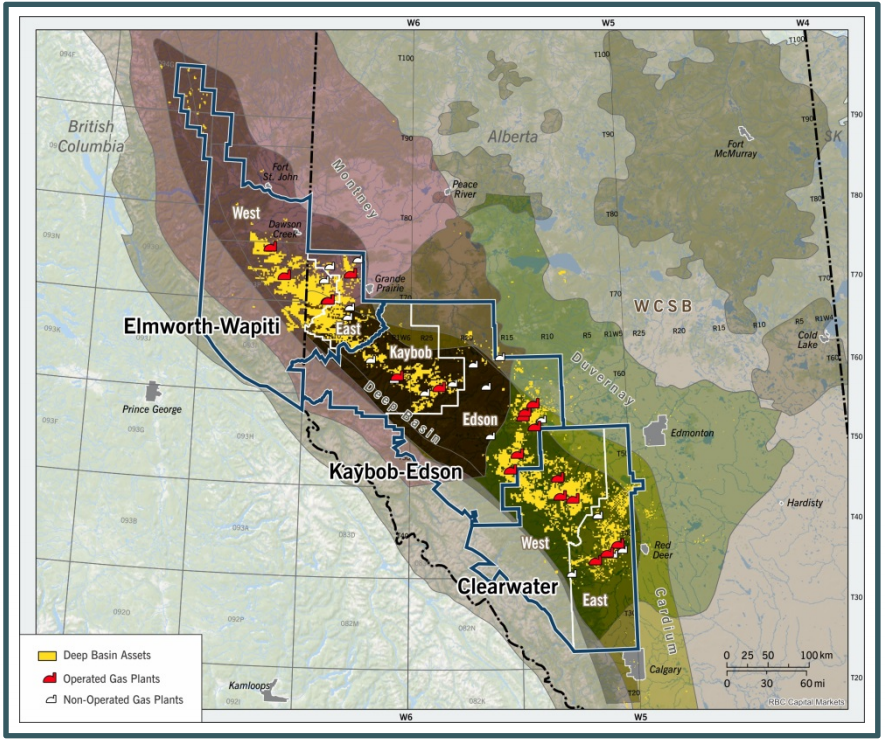

In addition to the oil sands properties, ConocoPhillips is selling its acreage in the Deep Basin, the Elmworth-Wapiti, Kaybob-Edson and Clearwater areas. These represent a combined 3 million acres and 120 MBOEPD of production.

Cenovus intends to spend about $130 million to develop its newly-acquired Deep Basin properties. Current plans are for a three-rig drilling program in 2017, with further expansion possible. Cenovus believes its Deep Basin properties have the potential to grow to 170 MBOEPD of production by 2019. About 1,500 drilling locations have been identified in the Spirit River, Montney, and Glauconitic formations.

ConocoPhillips will pay down debt, repurchase shares

This acquisition is funded by $10.6 billion in cash and 208 million shares of Cenovus, valued at $2.7 billion. Additionally, if the price of Western Canadian Select rises aboveC$52/bbl, Cenovus will pay C$6 million for every CA$1 WCS price above CA$52/bbl. Based on current exchange rates and differentials, C$52 WCS equates to a WTI price of U.S.$52/bbl.

Conoco plans to use the proceeds from this sale to accomplish its three-year financial plan. As outlined in November, these goals are:

- Invest capital to maintain production and pay existing dividend.

- Annual dividend growth.

- Reduce debt and target ‘A’ credit rating.

- 20-30% of cash from operations total shareholder payout.

- Disciplined growth capital.

More than half of the cash from the divestiture will be used to reduce debt from $27 billion to $20 billion. ConocoPhillips’ share repurchase program will double from $3 billion to $6 billion, and buybacks will triple to $3 billion. The remaining $3 billion will be allocated to 2018 and 2019.