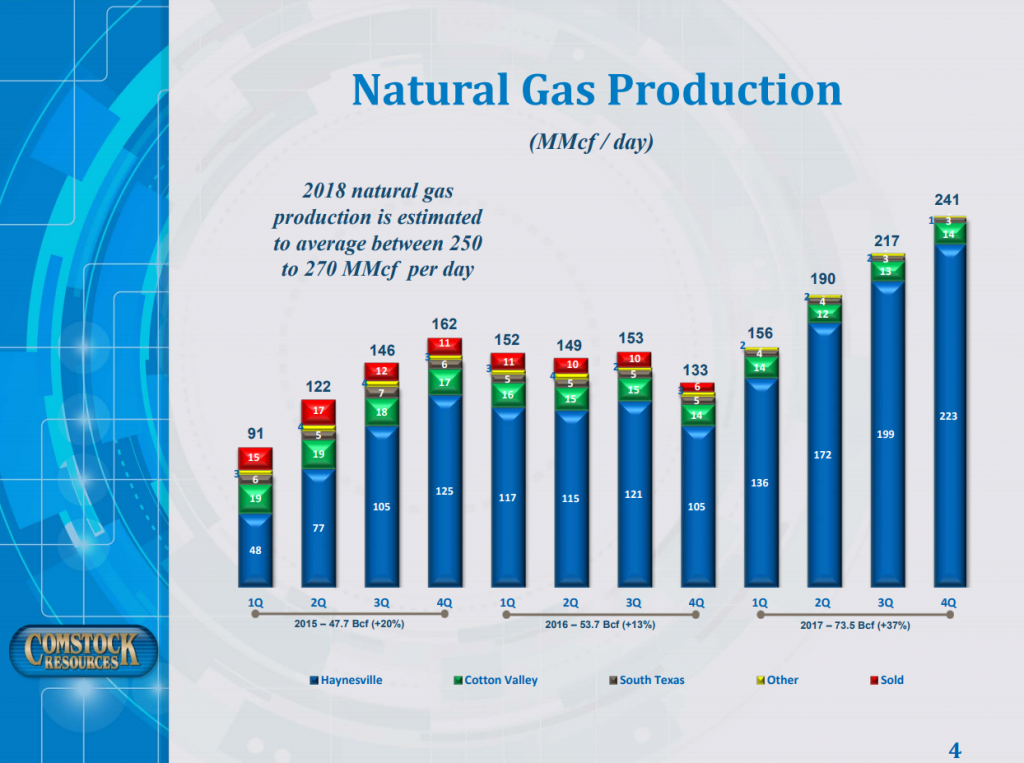

Haynesville producer Comstock Resources, Inc. (ticker: CRK) produced 22 Bcf of natural gas and 214,000 barrels, or 23.5 Bcfe in the fourth quarter of 2017.

Natural gas production averaged 241 MMcf/d, reflecting growth of 90% from pro forma natural gas production in the fourth quarter of 2016 (excluding the divestitures completed in 2016). According to Comstock, the growth in natural gas production was driven by the company’s successful Haynesville shale drilling program.

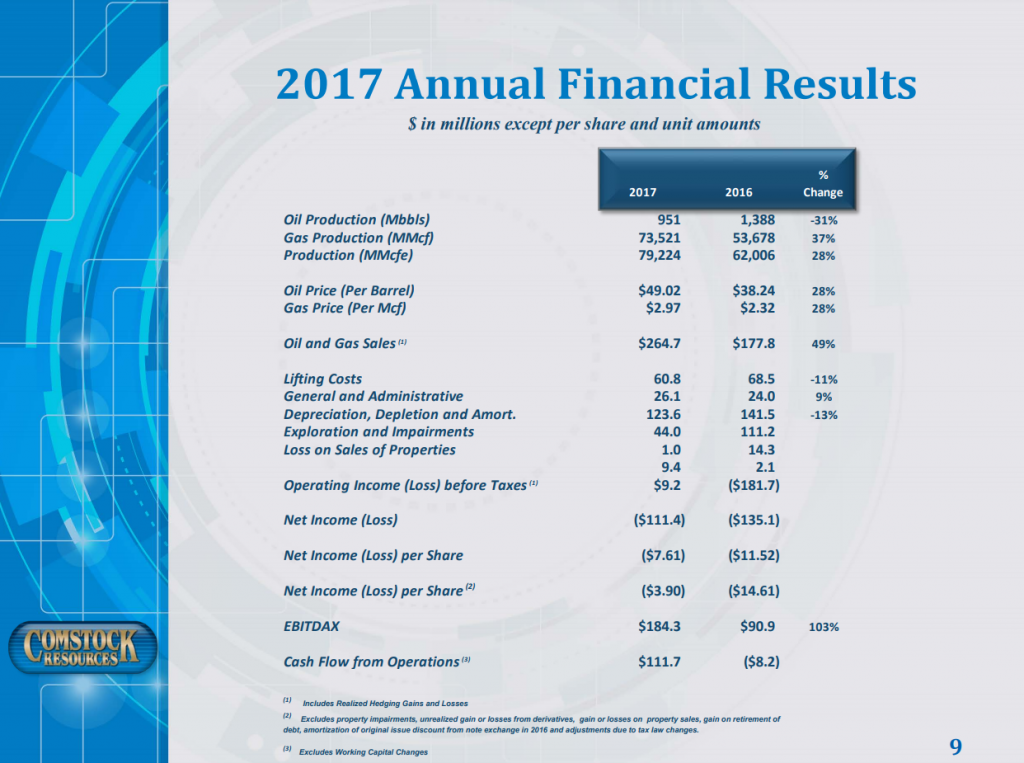

Comstock produced 73.5 Bcf of natural gas and 951,000 Bbls, or 79 Bcf of natural gas equivalent in the year ended December 31, 2017, compared to 54 Bcf of natural gas and 1.4 MMBbls, or 62 Bcfe in 2016. Natural gas production averaged 201 MMcf/d in 2017, an increase of 46% over pro forma 2016 natural gas production, excluding the divestitures completed in 2016, Comstock said, and oil production in 2017 declined by 31% from 2016.

Drilling

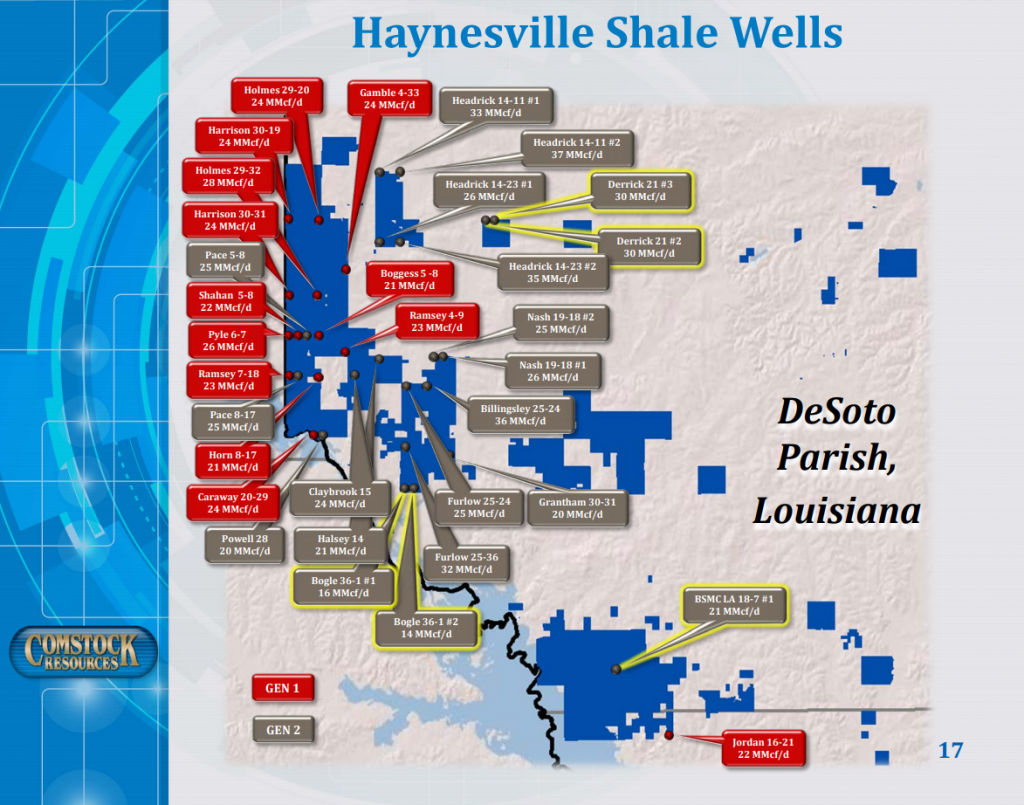

During 2017, Comstock spent $178.8 million on its development and exploration activities and drilled 30 horizontal natural gas wells (15.7 net) and had four operated wells (1.5 net) drilling as of December 31, 2017. Since the last operational update, Comstock has completed six operated Haynesville shale wells.

The two Derrick wells drilled in the Logansport area of DeSoto Parish set a new corporate record with both wells exceeding 6.5 MMcf/d per 1,000 feet of completed lateral. The Derrick 21 #2 well was drilled to vertical depth of 11,957 feet with a 4,549 foot lateral and the Derrick 21 #3 well was drilled to a total vertical depth of 11,942 feet with a 4,552 foot lateral. Both wells were each tested with an initial production rate of 30 MMcf/d.

Comstock also reported results of its first two joint venture wells drilled in Caddo Parish, Louisiana. The Hunter 28-21 #1 was drilled to a total vertical depth of 11,182 feet with a 9,301 foot lateral and the Hunter 28-21 #2 well was drilled to a total vertical depth of 11,088 feet with a 9,135 foot lateral. Both wells were each tested with an initial production rate of 27 MMcf/d.

Comstock has five additional wells in various stages of completion and two additional Haynesville shale horizontal wells waiting to be completed.

Financials

Q4 2017

Comstock reported a net loss of $42.3 million or $(2.86) per share for the fourth quarter of 2017 as compared to a net loss of $54.9 million or $(4.48) per share for the fourth quarter of 2016.

The loss included several unusual items, Comstock said, including an impairment charge of $44.0 million, primarily of the company’s South Texas oil properties which are held for sale, $10.9 million of non-cash interest expense associated with the discounts recognized and costs incurred on the debt exchange that occurred in 2016, an unrealized loss from derivative financial instruments of $1.9 million and a $19.1 million income tax benefit due to the new U.S. federal income tax law.

FY 2017

Comstock reported a net loss of $111.4 million or $(7.61) per share for the year ended December 31, 2017, as compared to a net loss of $135.1 million or $(11.52) per share for the year ended December 31, 2016.

The results for the year ended December 31, 2017 include an unrealized gain from derivative financial instruments of $7.3 million, impairments and loss on sale of oil and gas properties of $45.0 million, $35.7 million of non-cash interest expense associated with the discounts recognized and costs incurred on the debt exchange that occurred in 2016 and the $19.1 million benefit due to the new U.S. federal tax law change.