The Shale Revolution has transformed the Bakken Shale from an area with production below 200 MBOEPD to the nation’s third largest producing oil field. Its transformation has been a staple of growth in North Dakota – a state growing at five times the rate of any of its competitors. Production in August 2014 is forecasted to surpass 1,100 MBOEPD, trailing only the Permian and the Eagle Ford, and the majority is attributable to hydraulic fracturing and horizontal drilling.

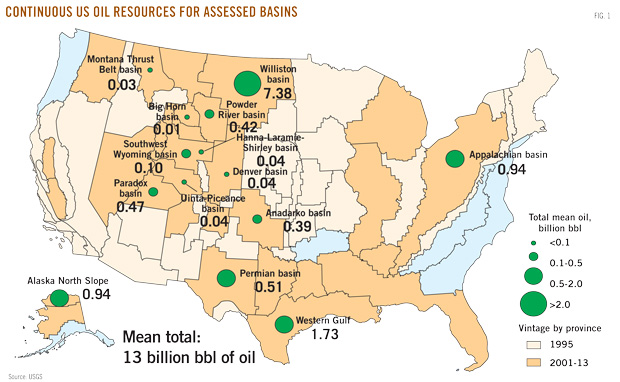

The United States Geological Survey estimates the Bakken, along with the Three Forks formation, holds 7.3 billion barrels of technically recoverable resources. The number is double the estimate from 2008 and represents more than half of the recoverable resources in the United States. Even though productivity is at all time highs, E&Ps and service companies continue to evaluate ways to improve recovery.

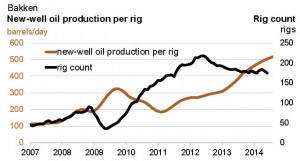

The Energy Information Administration says efficiencies and infrastructure improvements have contributed to the reemergence of the region. The government arm’s Drilling Productivity Report shows how drilling efficiencies have climbed upward since 2011, reducing the rig count in the process.

Bakken a Trend in Conference Call Season

“The Bakken is very established,” said Gary Kolstad, Chief Executive Officer of CARBO Ceramics (ticker: CRR), in his company’s Q2’14 conference call. Kolstad added his company has shifted from a proppant company to a production enhancement company in recent years, and the Bakken Shale is one of its main targets. “I think it’s more established every day, especially when people move more in the slick water and finer mesh ceramics, including the success that Liberty has had.”

The executive is speaking about the slickwater technique utilized by privately held Liberty Resources, which allowed the company to double estimated ultimate recovery and boost production gains by as much as 200%. Wells Fargo hosted a conference call with the group on July 2, and summarized as follows: “Compared to the Bakken as a whole, Liberty’s 365 day cumulative oil number is 56% higher than the basin’s average. Investors on the call had questions whether slickwater only enhances economics in the lower-quality portions of the Bakken; management provided data showing the exact opposite; i.e., it sees more of an uplift in higher-quality areas. Further, Liberty’s service group works with 10-12 operators across the basin and said it has seen similar improvements across all areas of the Bakken.”

The executive is speaking about the slickwater technique utilized by privately held Liberty Resources, which allowed the company to double estimated ultimate recovery and boost production gains by as much as 200%. Wells Fargo hosted a conference call with the group on July 2, and summarized as follows: “Compared to the Bakken as a whole, Liberty’s 365 day cumulative oil number is 56% higher than the basin’s average. Investors on the call had questions whether slickwater only enhances economics in the lower-quality portions of the Bakken; management provided data showing the exact opposite; i.e., it sees more of an uplift in higher-quality areas. Further, Liberty’s service group works with 10-12 operators across the basin and said it has seen similar improvements across all areas of the Bakken.”

E&Ps Taking Notice

Whiting Petroleum (ticker: WLL) is poised to become the new production leader of the Bakken Shale once its acquisition of Kodiak Oil & Gas (ticker: KOG) is finalized, and questions about completion techniques were common in the company’s Q2’14 conference call on July 31, 2014. Whiting Petroleum management said completion techniques with cemented liners have increased EURs by 23%. A slickwater frac at Missouri Breaks outperformed an offsetting well by 44% over a 120 day period, and 11 additional fracs are currently being tested.

Similarly, Oasis Petroleum (ticker: OAS) reported uplift of 25% to 30% in its Williston wells from the use of slickwater, according to its Q1’14 earnings call. As a result, the company plans on using the fracing technique to complete 20% of its wells (32 total) in Q2’14. A test on a Three Forks well is expected in the near future, and OAS management said, “There’s no reason why you shouldn’t get a similar uplift by doing that stimulation in the Three Forks versus the Bakken.”

Turning Flaring into Finances

The North Dakota oil rush left many operators flaring off natural gas resources, an event the government is curbing in the near future. A report from Reuters showed roughly $100 million in natural gas per month was being burned away, accounting for nearly 33% of all production. The North Dakota Industrial Commission warned crude production will be capped if E&Ps don’t comply with new flaring rules, which calls for total reduction of roughly 43% by Q1’15.

Companies are using different methods to account for the flaring rules. Statoil (ticker: STO) is developing technology to create compressed natural gas on site and Hess Corporation (ticker: HES) is spending $325 million to more than double its Tioga, North Dakota, processing plant’s daily capacity once it opens in May.

Optimization companies like Core Laboratories see opportunity where others deemed excessive. In Core’s Q2’14 call, David Demshur, Chief Executive Officer, said: “Some of the flaring going on right now in the Bakken could be utilized, I think very effectively, for some light hydrocarbon gas flood. The flooding from methane all the way through butane could be injected back into the field to lift recovery rates.”

Demshur added that CLB is “looking at alternating steam and gases for enhanced oil recovery, both in the Bakken and in the Eagle Ford.”

The enhanced recovery methods, on average, cost a few million dollars more compared to a well without the added methods and frac stages. That shouldn’t deter operators, said Demshur. “You have operators out in the Permian Basin that, on average, spend $1 million more per well, but they’re yielding an additional 400,000 barrels in ultimate estimated recovery,” he said. “For me, that’s a no-brainer.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long only position in Oasis Petroleum and Core Laboratories.