$9.5 billion purchase of RSP Permian

M&A activity in the Permian has come roaring back, with Concho Resources (ticker: CXO) announcing the biggest deal ever seen in the basin.

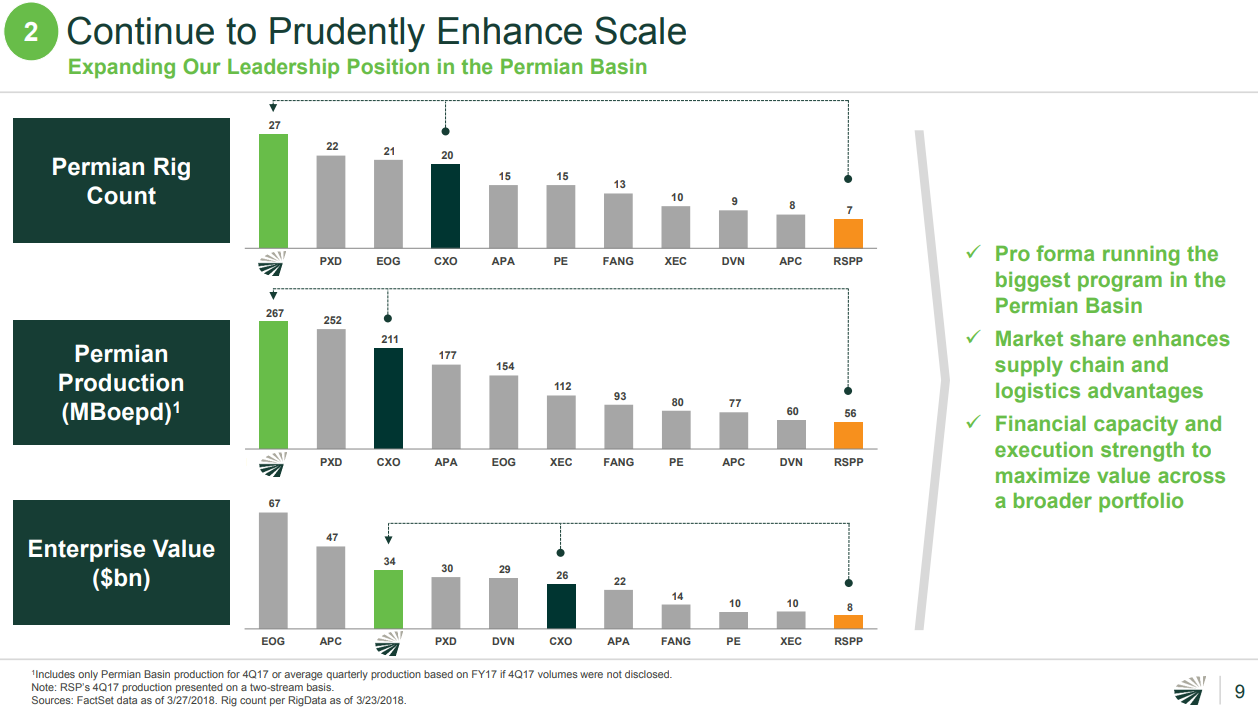

Concho will acquire RSP Permian (ticker: RSPP) in an all stock deal valued at $9.5 billion, inclusive of debt. According to Concho, this will make the company the largest unconventional shale producer in the Permian, and give it the largest drilling program in the basin.

Deal will make Concho biggest Permian shale producer

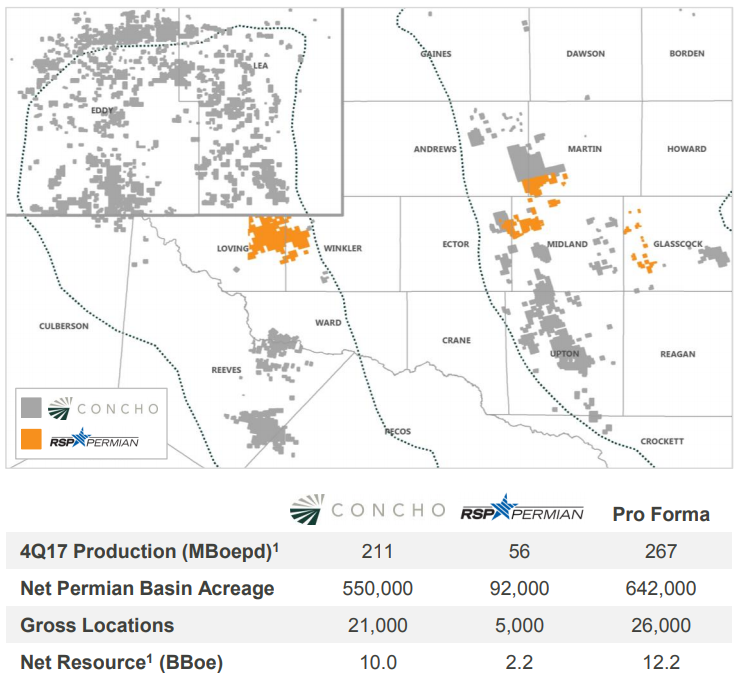

The resultant company will hold 642,000 net acres in the basin, with production of 267 MBOEPD. This is enough to vault Concho past Pioneer (ticker: PXD) to the highest-producing Permian shale company. Concho will add RSP’s highly consolidated Delaware basin acreage, consisting of 45,000 net acres in Loving and Winkler Counties, and the more diverse 47,000-acre Midland position, which stretches over five counties. The acquired Midland acreage is contiguous with Concho’s existing Midland properties, while the Delaware acreage is a self-contained unit, separate from Concho’s properties but nearly one single block.

Combined company is running 27 rigs

The acquisition will give Concho significant scale, with a tremendous 27-rig drilling program. Concho reports it will realize over $60 million in annual corporate level savings, and will see even more extensive savings in operations. According to Concho, efforts like asset optimization, shared infrastructure and high-grading capital spending will produce total synergies with a present value of more than $2 billion.

Deal surpasses $7.1 billion Encana-Athlon buy

Concho will pay RSP shareholders 0.32 shares of Concho stock in exchange for each share of RSP stock, representing a 29% premium based on yesterday’s closing prices. Previous closing prices value this payment at $8 billion. This transaction will leave Concho shareholders with 74.5% of the resultant company, while RSP shareholders will hold the remaining 25.5%. Concho will expand its board of directors from 10 members to 11, including one independent member of the RSP board. The transaction is expected to close in Q3.

With a deal value of $8 billion, $9.5 billion if debt is included, this is the largest deal the unconventional Permian has ever seen. The previous record holder was Encana’s purchase of Athlon Energy, when the company paid $5.9 billion and assumed $1.2 billion in debt.

Price equates to an adjusted $65,650 per acre

While deal metrics of corporate acquisitions can be more murky than simple acreage deals, the price paid for acreage can still be very informative. Assuming RSP Permian’s 56 MBOEPD of production is valued at $35,000 per flowing BOE, $1.96 billion of the purchase price went to acquiring production. This means that Concho paid $6.04 billion for RSP Permian’s 92,000 acres, valuing the land at $65,650 per acre. If the purchase price is not adjusted for production, RSP’s acreage is valued at nearly $87,000 per acre. With or without accounting for production, this is one of the highest acreage valuations seen in recent years. Previous Permian deals typically saw unadjusted acreage values between $25,000 and $45,000.

More Permian acquisitions may be coming next

This deal raises the possibility of further consolidation in the Permian, as companies attempt to secure large, ideally contiguous positions. While this was typically accomplished through acreage deals and purchasing private companies in 2017, midsize public companies are now clearly potential targets. Depending on which analyst is consulted, virtually all mid-cap Permian companies are potential acquisition targets, while buyers may include Diamondback and Centennial.

Q&A from Concho conference call

Q: I’d jump in first with a question around inventory management in a context for these deals, as we see both entities had some of the longest runways already in the Permian Basin and combining the two only furthers that. But how should we think about what moves to the back of the hopper, if you will, in the pro forma entity and over what sort of timeframe should we expect maybe some culling of the long-dated inventory?

Timothy A. Leach: I think that this set of assets really gives the company a strong runway for better capital allocation. So, I think that these new assets will go right to the top of our development inventory and we really look forward to the future and 2019 and beyond on how this capital allocation strength will really enhance our returns and capital efficiency.

Q: Historically, when you all have done deals, you’ve been pretty active shortly thereafter, I mean, this is an all-stock deal, but historically you guys have pursued divestitures a little bit more aggressively post deal. Do you have a similar follow-up plan once this then closes in the third quarter to look to divest to what you would consider to be non-premium? Or is this going to just be a sort of an opportunistic pursuit as opposed to a little bit more explicit?

Timothy A. Leach I would highlight that our portfolio management is a key to how we create value. So, I expect that portfolio management to continue. I’d also direct you to look at the map in the slide deck at how cored up and strategic all our assets are right now and I know it’s early in the morning, but if you can’t detect the excitement in my voice about this deal and the power of the assets on that map, it’s going to be really exciting and a compelling business proposition to have such great assets.

Q: And I appreciate the excitement regardless of the time zone. I guess, I’m also curious just in the process of this deal, this is the first public corporate transaction that you all have pursued. Historically, you guys have worked more on private negotiated deals. Can you speak to – I mean, you’ve highlighted here why you see this as massively accretive. Was this logically like the most accretive opportunity for you or as you look at some of the private packages or asset packages, are you seeing less opportunity out there now versus the last few years?

Timothy A. Leach: I mean, we talked in the past about how high the bar has been set for us in terms of acquisitions and our relationship with Steve and with RSP goes way back and we’ve admired what they were doing for a long time. So, we all recognize that corporate transactions are more complicated and time consuming. But Steve mentioned the hand in glove kind of fit that this thing is, so I don’t – don’t read that this means anything relative to private transactions versus public. This is a bit of an acquisition, it’s been a long time coming and it’s a perfect fit for us.